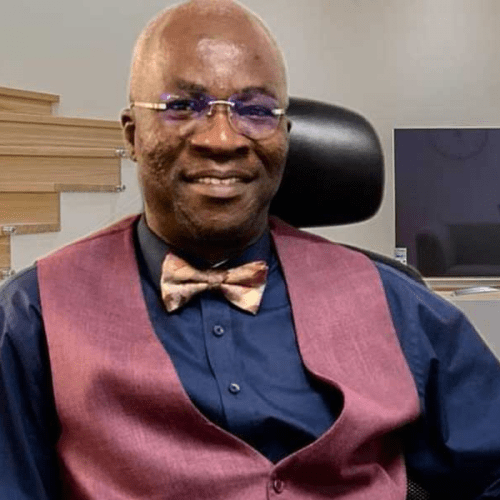

With over 30 years of experience managing transformation teams in the financial service industry, STELLA OKUZU currently runs a consulting practice, EDD Consulting Limited. The company provides market entry strategies for African businesses seeking to expand into the United Kingdom and for companies in the United Kingdom seeking to expand their business footprint to Africa.

For five years up till January 2023, she was the pioneer Head of Personal & Business Banking, Head of Marketing, and an Executive Committee member of FCMB Bank (UK) Limited. This was a Bank of England-approved role in which she set up and grew the retail banking division of the bank.

Stella sits on the Board of Directors of a Nigeria-based non-bank financial institution that leverages modern technology and partnerships to provide clients with loans and payment solutions with a specific focus on consumers and SMEs thereby promoting financial inclusion. She is the Chairman of the Audit Committee and is also a Member of the Board Credit & Fintech Committees.

She has both a science and humanities background with a Bachelor’s degree in Zoology from the University of Calabar, Nigeria, and an MBA from IESE Business School University of Navarra, Spain. She is also a Member of the Chartered Institute for Securities & Investments (CISI).

Passionate about developing entrepreneurship for sustainable wealth creation, especially for women, she is currently a Doctorate Researcher at Cranfield University, United Kingdom. She is researching ‘The impact of business digitalisation on the access to finance by sub-Saharan female entrepreneurs.’

She is happily married to her best friend Chieme with whom she co-pastors the Beacon London Church. She was recently nominated through the Office of the Mayor of London as one of the Women who make London Great and was in 2022 listed in the Global Powerlist of top 200 Voices in Leadership to Watch.

She is a member of the Institute of Directors, UK, a Fellow of the Royal Society of Arts and an Honorary Senior Member (HCIB) of the Chartered Institute of Bankers of Nigeria.

What memory of childhood would you want to share?

I grew up in a close-knit family of two girls. My early childhood was in London where I was born until I returned to Nigeria in the 70’s with my parents. I grew up in a safe environment in Calabar. My late Father was a lecturer of Electrical Engineering.

My mother had trained both in TV production and in fashion design in the United Kingdom. Upon our return to Nigeria, she opted to run her own business making clothes, teaching other women to do so as well as engaging in various public and private sector contracts. You could say we were very much shielded but grew up believing we could aspire to anything in life. Based on how we were raised, we had no reservations as regards our ability as female children.

The background of discipline, confidence in oneself and the fact that my sister and I were given free rein to express ourselves within the limits of respect to others have put us in good stead through life. We were imbued with a deep sense of self-actualisation, the fear of God and self-dignity. These virtues have remained with me through life.

With over 30 years of experience managing transformation teams in the financial service industry, what have you learned?

Through the years, I have learnt that no matter how good or brilliant an endeavour is, there is always room for improvement. There is however only so much that one can achieve on one’s own. With the benefit of hindsight, I realise that my greatest career achievements have resulted from teamwork. Every person is endowed with specific skills, and it takes a good leader to identify and hone these skills in others. It is therefore through the collective effort of a dedicated team that great feats are accomplished.

I also learned the power of relationships and the immense benefit of building a network of associates. I try to never burn bridges as one of the greatest asset one can have is a network of people who can trust and vouch for you.

The phrase which states that the only constant feature in life changes is also very true. In my thirty years, I have seen organisations rise and fall for various reasons such as leadership style, non-congruence of vision through organisations and the simple unwillingness to adapt to change. These are continuous phenomena.

Why the decision to provide market entry strategies for African businesses seeking to expand into the United Kingdom and for companies in the United Kingdom seeking to expand their business footprint to Africa?

I decided to venture into this specific area to take advantage of the benefit I have had in working in both jurisdictions. Any successful business is borne out of using your strengths to fill identified gaps.

Globalisation is real and there are gaps to be filled across both jurisdictions. The aftermath of Brexit and Covid has resulted in businesses and indeed the government of the United Kingdom seeking areas of growth in emerging markets. Africa with its youthful and growing population and room for growth in various areas considered mature in the United Kingdom presents a veritable growth opportunity.

