The popularity of fintech companies that drive digital financial services is being questioned by the spate of unabated cases of fraud and unethical practices trailing them, writes Festus Akanbi

From all indications, the growing population of digital consumers in Nigeria has accelerated the demand for digital transformation from all industries and it is not a surprise that it has finally caught up with the banking and financial services industry.

In the emerging technological-driven world, fintech and digital banking have become the toasts of consumers, investors, and institutions providing all manners of financial services.

Fintech and digital banking compete against old traditional financial banking methods and long-standing institutions with new technology-thinking products and services offered via online channels, applications, and mobile platforms.

The list includes companies like Flutterwave, Piggyvest, Paystack, Bankly, Opay, Carbon, Kuda, Risevest, Bamboo, Interswitch, Paga, e-Tranzact, Eyowo, Fair Money and Wallet Africa, among others.

Operators described fintech start-ups as digital natives who disrupted legacy banking with digital functionalities, simplicity, big data, accessibility, agility, cloud computing, contextuality, personalisation, and convenience. Companies under this category are not only improving the financial consumer experience, but are changing the way people pay, transfer money, lend, borrow, and invest. Digital banking is traditional banking dressed up in a digital wrapper.

Customers’ Protest

However, public attention was drawn to some of the complaints trailing the activities of these fintech companies when a video of some protesting customers of Opay surfaced online with the allegation of illegal deductions from their accounts.

In the video, some agents of OPay stormed the Alender House Office of the company in the Alausa area of Ikeja, to protest what they described as unauthorised withdrawals, which they allegedly brought to the notice of the company without redress.

They also said they had reported the matter to the police to help them in recovering their stolen money: “Huge sums of money were unscrupulously taken away from our accounts. Balances of our accounts were removed, some were transferred to other banks, and some were used to purchase airtime, others were transferred to different OPay accounts that we do not have any dealings with,” a leader of the agents who spoke on camera stated.

However, the management of the company, in its reaction described the video as a regurgitated protest which took place two years ago.

“It has been brought to our notice that a video has resurfaced on some social media platforms (TikTok, Twitter & WhatsApp) regarding alleged fraudulent activities on some OPay Agent accounts. This incident occurred over two years ago (August 23, 2021), and we took the right and appropriate actions with the relevant stakeholders to resolve the stated issues,” the company said.

It claimed that it has continued to periodically educate and sensitise its customers about account data security, encouraging them not to fall victim to malicious information, fraud, and scams.

“In order to further protect our users, we have taken significant measures to protect customer data and accounts by continuously upgrading our security system and adding extra layers of security measures such as BVN verification, and Face ID verification,” the statement added.

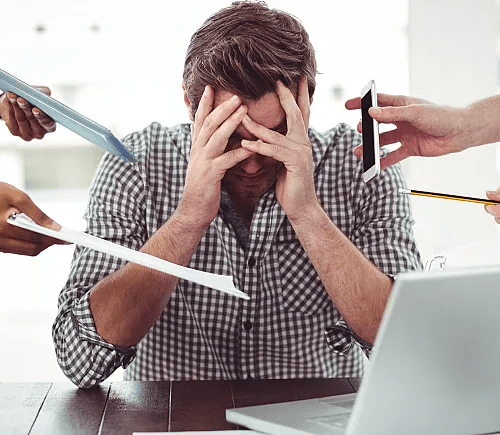

Apart from the allegation of illegal withdrawals, some customers of these companies also protested unethical methods of loan collection. Experience has shown that most of the loan apps (which operate digital banking) are fond of sending hurtful messages and threats to their subscribers and families, falsely accusing them of being fraudsters who absconded with company funds.

There was the case of Mrs. Theresa Ogunde (not her real name), who borrowed N150,000 for her son’s school fees. Following her failure to meet the payment deadline, the loan app decided to send hurtful messages to her family members labelling her as kidnappers and organ harvesters. In another message to other members of the debtor’s family, the loan app announced her burial arrangements.

On the excesses of many of the online money lending platforms, Mr. Boye Adegoke, who is the manager of Digital Rights Advocacy and intervention projects, described the acts by the lending agencies as sheer lawlessness.

“So those loan organisations are breaching the privacy rights of people, and I am aware that there is a court judgment regarding that already, but I think that the level of awareness is still very low among Nigerians. And this is also because the affected people rarely take it up with these loan companies.”

Migration to Fintech

Perhaps the finest hours for this online financial platform came between December 2022 and March this year when Nigerians were experiencing cash problems as a result of the naira redesign which plunged the naira into a serious crisis.

With the closure of banks and automated teller machines, Nigerians were compelled to opt for digital banking, a development that led to the migration to these online banking platforms.

Reports have it that the main winners in Nigeria’s banking sector after a botched currency overhaul are two Chinese-owned fintech apps-Opay and Palmpay.

For instance, in January this year, vendors and customers turned to upstarts OPay and PalmPay to send and receive money after a central bank edict to swap old banknotes for new ones, which was later overturned, creating a shortage of cash in Nigeria. Traditional banks could not handle the surge in online transactions. As of March 24, the two apps were ranked first and second in a list of Nigeria’s most downloaded finance apps on Google’s Play Store compiled by analytics company SimilarWeb — above the apps of traditional banks.

OPay, owned by Chinese billionaire Yahui Zhou through his web browser company Opera, has become the main alternative to banks for money transfers and bill payments during the cash crunch, say industry observers. It comes three years after the company shut down various services on its app, including motorcycle taxis and food delivery, that were part of an initial push to be a super app.

Red Flag

With the erosion of customers’ trust in some of these online financial platforms, analysts said many people are bound to be discouraged from migrating to these online payment banks.

A lecturer from the banking and finance department of the University of Lagos, who craved anonymity said the erosion of trust in fintech companies has provided enough justification for some conservative bank users to stay glued to conventional banks.

“I cannot expect my dad, a 72-year-old man to get entangled with these online banks with the associated problems,” he told THISDAY in an interview last week.

According to him, in this era of internet fraud and online scams, it will be a great risk to depend on digital banks and fintech companies for banking services.

After an N11billion fraud case hit eTranzact in 2018, several senior leaders of the online payments company elected to resign. eTranzact’s Managing Director, Valentine Obi, Chief Technology Officer, Richard Omoniyi, and Head of Operations, Kehinde Segun stepped down from their roles alongside two executive directors.

The eTranzact affair – which was perpetrated by the chief executive of a client firm – bears little resemblance to the numerous fraud attempts payment companies in Nigeria face today. Instead, the significance of the news in 2018, to anyone paying attention, was that tech-enabled financial services fraud could be very costly.

Quoting data from the Nigerian Deposit Corporation (NDIC), TechCabal, an online media platform, stated that between 2020 and 2021, fraudulent activities recorded by deposit banks in Nigeria rose by 44.8 per cent.

According to Smile Identity, a KYC provider, fraud attempts increased by 50 per cent between the second half of 2020 and the first half of 2022. The first half of 2022 alone recorded a 30 per cent increase compared to the same period in 2021. In the first nine months of 2020, cybercriminals had an astounding 91per cent success rate from over 46,000 attempts.

It is hoped that the Central Bank of Nigeria (CBN) will step in to stabilise the online payment system as part of the ongoing reforms of the apex bank before it wreaks monumental havoc on Nigerians.

ThisDay