Chairman, Nigeria Revenue Service (NRS), Dr. Zacch Adedeji, yesterday, declared that the country currently lacked a framework to tax operators in the informal sector of the economy.

Adedeji said existing tax provisions were designed for taxation of the formal economy.

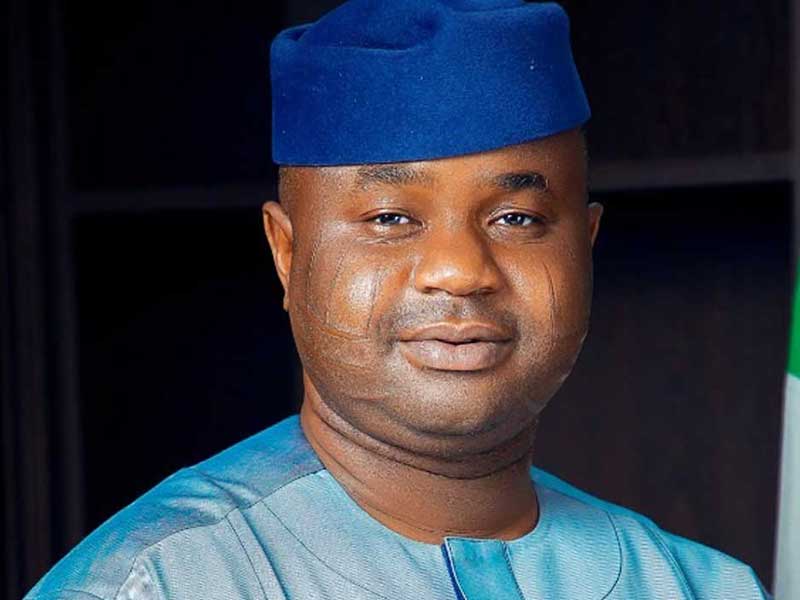

The NRS chairman spoke to the Editorial Board of THISDAY in Abuja on the implementation of the new tax laws.

He said the only way to tax informal businesses was to continue to encourage them to formalise their operations.

Adedeji said, “On the informal sector, you cannot tax what is informal. That is why they are called informal. To tax them, you must first formalise them. Encourage them to register and grow. Once they are formal, they fall into proper categories and can be taxed accordingly.

“Education and engagement will continue. We have departments for media, engagement, and stakeholder relations so that solutions can be tailored. Our goal is to help small businesses grow or, at the very least, sustain themselves.”

Adedeji further clarified that contrary to speculations, the Value Added Tax (VAT) was not imposed on poor Nigerians. Rather, it was a consumption tax with exemptions, he stated.

He said the aim of the Nigeria Tax Administration Act (NTAA) 2025, was to remove the burden of tax on the poor, adding that the new tax regime has ensured that only income or profits are subject to tax, not capital or investments.

He said while the new tax reforms had restored clarity, capacity, and accountability in tax administration, technology and process had also ensured that revenue collection was better tracked.

According to him, tax is paid by less than 10 per cent of the population everywhere in the world. He added, “VAT is not imposed on the poor.”

He said under his administration, no businesses will be shut down for noncompliance.

Adedeji said, “If I want revenue to grow, I must help you grow. I am not here to suffocate businesses. I am not a policeman or someone chasing bandits. I am like a farmer who prunes a tree so it can bear more fruit.

“That is why audits are now part of operations. Auditors work alongside tax officers. I have told them never to shut down a business, because sales lost today can never be recovered. If a business does not make profit, there is nothing to tax.

“That is why we now have tax service partners in every operation—to guide, explain, and assist businesses.”

He further clarified that his administration stopped the tax credit scheme due to the abuses it was subjected to, and “because it turned tax authorities into project supervisors, which we are not equipped to be”.

He said tax credit was not within NRS’ remit, adding that the service lacks the required competence to assess the projects.

He also said tax reforms around VAT remained one of the most significant of the interventions, as the federal government had given more financial resources to states.

The NRS boss also explained that the federal government’s decision not to subject food and agricultural items to VAT was to keep food inflation under check, and make food cheaper.

Adedeji said information currently remained the biggest challenge in the implementation of tax reforms, adding that government will continue to listen and address emerging concerns.

He said, “Trust is critical. People must first believe that government is not trying to make life harder. That understanding is the foundation.

“We do not claim to be perfect. Information is the biggest challenge right now, especially in an environment like ours.

“We are listening. Where something is not working, we will adjust. That is why we are here.”

On tax accountability and compliance, the NRS boss said, “Tax compliance is the law. It is not optional. In other countries you mentioned, people pay as much as 40 per cent of their income in taxes. Benefits do not come before compliance.

“We must ask ourselves if we are ready for the Nigeria we talk about. In the last three years, we invested heavily in education and skills development so graduates can find jobs. Accountability is not optional.

“Government officials are accountable for how tax revenue is spent. People are now asking questions, and rightly so. The era of taking citizens for granted is over.”

Adedeji added, “Trust takes time everywhere, not just in Nigeria. That is why we focused on actual implementation rather than explanations. People are now seeing that what we promised is what is happening.

“We are open to feedback. This process will not be perfect, but we will keep adjusting. Transparency and rule of law are non-negotiable. I have told my staff: everything must be open.”

Adedeji also addressed issues on deduction and non-remittance of tax.

He disclosed that with the consolidated law, revenue agencies will no longer lay claims to costs of collection but rather cost of operation, stressing that government should be able to fund its agencies.

Among other things, he said individual bank account balances could not be taxed.

He said, “Let me explain why it is difficult to do that now. Salary is a deductible expense. The only way to prove that salary was paid is evidence of tax remittance. So the system is self-regulated.

“On the issue of cost of collection, one reason we consolidated the law was because agencies were collecting taxes independently. When we consolidated, those costs became costs of operation. It is the duty of government to fund its agencies.

“I don’t generate revenue; I only collect revenue. My job is to ensure businesses and individuals do well. When they do well, revenue comes automatically.

“Revenue grows not by harassment, but by creating a conducive environment. That is why our focus is economic prosperity.

“Your bank account is your asset. Nobody has the right to tax your bank balance. Money in your account does not automatically mean profit.”

Stay ahead with the latest updates!

Join The Podium Media on WhatsApp for real-time news alerts, breaking stories, and exclusive content delivered straight to your phone. Don’t miss a headline — subscribe now!

Chat with Us on WhatsApp