The Federal Government through the Road Infrastructure Tax Credit Scheme has attracted investments worth N97.47bn from the private sector to fund critical road infrastructure in the country.

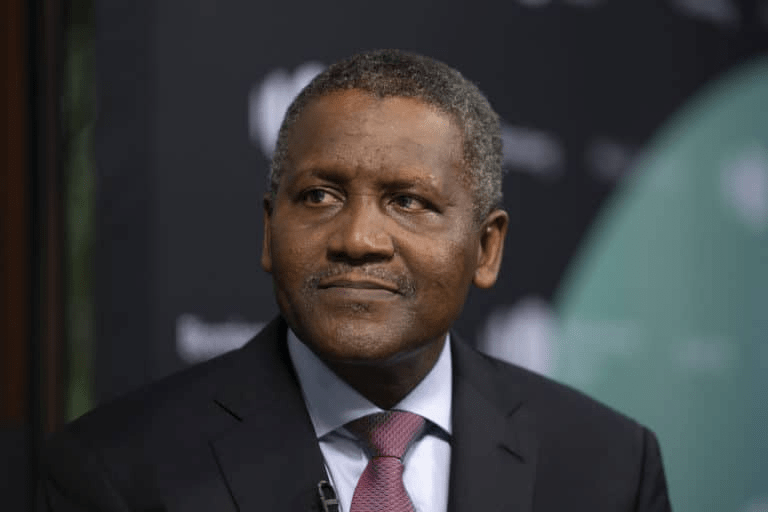

Documents obtained by our correspondent from the Ministry of Works and Housing and the Ministry of Finance, Budget and National planning showed that the initiative which is in partnership with companies like Dangote, Nigerian Liquefied Natural Gas companies and BUA group among others have completed the rehabilitation and reconstruction of 33 key road networks across the country in four years.

it did not include the funding of road constructions from the Nigerian National Petroleum Company Limited and SUKUK bonds, totalling N651 billion and N742.5 billion respectively.

The document read, “We are leveraging private sector capital and expertise to construct, repair and maintain critical road infrastructure in key economic corridors and industrial clusters.

“Under the Road Infrastructure Tax Credit Scheme, 33 road projects covering a total length of 1,564.95 km have been approved, pursuant to which private sector companies are incentivised to invest in the construction and rehabilitation of federal and state roads, and subsequently recover their investment back through an innovative tax credit mechanism, setting off credits against corporate tax liabilities.

“About N97.471 billion in tax credits have been approved for issuance.”

The scheme, coded Executive Order 007, is expected to expire in ten years. It was signed by the President, Major General Muhammadu Buhari (retd) on January 25, 2019, as part of efforts to improve the condition of the road infrastructure and transportation in the country.

It is predicated on the recognition to harness Nigeria’s resources, promote national prosperity, and operate an efficient, dynamic and self-reliant economy in the roads transportation sector, as well as other major sectors of the economy.

The scheme focuses on leveraging private sector funding for the construction and refurbishment of eligible road infrastructure projects. The eligible roads are to be approved by the President, on the recommendation of the Minister of Finance and published in the Official Gazette of the Federal Republic of Nigeria.

According to the order, costs accrued by investing in private companies during the construction or rehabilitation of approved roads will be refunded by a grant of tax credits against their future companies’ income tax.

So far, some of the roads constructed include the Apapa-Oworonshoki-Ojota Road in Lagos and the Lokoja-Obajana-Kabba Road connecting Kogi and Kwara States constructed by Dangote Cement and 110km Enugu-Onitsha Road in Anambra State by MTN.

Other roads are Oyinbo-Izuoma-Mirinwayi-Oklama-Afam Road constructed by Transcorp group, Oniru axis of VI-Lekki circulation road in Lagos State by Access bank, Umueme village road, Abia State by GZI Industries, Malando-Garin Baka-Ngwaski Road by Mainstreet Energy, Bode-Saadu-Lafiagi road; Eyinkorin road and bridge by BUA group and construction of Bodo-Bonny Road with a bridge across the Opobo channel in Rivers state by NLNG.

Speaking on the tax credit scheme during a press briefing on the ministry’s achievement recently, the Minister of Finance, Zainab Ahmed, described the initiative as one of the greatest innovations of the Federal Government in its resolve to tackle Nigeria’s infrastructure deficit.She added that the roads selected are critical economic corridors to interested companies and the general public.

She said, “We also have been to launch the Road Infrastructure Tax Credit Scheme, an initiative that started in January 2019. It is a very innovative tool that enables us to use private sector funds to develop funds and then recover their investment over a period of time using tax credits.

“33 Road Projects, covering a total length of 1,564.95 km have been approved, pursuant to which private sector companies are incentivised to invest in the construction and rehabilitation of Federal and State Roads, and subsequently recover their investment back through an innovative tax credit mechanism, setting off credits against corporate tax liabilities.”

