When the Bank of Industry announced the growth of its asset

base beyond the N1 trillion mark, it was a historic achievement

among Development Finance Institutions in the country. With the

announcement in 2018, came with high expectations of the bank’s

growth trajectory in the years ahead.

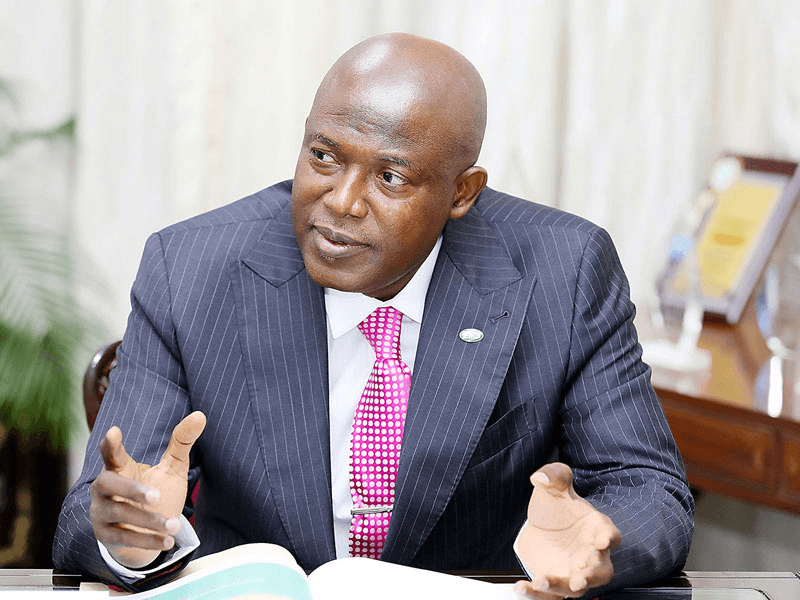

“For the first time in the bank’s history, we surpassed N1 trillion

in asset base. The Group’s profit was over N36 billion. For a bank

that is owned by the government, it is a very good result,” Mr

Kayode Pitan, the Managing Director, said.

The Bank’s Chairman, Alhaji Aliyu Abdulrahman Dikko, confirmed

the achievements in his details of the bank’s financial results,

which included: a 30 percent increase of N36.7 billion in profit

before tax, compared to the N26.4 billion made in 2017, a growth

of the Group’s total assets by 49 percent to N1.07 trillion from

N713.3 billion in 2017; as well as an improvement in total equity

which increased by 12.5 percent year-on-year to N258.3 billion

from N241 billion in the previous year.

However, the high hopes of the bank to build on these

achievements and their resilience were soon to be tested in a global

economic storm with strong headwinds. In 2020, the national economy shrank by 1.8%, its most profound decline since 1983. The COVID-19 crisis drove the economic slowdown and intensified risk aversion. This was heightened by low oil prices and shrinking foreign remittances.

With economic activities grounded by COVID-19 and many

businesses struggling for survival, the Bank of Industry, as a

development financial institution catering to thousands of Micro,

Small, and Medium Enterprises (MSMEs) as well as large

enterprises, came under additional pressure because it also had

to support its numerous customers to survive.

Despite these challenges, by 2022, the bank’s financial results

and further achievements told the story of resilience and

remarkable success, of its Board and management.

2022 Results

The BOI continued its consistent trend of reporting appreciable

growth in major financial indices on a year-on-year basis, thus

consolidating its position as Nigeria’s largest and most impactful

Development Finance Institution.

Gross earnings grew by 15.4 per cent to ₦212.96 billion in 2022

from ₦184.55 billion in 2021. Also, interest income improved by

21.1 per cent in 2022 to ₦212.96 billion from ₦175.83 billion in

the previous year. Revenue from customer loans and investments

were responsible for this growth.

Profit before tax improved by 15.6 percent to ₦71.99 billion in

the year from ₦62.28 billion in 2021. A remarkable growth in

interest income and other income lines, alongside the reduction in

impairment charges, facilitated this appreciable growth.

Total equity grew by 11.7 percent to ₦429.83 billion from

₦384.85 billion in 2021, while loans and advances improved by

3.2 percent to ₦805.46 billion from ₦780.48 billion in 2021.

The Pitan Years

Since his commencement in 2017, the leadership of Kayode Pitan

has demonstrated commitment and innovativeness that has

improved the bank’s fortunes.

- The bank’s total assets have grown by an impressive 248%

between 2016 and 2022, reaching ₦1.71tn by the end of 2021

and closing at ₦2.38tn as of December 2022. - BOI has also grown its equity position by 95% since 2016 –

from ₦220bn to ₦430bn ($935mn) in December 2022, exceeding

the regulatory requirement of ₦ 10bn ($ 26mn) for retail DFIs - Profit before tax (PBT) jumped by 325% between 2016 and

2022, from N17bn to N72bn. The bank has contributed to the

national budget by paying dividends of approximately N28.9bn

and taxes amounting to N30.4bn. Generally, the bank typically

distributes 15% of its net income as dividends.

With over 85% of loans backed by a guarantee and with

aggressive recovery efforts, the Bank has historically been able to

maintain a non-performing loan (NPL) rate below the regulatory

threshold of 5%.

A fundamental enabler of this sterling financial performance is the

successful conclusion of key capital-raising transactions from the

international financial market by the bank. Under Pitan, from

2017 to date, BOI has raised over $5b from the international

financial markets.