Entering new markets however requires insight into the peculiarities, market knowledge and the identification of credible partners in the proposed growth market. There are always risks in entering new markets. These can however be mitigated.

The same is applicable to businesses in Africa that seek to diversify their earnings to stable and global currencies. It is for this reason that we currently witness a growing number of, for instance, Nigerian real estate companies seeking to set up businesses and expand their services to the United Kingdom. Doing so however requires insight into the peculiarities of the UK market, the customer preferences, regulations and specific nuances of this market.

What are your observations in this process? What are the results so far?

In this process, I have observed that some cultures are more likely to pay for services as opposed to ‘hard core products. The knowledge economy may be overlooked in Nigeria with people sometimes expecting to receive advisory services for next to nothing.

This has led to my business expanding its proposition to provide packages that clients can more readily appreciate. This expansion has been facilitated by the engagement of partner organisations. When you clearly define your business objective, other organisations which seek to participate in your identified segment will approach you for partnership opportunities.

This has been my observation to date, and it speaks directly to the value of working with partners as opposed to as a sole organisation. Finally, I have observed that while huge benefits exist in advertising one’s services, the most credible source of business growth is through referrals from satisfied clients.

Share with us about being the pioneer Head of Personal & Business Banking, Head of Marketing and an Executive Committee member of FCMB Bank (UK) Limited

This was a very peculiar role as the business only existed in paper at my point of joining the bank with an application for this having been submitted to the Financial Conduct Authority, the UK Banking regulatory body. This, therefore, gave me the opportunity of acting as an intrapreneur, an entrepreneur within a corporate setting.

There is a specific sense of achievement one derives from building anything from scratch. Whilst at the onset this may be scary, as you begin to see the business grow, it is such a rewarding experience.

Operating in a highly regulated sector as banking in the United Kingdom requires maintaining a delicate balance between meeting your business growth aspirations and keeping to the ever-changing compliance requirements.

It is also important that we bring all our skills and talents to bear in the workplace. I mention this as my initial role was as the Business Head but due to the Bank’s CEO at the time realising that I had further skills in marketing, this resulted in being given the additional responsibility of being the Head of Marketing for the Bank. This enabled me to provide increased market visibility to the bank as a whole, a responsibility I especially enjoyed.

I was also the first female to be part of the bank’s executive committee. With the benefit of hindsight, this provided me with a special connection with other female staff in the bank as I came to realise that I demonstrated what they could aspire to, if they so desired. I was subsequently appointed as the Diversity & Inclusion Champion of the Bank, a position that enabled me propose policies and practices to ensure equity through the organisation, including for females in the bank.

In what ways did you grow the retail banking division of the bank?

I was able to grow the retail business of the bank by a combination of drawing from my previous individual and business networks, establishing partnerships with organisations both in the United Kingdom and in Nigeria that were aspiring to serve the same customer segment we were focused on, and through organising targeted events and the adoption of social media.

Operating as a subsidiary of a Nigerian-owned bank in the United Kingdom, it was also important that I maintained cordial working relationships with different colleagues in the parent bank. By virtue of this specific intent, they served as advocates and indeed champions of the work I was doing in the United Kingdom. Again, a pointer to the importance of building and nurturing relationships.

Tell us about being on the Board of Directors of the financial institution you are involved with, your role, and experience

In my Non-Executive Director capacity, I serve as the Chairman of the Audit Committee. I am also a member of the Credit & Fintech Committees.

Serving on a board requires a deep interest in the area of operation of the applicable company and an immersed knowledge of the business’s dynamics. It is, however, a very peculiar role as while you have a specific fiduciary responsibility to the organisation, your role is not to take over the work of the executives, but to provide them with oversight and guidance for the organisation’s optimal operations.

It also requires that I keep abreast of developments in the sector globally in order to share best practices with the executive team. Board roles require a considerable level of multi-tasking which I dare say is an attribute women are most generously endowed with.

What can be done to increase the number of women on boards?

Different regulatory bodies across the world have set targets for gender representation on boards. This is the first step in the right direction. This however has to be supported by a continued pipeline of women at senior management positions who can aspire to these board positions.

It is therefore imperative that the culture of different organisations is not inimical to females progressing to top positions. For the balanced growth of our society, the role of women in families cannot be downplayed. An organisation which therefore expects its staff to work from say 8am to 10pm could inevitably lose a significant proportion of its female staff over time.

Finally, women who have attained board positions have a specific responsibility to mentor other women and demonstrate to them that their desires are achievable. We also must be circumspect in our choice of life partners; the key word being ‘partners’ and not ‘detractors’.

Share with us about being a Certified Master Coach from the International Institute of Coaches and Mentors

My training and certification came from my desire to improve my people skills. I trained under MasterCoach UK. Whilst I do not provide coaching as a business proposition, my training and certification have been most useful in my volunteer mentorship roles and in managing the various teams I have led. It is important that we continually seek ways to self-develop.

