The deal between Access Bank and Intercontinental Bank has remained a source of controversy to date.

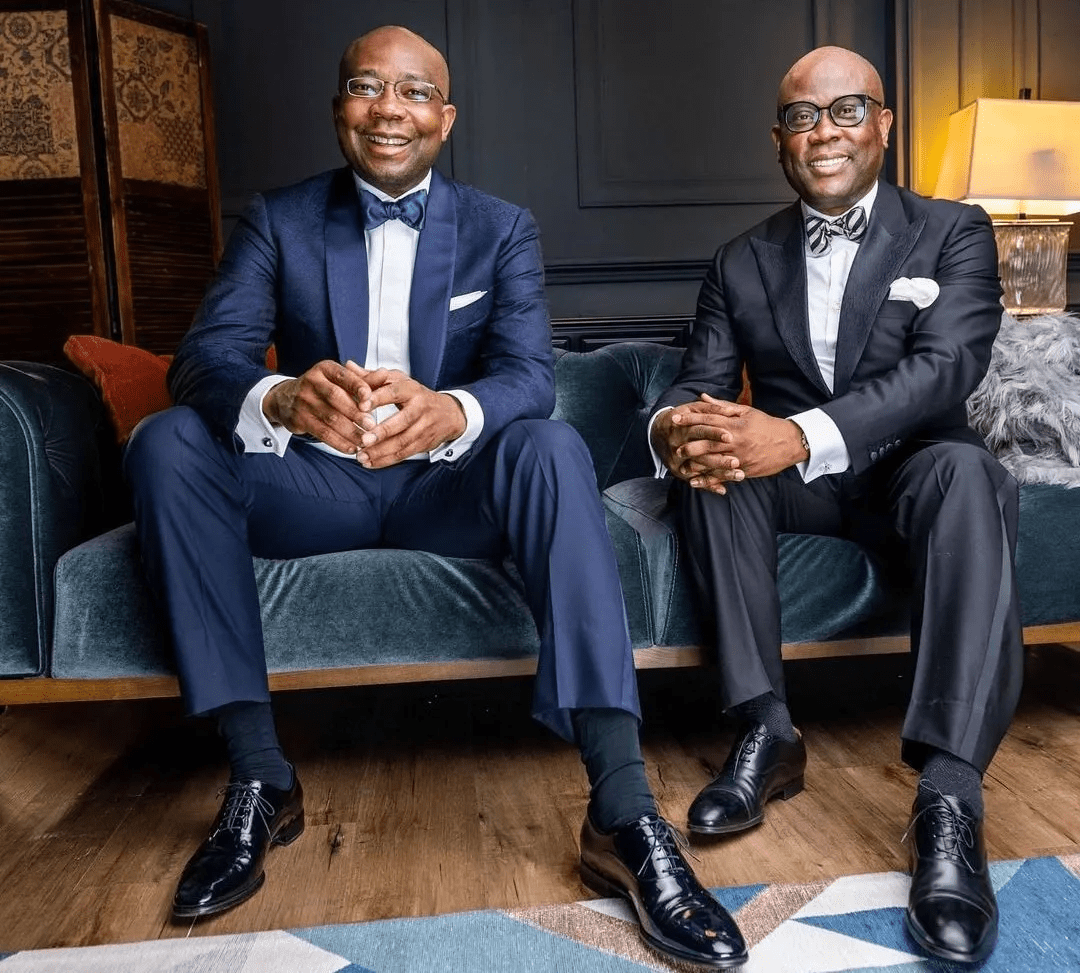

The story of Access is that of two audacious young men who chose to dream, follow up on their dreams by taking on the industry in a different and unprecedented way…. Between both men, they took on a path that paid off and won for them a fair mix of admirers and adversaries…. In only two decades, two men took to their own path and have turned a struggling bank into one of the largest in Nigeria. Whatever questions that others might have of them, which they will do well, as well clear up, what they have done in these 22 years was absolutely phenomenal.

Three things.

One, Access Holdings has just declared a profit after tax of N612 billion, with a 300 per cent increase year-on-year.

Two, the return of Aigboje Aig-Imokhuede to Access, not as CEO of Access Bank, which he was until 2013, but this time as Chairman of Access Holdings, the umbrella for the different interests of Access, including Access Bank, in which he, along with Herbert Wigwe, through their jointly owned company, acquired substantial interest in 2002, thus becoming the largest single shareholder, then taking over management of the Bank (with Imoukhuede as managing director and Wigwe as deputy managing director).

Three, the announcement that Access Bank has entered a binding agreement to acquire National Bank of Kenya (NBK) from KCB Group Plc, the second acquisition in Kenya, after that of Transnational Bank Limited in 2019.

These events signal that the dream that propelled the entity to where it is today is still intact, despite the death of Herbert Wigwe. It is also a reassurance to stakeholders that the template that was deployed to grow the institution, from where it was in 2002 to where it is today as ‘Nigeria’s largest bank by customer base’ and one of the top five by market capitalisation, valued at over N1 trillion, is not about to be jettisoned. With the benefit of hindsight, the transition from ‘Bank’ to ‘Holdco’, like in some other banks, has turned out to be a smart and timely move, as it made the way for a smooth and preferred transition before Wigwe’s transition, with the return of Imoukhuede to Access, albeit, in a non-executive capacity, as Chairman helping to ensure the transition with minimal disruption.

