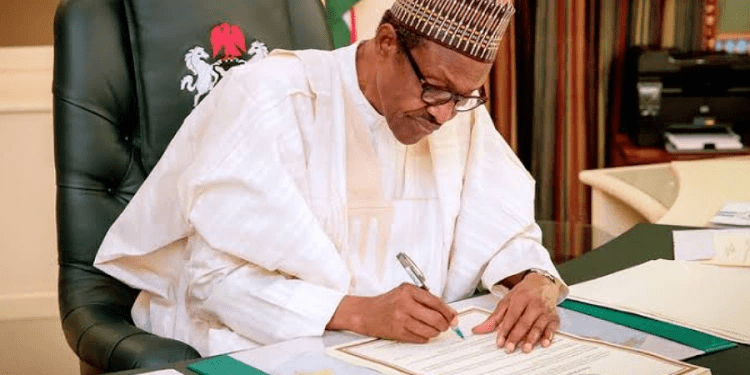

President Muhammadu Buhari has given approval to the acquisition of Exxon Mobil shares by Seplat Energy Offshore Limited, in his capacity as Minister of Petroleum Resources, the Presidency has said.

According to a statement by Special Adviser to the President on Media and Publicity, Femi Adesina, the consent is also in consonance with the country’s drive for Foreign Direct Investment (FDI) in the energy sector.

What Buhari is saying

- Buhari explained that Exxon Mobil had entered into a landmark Sale and Purchase Agreement with Seplat Energy to acquire the entire share capital of Mobil Producing Nigeria Unlimited from Exxon Mobil Corporation, Mobil Development Nigeria Inc, and Mobil Exploration Nigeria Inc, both registered in Delaware, USA.

- “Considering the extensive benefits of the transaction to the Nigerian Energy sector and the larger economy, President Buhari has given Ministerial Consent to the deal.

- “The President, in commitment to investment drive in light of the Petroleum Industry Act, granted consent to the Share Sales Agreement, as requested by the parties to the transaction, and directed that the approval be conveyed to all the parties involved.

- “Exxon Mobil/Seplat are expected to carry out operatorship of all the oil mining licenses in the related shallow water assets towards production optimization to support Nigeria’s OPEC quota in the short term as well as ensure accelerated development and monetization of the gas resources in the assets for the Nigerian economy.

- “President Buhari also directed that all environmental and abandonment liabilities be adequately mitigated by Exxon Mobil and Seplat.”

What you must know

- Seplat Energy Plc had unveiled its plans to acquire the entire share capital of Mobil Producing Nigeria Unlimited (MPNU) from Exxon Mobil Corporation Delaware (USA Incorporated).

- Confirming the deal, Chief Financial Officer, Seplat, Emeka Onwuka said the arrangements have reached an advanced stage while completion of the transaction is subject to ministerial consent and other required regulatory approvals.

- According to the transaction summary, Seplat Energy Offshore Limited, a wholly owned Nigerian subsidiary of Seplat Energy Plc, had entered into a sale and purchase agreement to acquire the entire share capital of MPNU for a purchase price of $1.283 million plus up to $300 million contingent consideration, subject to a lockbox, working capital and other adjustments at closing relative to the effective date.

- “The Transaction encompasses the acquisition of the entire offshore shallow water business of ExxonMobil in Nigeria, which is an established, high-quality operation with a highly skilled local operating team and a track record of safe operations, producing 95,000 of oil per day (kboepd) in 2020,” it stated.

- Seplat said the buy-over does not include ExxonMobil’s deep-water assets in Nigeria.

- It stated that the transaction would create one of the largest independent energy companies on both the Nigerian and London Stock Exchanges, and bolster Seplat Energy’s ability to drive increased growth, profitability and overall stakeholder prosperity.

- Seplat said the cash consideration payable under the transaction will be funded through a combination of existing cash resources and credit facilities of Seplat Energy, and a new $550 million senior term loan facility and $275 million junior off-take facility.

- Also, a global financing syndicate comprising Nigerian and international banks, as well as commodity-trading companies will aid the deal.

- According to the agreement, the transaction will not result in any changes to the Board of Seplat Energy. The company currently expects the transaction to close in second half of 2022.

Half-year results highlights

- Seplat Energy Plc reported a rise of 238% in its half-year 2022 profit before tax (PBT) to $209.9 million from $62.1 million year-on-year. The company also maintained a strong balance sheet with $350 million in cash at the bank.

- In the company’s unaudited results for the six months ended 30 June 2022, revenue for the period under review also appreciated by 71% to $527 million from $308.8m year-on-year, with a dividend of US$2.5 cents per share declared.

- The indigenous energy company also reported a 208.5% rise in gross profit to $274.3 million from $88.9 million year on year and has committed to stopping routine flaring by the end of 2024.

- Revenues up 71% from 6M 2021 to $527.0 million, higher realised oil prices of $107/bbl.