The Bank of England has told the Treasury that it is planning to reject Revolut’s application for a banking licence, after a two-year campaign by Britain’s most valuable fintech company.

The Prudential Regulation Authority (PRA), the arm of the Bank responsible for licensing, informed the Government in March that it planned to issue a statutory warning notice to Revolut within a few weeks.

It said the company’s initial application would be turned down owing to concerns over its balance sheet, after a qualified audit opinion in overdue accounts released that same month. Revolut has said auditors’ concerns were about revenues, not the balance sheet.

However, it is understood that the warning notice has not been served and there are now urgent talks taking place behind the scenes in a bid to rescue the licence application.

There are signs the Government is growing increasingly frustrated over the conduct of regulators towards companies in emerging industries, which has led to accusations that Britain is seen as a hostile environment for entrepreneurs.

Earlier this week, Jeremy Hunt said that competition chiefs must “understand their wider responsibilities for economic growth” after regulators blocked the $69bn (£55bn) takeover of videogame company Activision Blizzard by Microsoft.

Revolut continues to actively pursue a UK banking licence.

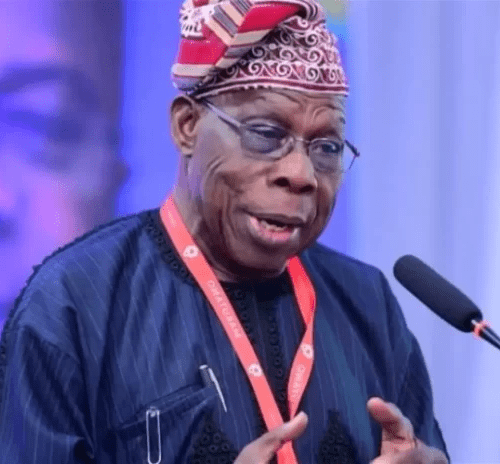

Jeremy Hunt has labelled Revolut a ‘shining example from our world-beating fintech sector’ CREDIT: LinkedIn

Senior sources close to Revolut said that the PRA had told it to produce a set of accounts with an unqualified audit opinion and to simplify its share structure before a licence could be granted.

The company’s own auditors previously issued a qualified opinion on its accounts after saying they were unable to satisfy themselves over the “completeness and occurrence” of nearly £500m of revenue. A business that receives a statutory warning notice has up to a month to challenge it. After that, a final notice of the decision is sent.

Revolut’s existing services will not be affected if it is refused a licence. However, the company would be unable to offer mortgages and loans to UK customers, who in 2021 accounted for more than 30pc of its revenues. Customers’ money is already protected through safeguarding rules and this will not change.

Revolut, a financial “super app” that includes current accounts, payments, cryptocurrency trading and overseas spending, has become one of the world’s most valuable fintech firms and Britain’s most valuable tech start-up on the back of a whirlwind global expansion.

As recently as January, Jeremy Hunt labelled it a “shining example from our world-beating fintech sector”.

Two years ago, it raised £800m with a record valuation of $33bn. Schroders, one of Revolut’s biggest investors, last month cut its estimate of the company’s value to $18bn amid a wider market downturn.

Earlier this month, Revolut’s chief executive, Nik Storonsky, claimed that Britain’s bureaucracy made it an unattractive place to do business, and raised the prospect of moving the company abroad if a licence was not granted.

Mr Storonsky said: “Ultimately it is not really us, it is generally the banking crisis we see at the moment that makes regulators extra cautious.”

Revolut had insisted on March 1 that a UK licence was coming “any day now”.

Although Revolut already has a Lithuanian banking licence, securing UK approval has been regarded as a key milestone that would help it win backing in other major markets such as the US.

The bank applied for a licence in early 2021, after appointing City veteran Martin Gilbert as chairman and hiring former senior Goldman Sachs banker Michael Sherwood as a board member.

A raft of senior executives in its UK banking team quit last year. Mikko Salovaara, the company’s finance chief, and James Radford, the head of its UK business, have both resigned in recent weeks.

Mr Radford is understood to have played a key role in the banking licence bid.

Revolut’s finance chief, Mikko Salovaara, quit the fintech company weeks after its independent auditor issued a critical notice about its accounts CREDIT: LinkedIn

Revolut’s auditor BDO, the UK’s fifth largest accounting firm, warned in February that the company’s revenues for 2021 “may be materially misstated”.

The accounting firm said it was unable to satisfy itself of the “completeness and occurrence” of revenues totalling £477m, which amounted to three-quarters of the group’s total income for the year.

Following BDO’s warning, Revolut criticised what it claimed was misreporting of the auditor’s statement and added that all of its revenues had been independently verified.

Revolut’s board was said to be frustrated with the company’s response, with some members believing that the statement was an overreaction.

Revolut has drawn scrutiny from regulators, with the City watchdog mandating a review of its culture last year and carrying out a separate review of its risk management in 2020.

Earlier this month, Mr Storonsky criticised British regulators, saying: “You wait for emails or letters for months. This is not the business environment to operate in the modern world.”

He added that an “extremely bureaucratic regulator” meant the company was more likely to float in the US than the UK.

A Revolut spokesman said: “We do not comment on ongoing licence applications.”

A spokesman for the Prudential Regulation Authority declined to comment.

A Treasury spokesman declined to comment.

Source: The Telegraph