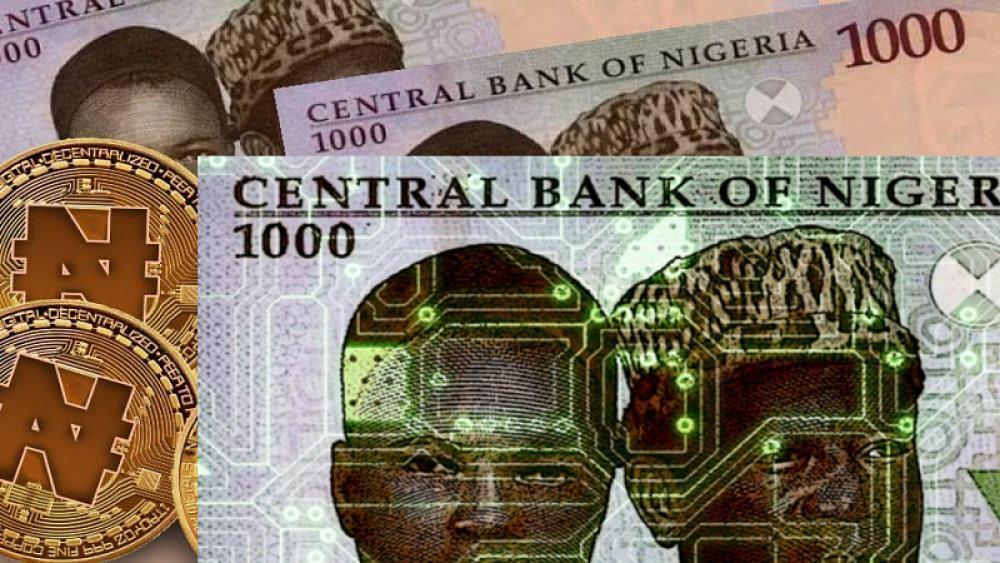

The Central Bank of Nigeria (CBN) has stated that the eNaira would ultimately boost remittance inflow to the country. The apex bank stated this in a document titled, “Design paper for the eNaira”

According to the CBN, the eNaira is meant to create a secure and cost-effective process for remittances, amongst other benefits.

What the CBN is saying

Remittances are an important source of foreign cash for countries in Sub-Saharan Africa, as well as a source of funds for financially excluded communities and a potential driver of economic progress.

The apex bank said, “In Nigeria, it is a key source of foreign exchange as US$23.8 billion flew into the country in 2019. The flow of remittance into Nigeria highlights its strategic position in sub–Saharan Africa as it is the top destination for remittance flows. Also, the country accounted for a 12.5% drop in overall flow to sub-Saharan in 2020 due to its 28% decline in 2020 which can be attributed to the COVID-19 pandemic.”

The CBN admitted that because of the importance of remittance flow to economies in sub-Saharan Africa, it had hoped to stimulate remittance inflows with the introduction of its “Naira 4 Dollar” initiative.

“Growth in remittance flow is a key objective of the CBN and this was highlighted by its “Naira 4 Dollar” initiative which incentivized Nigerians by paying them NGN 5 for every US Dollar received via the remittance channel. While that has helped stimulate remittance flows, the issue of cost is still paramount. The sub-Saharan Africa region remains the most expensive region in the world to send money to, sending US$200 costs an average of 8.2% and as high as 19.6%3,” the CBN stated.

Highlighting how the eNaira will improve diaspora remittances, the apex bank said, “the eNaira would provide a secure and cost-effective process for remittances and ultimately boost remittance flows. It would also reduce the number of remittances flowing through informal channels as the cost of remittance will be significantly low. Ultimately, the eNaira will make remittances easier, faster, and cheaper.”

Other major advantages of the eNaira, as listed in the document by the CBN are as follows:

- The eNaira will make it possible for governments to make targeted welfare payments to citizens directly, without the need for any intermediary

- The eNaira can help streamline this process and significantly reduce the time taken for transactions to be confirmed as it allows real-time cross-border foreign exchange payment-versus-payment transactions for traded goods and services.