How are you a bridge between Africa and the other economies?

I operate in this capacity by assisting businesses in Africa set up in the United Kingdom and vice versa. It is important that we are consistent in our business and self-branding. As I have remained consistent in my focus on Africa even though I live and work in the United Kingdom, other organisations that are interested in expanding into Africa have approached my company for partnership opportunities.

From a background of facilitating real estate investments in the United Kingdom by Africans, especially Nigerians, by virtue of our specific focus on Africa, we now work with partner organisations that provide trade finance, foreign exchange services across various jurisdictions, and trademark registration services in the United Kingdom with a specific focus on sub-Saharan African countries. Globalisation is real, it is, however, important that you be known for a specific proposition.

How important is mentorship? Share your passion for mentorship through Oxford MBA students on their aspiring business ventures, through Invest Africa/Oxford University’s mentoring scheme and female entrepreneurs through the Cherie Blair Foundation for Women, amongst others

Mentorship enables the mentor to impart knowledge from their past experiences and knowledge gained over time to the benefit of their mentors. A mentorship relationship therefore enables the mentee to leapfrog if you will, avoiding mistakes and drawing from the experiences of their mentor.

Whilst the mentee drives and is the primary beneficiary of the mentoring relationship, the mentor also benefits from learning from often times younger people, thereby remaining current with ongoing issues.

To this end, mentoring is very important and is a great tool for transferring knowledge in a structured manner. My mentoring African Oxford MBA Students and female entrepreneurs stems from my passion for contributing to the growth of the world’s two greatest emerging ‘economies’: Africa and Women! I currently serve as a mentor with WIMBIZ (Women in Management, Business & Politics). I thoroughly enjoy the experience and I am grateful for the opportunity to share my experiences with others.

Tell us about your passion for developing entrepreneurship for sustainable wealth creation especially for women

For global wealth to be created in a sustainable manner, it is important that we do not leave half of our team (half of the world’s population) that is women, on the bench. Unfortunately, female-owned businesses globally are under-financed with the International Finance Corporation providing a current estimate of $300billion in the global funding gap for women-owned small and medium-sized businesses. The figure for sub-Saharan Africa is $42billion as indicated by the World Economic Forum.

It is one thing to identify a problem and yet another to proffer solutions to the problem. Due to my passion to contribute to women’s empowerment, I commenced a part-time doctorate programme in Cranfield University in 2021. My specific objective is to determine how the female business funding gap may be bridged particularly in Africa through business digitalisation. I believe every problem must have a solution.

You were recently nominated through the Office of the Mayor of London as one of the Women who make London great. How does this make you feel? What was the nomination process and what are the expectations from you as a recipient?

The nomination through the Office of the Mayor was a pleasant surprise to me, especially as I only returned to live permanently in London ten years ago. The process is such that the Office of the Mayor requests for nominations from the public which are then vetted and verified before publishing. Having been selected as one of the ‘Women who Make London Great’ has given me a certain sense of responsibility. As I have no idea who nominated me, it is a sure reminder that people are constantly watching and observing what we do. London is one of the greatest cities of the world and I am happy to contribute my bit to its diversity and vibrancy.

What are the common challenges top female executives face? How were you able to navigate those challenges as one?

I will mention two specifically. One is the challenge of maintaining a work-life balance. As top female executives, we seek to be our very best in the workplace without compromising on our responsibilities to our families and to our personal well-being. I have been able to navigate this by learning to say ‘no’ when required and overtime working out a time schedule that works specifically for me. On several occasions, I have decided to dedicate time to attend to my non-work responsibilities and made up for these by sometimes working late at night to meet work deadlines. It is however important that we determine what works best for us individually. Not everyone is a night owl like I am.

Secondly, as women progress through organisations, we could run the risk of losing the essence of our individuality and inadvertently adopting a persona prevalently and sometimes expected in say high-pressure work environments. In the long term, this is not sustainable especially if you have long-term aspirations for your career and could lead to burnout. I have navigated this by intentionally taking stock, reassessing my priorities, and ensuring that I do not unduly internalise work pressures. It is a constant balancing act.

What urgently needs attention in Nigeria’s banking system?

Nigeria, Egypt and South Africa jointly contributed 46% of Africa’s GDP. Nigeria alone contributed 16.87% of Africa’s GDP. As the West continues to pay increased attention to business growth opportunities in Africa, Nigeria will remain an attractive market for the international business community.

To make the most of this, it is important that Nigeria’s banking system pays increasing attention to issues around Environment, Social and Corporate Governance (ESG) issues. These are no longer fancy buzzwords but are fundamental standards expected across the world, including Nigeria.

Nigeria is blessed with a vibrant and youthful workforce. It is however important that our workforce across the board and specifically in the banking sector keeps abreast with technological advances such as artificial intelligence and blockchain applications with attendant impact on our banking sector.

Business Day