The first of the transactions was a $750 Million syndication

concluded in 2017 with the support of Afreximbank and a team

of international Financial Institutions (now fully paid off). The

second and third were the Euro 1Billion syndication closed in

March 2020 and another $1Billion syndication that closed in

December 2020 (to be fully paid off by December 2023). The

bank’s maiden Eurobond of €750 million, concluded in February

2022 was the fourth transaction. This transaction marked the first

of its kind in several ways to the bank, Nigeria and Africa. This

deal was the bank’s first Eurobond transaction and the first Euro-

denominated Eurobond transaction in Nigeria. The transaction

was also the first Eurobond transaction covered by Nigeria’s

sovereign guarantee.

It, therefore, represents a benchmark for

other prospective issuers from the African continent. It earned

the bank the Agency Bond Deal of the Year award at the 2023

Awards event of the Bonds, Loans and ESG Capital Markets in

Cape Town, South Africa.

The fifth capital raising transaction was the €1 billion guaranteed

senior loan facility concluded in August of 2022. This deal also

represents the first of its kind, by any Nigerian financial

institution, both in terms of its size and structure. Through this

transaction, the bank raised liquidity at affordable rates and

diversified its funding sources by attracting new lenders at a time

when the international capital markets were prohibitively

expensive and shut to many borrowers.

A €100 million line of credit from the French Development Agency

(AFD) was also concluded in August 2022 representing the sixth

capital raising. Through this credit facility, the bank can expand its financing interventions in environmentally friendly and green

projects. A grant of €2.5 million was also included in this deal to

support capacity building for both our staff and customers.

Regarding developmental impact, BOI disbursed the sum of

₦210.7 billion to 418,436 beneficiaries in the year through its

direct and indirect lending platforms and through funds that it

manages on behalf of its strategic partners.

The bank’s intervention programmes, which traversed several

sectors and segments of the Nigerian economy did not only

contribute significantly to our national goals of economic recovery

and millions of job creation but also empowered Nigerian

businesses, especially micro, small, and medium enterprises, to

remain in operations sustainably.

BOI has disbursed over N418 billion to 41,654 beneficiaries in

Food and Agro Processing, and about 88,700mt of rice and maize

was produced.

Pitan attributes these and other achievements to the collective

efforts of the Board, management and staff, his predecessors, its

partner banks that provide credit enhancements and the

unflinching support of its majority shareholders (the Federal

Ministry of Finance Incorporated and the Central Bank of Nigeria),

the Federal Ministry of Finance, Budget and National Planning and

its supervising ministry, the Federal Ministry of Industry, Trade

and Investment with whom it has a harmonious relationship.

Platforms For Government Programmes

The Bank of Industry is the implementing agency of many

government programmes. They include the Government

Enterprise Empowerment Programme (GEEP) and N-Power Social

Investment Programmes, under which BOI facilitated the

disbursement of ₦ 68.0bn ($188.5mn) to 2.9mn beneficiaries.

It has disbursed ₦569.3mn ($1.6mn) to 56,934 beneficiaries

under the North-East Rehabilitation Fund (“NERF”) – BOI fund to

rejuvenate the economies of the 6 States in North-Eastern

Nigeria affected by the adverse impact of insurgency over the

years.

Under the MSME Survival Fund Scheme (part of the Nigerian

Economic Sustainability Plan), BOI facilitated the disbursement of the ₦75 billion MSME Survival Fund. To date, ₦66 billion

($156mn) has been disbursed to 1,258,188 beneficiaries under

the scheme. Others include:

- NEPC Export Expansion Facility – Over N22.3 billion disbursed to

1,309 SME beneficiaries. - Nigeria Content Intervention Fund – Over $300 million

disbursed to local players in the Oil & Gas sector with no default. - The bank is the executing agency for the FGN/Islamic

Development Bank for BRAVE programme designed to increase

female entrepreneurs’ economic opportunities, especially in

conflict and social unrest. - Also executing agency for FGN/World Bank $750 million Nigeria

Covid-19 Action Recovery and Economic Stimulus (NG – CARES)

Programme.

Awards And Recognitions

In six years of Mr. Pitan’s leadership, the Bank of Industry has

received over 20 awards and recognitions, 12 of which were

received in 2022, for outstanding performance and commitment

to drive economic growth in Nigeria.

They include the Award for Innovation in Financial Services, the

African Banker Awards 2021; Award for Innovation in Financial

Services, the African Banker Awards 2021; Award of Honour 2021

by the Manufacturers Association of Nigeria; and Best SME

Funding DFI in Nigeria award at the All Africa Association for

Small and Medium Enterprises.

Others are the Most Sustainable Bank Award at the 2022 World

Finance Awards, October 2022; ‘Best SME Partner Bank of the

Year’ by the European Magazine Global Banking and Finance

Awards, October 2022; Best Development Bank Africa 2022

award’ at the International Banker 2022 Banking Awards, October

2022; and ‘Banking CEO of the Year, 2022’ by the European

Magazine Global Banking and Finance Awards, October 2022.

Infrastructure Development

The bank continuously improves its internal processes for

managerial efficiency. The number of BOI State offices/branches

nationwide increased from 21 in 2016 to 31 in 2022. Last year,

BOI completed the construction of BOI Tower 2 in Abuja, a

thirteen-floor Eco-friendly office complex with a six-level car park

structure, to provide its workers with a modern and efficient

workspace to better serve customers.

The bank’s stakeholders believe that the key to the list of

achievements is the robust industrial harmony in the company.

One senior staff member of one of the Banks customers

reportedly described Pitan as “an engaging and peaceful man,

traits which are the hallmarks of his management style.”

However, Pitan also credits the bank’s board chairman for the

growth-enabling climate in the bank. He describes him as “a calm

and experienced team player, always eager for improvement and

service to the country.”