President of the World Bank Group, Mr. David Malpass, has pointed out that Nigeria’s economic challenges are more of internal than external.

Mr. Malpass noted that staggered exchange rates and over-bloated fuel subsidies were vital areas that should be addressed by the All Progressives Congress (APC)-led Federal Government.

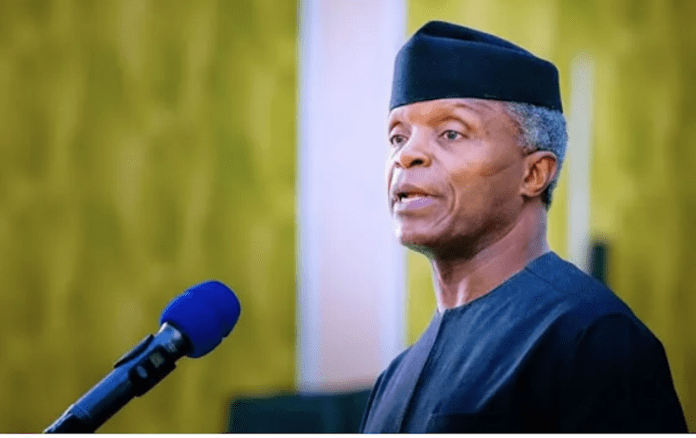

The World Bank President, therefore, urged Vice President Yemi Osinbajo, who led Nigeria’s delegation to the United States of America for another talk show on economic rejuvenation, to return home and address the issues raised.

The outcome of the meeting with the World Bank, which took place in Washington D.C., in the United States of America, was disclosed in a statement posted on the World Bank’s website.

During the meeting, Mr. Malpass reportedly emphasized the critical need for a decisive move toward exchange rate unification and stabilisation by Nigeria.

“President Malpass emphasised to Vice President Osinbajo that a unified exchange rate will significantly improve the business enabling environment in Nigeria, attract foreign direct investment, and reduce inflation.

“President Malpass and Vice President Osinbajo also discussed the importance of increasing domestic revenues through broadening Nigeria’s tax base and increasing the efficiency of tax administration,” an official statement stated.

The World Bank chief also pointed out that Nigeria, for the first time since its return to democracy and as the only major oil exporter, hasn’t been able to benefit from the windfall opportunity created by higher global oil prices presently, due to its rising petrol subsidy burden.

Meanwhile, the Director-General of the Debt Management Office (DMO), Mrs. Patience Oniha, has confirmed that Nigeria’s total debt profile as of March 2022 stood at N41.60 trillion.

Oniha said this during her appearance at the ongoing engagement on the 2023 – 2025 Medium Term Expenditure Framework (MTEF) and Fiscal Policy Paper held by the House of Representatives Committee on Finance yesterday. She attributed Nigeria’s high debt profile to a shortfall in revenues and the deficit in the annual budget as approved by the National Assembly. These, according to her, increased the debt stock of the country.

The express