On his part, the Minister of Works and Housing, Babatunde Fashola, said the scheme has been successful as more companies were indicating interest to participate in the scheme and help reduce the infrastructural deficit.

The minister gave his response while speaking with journalists during a briefing on ember month programme recently.

He said, “On the tax credit scheme, it is based on Executive Order 07, signed by the president to enable companies to invest their tax ahead of time to develop road infrastructure which has been a very successful model and it has enhanced the development of road infrastructure.

“Currently, many companies are indicating interest to undertake road construction in areas of economic value.”

He noted that no company had defaulted in completing projects and fulfilling the necessary requirement as it is practically impossible to do so.

“We don’t have any reported case of default. secondly, there is unlikely to be a default because if you don’t do the work there is no payment and this is not ascertained by us. There is zero room for default what you can possibly classify as a default is if the contractor is unable to do the work, we change them and bring capable hands.

“So, the issue of defaulting to a large extent is not present because you have to do the work and the engineers certify it before you can even get the tax rebate needed.”

He explained that there is also a management structure of a team headed by the minister of finance, the Vice chairman is the minister of works and housing and there is a technical working group that has to evaluate the value of work done before payment is made.Related News

- Road infrastructure has improved learning in schools – FG

- Dangote, others shine at PEARL Awards

- Dangote plans fresh 300,000 jobs for Nigerians

NNPCL, SUKUK allocate N651 billion, N742.5 billion respectively

Similarly, alternative funding from the coffers of Nigerian National Petroleum Company Limited and SUKUK bonds have yielded investments to the tune of N651 billion and N742.5 billion respectively.

This is apart from a planned release of N1 trillion by NNPCL for the same purpose.

A breakdown by the Group Chief Executive Officer, Mele Kyari, during an inspection tour showed that North-central got the highest chunk of N244.87 billion with South-south emerging as the second highest beneficiary of the NNPC road projects with the sum of N172.02 billion.

In addition, the South-west has a total allocation of N81.87 billion; it’s N56.12 billion for the northeast, while the South-east has an N43.28 billion allocation. The North-west was allocated N23.05 billion.

Also, four cycles of SUKUK bonds generated N742.5 billion, funding 71 projects through the ministry of works.

According to the minister, Sukuk bonds have supported road repairs and construction while adding to financial inclusion.

Fashola said, “On the SUKUK funds, we have had four cycles of SUKUK and these are funds invested by members of the public to develop roads infrastructure and it is guided by certain rules and regulations. First, the work must be done before payment is made.

“So far, with funding received, we have concluded several road projects which would have still been ongoing if we had relied on the budgetary allocation from the federal government.”

“We have completed the Ikom bridge which was an impediment that was affecting easy passage on that route. People couldn’t convey goods from Calabar port to the northeastern part of the country. The existing bridge could only carry a certain amount of load.

“I can add that we have 71 roads now that are covered by SUKUK, the plan is not necessarily to increase the number of roads covered but to eject more funding into those roads so that they can be completed. The Sukuk is not really a large fund if we look at it, a hundred billion for seventy roads is not a big amount per se.

“What we want to do is as the number of roads completed is dropping then we increase the number of resources to existing projects across all six geopolitical zones and the money equally distributed to fix bad roads.

Experts’ reaction

Reacting, The Chief Executive Officer of the Centre for the Promotion of Private Enterprise, Dr Muda Yusuf, suggested that the scheme be extended to other infrastructures such as waterways and railways, noting that it had yielded positive results for road infrastructures.

He said, “Infrastructure can be financed by both public and private sectors directly or through arrangements. The decision of the federal government to allow some private sector entities to fund infrastructure belongs to the second mode of financing.

“However, it has to be properly coordinated by the government in terms of appropriate costing of each type of infrastructure, the period of coverage, the expected quality of the jobs, the degree of openness of the processes and procedures and the signing of appropriate MOU for each project.

“It can be used for any type of infrastructure but these are more specialized infrastructures that are better done through PPP involving other country or countries.

“So, there is nothing wrong with arrangements. We just hope the government will not do it alone but involve professionals like accountants, builders, engineers, etc. in the public and/or private sector.”

In his expert opinion, a professor of Economics at Olabisi Onabanjo University, Sheriffdeen Tella, warned the government against complacency urging them to seek investments for waterways and sea ports.

He said, “The tax credit scheme is something that can be sustained as long as the policy is there with terms and conditions spelt out and complied with, especially by the government. As long as they are investing in the right kind of infrastructure and not constructing in an obscure location with no economic value. It should be more of a strategic road infrastructure

“It is another way of building infrastructure much faster without bureaucracy. The cost is efficient as private companies can negotiate a much better cost for those than the government. It is a good and sustainable thing that companies are already taking advantage of it.

“Other means of transportation should also be considered like our waterways but on a larger scale, it should be about improving our ports. Good infrastructure at the port will enable bigger vessels to land at our seaports and boost revenue.”

Punch