In the wake of the unfortunate helicopter crash which took the lives of Herbert Wigwe, his wife and son, his friend, Bimbo Ogunbanjo and the two pilots, reportage by the media, that might have reinforced commentary on social media, kept on referring to Wigwe as co-founder of Access Bank. Of course, he was not. The surprise was not just that the misstatement of fact was lost to many, a simple 20-word correction of that misrepresentation elicited a pushback from some quarters, which insisted on holding on to what was obviously a false claim.

That pushback, in a way, reminded me of how much of recent history there is a lot of confusion about/around, even if that confusion is, often, either contrived or mischievous. That appears to have also been the case with the story about Access Bank, even if indeed there was a bit of genuine confusion about who actually founded the Bank, the circumstances under which Imoukhuede and Wigwe took it over, leading to the controversy surrounding the takeover of the erstwhile Intercontinental Bank by Access Bank.

I was prompted to make a commitment to do a deep dive into the history of Access Bank to clear up some of the confusion. It’s been over a month now, but I have only just managed to squeeze out time to do that.

- Who founded Access Bank?

Access Bank was founded in 1988, and it began banking operations in 1989, at the time Imoukhuede and Wigwe, who were in their 20s then, were only just beginning their banking careers, which would, shortly after, take them to Guaranty Trust Bank, where they spent a decade before eventually moving over to Access Bank in 2002. Just as it was with the other banks licensed at that time by the Babangida administration, Access was set up by a group of investors. At the time, obtaining a banking licence required a minimum paid-up share capital of N20 million (a lot of money then), with individual ownership limited to five per cent of that capital, even though some found a way around that limitation through the use of proxies.

What the promoters of virtually all the banks that were licensed at the time did was to put together a list of prospective investors, who they reached out to, eventually settling for a number that enabled them to raise the capital, and ensuring that there were also a few men in the team with enough clout or profiles to help them in securing a licence. It was a group of carefully screened 42 investors in the case of Guaranty Trust Bank, with Fola Adeola and Tayo Aderinokun as the core promoters.

According to those with inside knowledge of the process that led to the licensing of the bank, Chief Dipo Farodoye was the principal promoter, with Dr Lawrence Omole, a renowned businessman and industrialist, who was owner of International Breweries Plc, being the other core promoter. The Farodoye and Omole families were also known to have invested in the project, which helped to increase their level of control of and influence over the Bank. The first Board of Directors had Dr Omole as chairman, with Chief Farodoye as vice-chairman, before taking over as chairman about two years later. Other directors included Professor Abiola Ojo, Mr Biodun Omole, Mr Kazeem, and Mr Odunaiya.

Alhaji Umaru Liman was the first managing director of the bank, but he left about one-and-a-half years later, with Mr Lateef Muse, who had joined the bank at inception from NAL Merchant Bank, as general manager, taking over as Managing Director of the bank and serving in that position till 1997. As with many of the banks at the time, power play among the promoters, directors, and senior management weighed heavily against the survival of these banks. This triggered undue interference, insider-dealings and mismanagement, which triggered crisis that led to distress and the eventual collapse of many of the banks.

Access Bank had its own share of problems, but was fortunate to have survived, unlike many other banks which went under between 1994 and 2000. As the bank grappled with the difficulties that banks were faced with at the time, the Muse-led management embarked on a repositioning exercise as part of a rescue mission for the bank. That saw to the recruitment of Arthur Andersen as management consultants. With intrigues and pressure from within and without, the team which commissioned Arthur Andersen did not stay long enough to see through the recommendations made by the consultants and their plans, including that for the recapitalisation of the bank through the capital market.

That was in 1997, and both the Chairman, Chief Dipo Farodoye, and the Managing Director, Mr Lateef Muse, were forced to leave the bank. In place of Chief Farodoye, Mr Ayo Oni, a former president of the Institute of Chartered Accountants of Nigeria (ICAN) and well-respected chartered accountant, who was former managing partner of Ernst & Young, Osindero, Oni, Lasebikan was appointed as chairman of the Bank, serving in that position till 2004. Mr Kayode Sufianu, who was an executive director, took over as acting managing director of the bank from Mr Muse, before Mr Tokunbo Aromolaran came in as managing director, serving in that position till 2001, before handing over to Mr Kayode Sufianu, who passed the baton on to Aigboje Aig-Imokhuede when he and his team took over the bank in 2002.

- The Coming of Imoukhuede and Wigwe

Following up on the advisory from Arthur Andersen, the Board and management of Access Bank had in 1999 recruited some executives from GTBank as management consultants. At the turn of the new century, with renewed efforts at shoring up the fortunes of the bank, a decision was taken to, again, approach the stock market to shore up the bank’s capital base. A public offer was launched in 2001.

About the same time, two young men who were then executive directors at GTBank came to the decision that the path forward for their careers was not in waiting in line for a shot at running the bank as Managing Director. Even as this had become an increasing possibility, they decided that the future belonged more to owners than managers of banks, while also concluding that the best route to attaining that was through mergers and acquisition.

The two young men were Aigboje Aig-Imokhuede and Herbert Wigwe. Both were 34 years old at the time. They set out to achieve their dream, which was tagged “Project Festival”, putting together a team of advisers coordinated by BGL Securities’ Albert Okumagba, who had served as head of Mergers and Acquisitions at Centre-Point Bank Plc, before setting up BGL, which midwifed the audacious merger of Standard Trust Bank (STB) and United Bank for Africa (UBA) in 2005.

Coming from GTBank, their initial target for acquisition was “banks that were doing fairly well by industry standards”, but they soon realised that it was rather naive to expect to buy a ‘ready-made’ bank, as they couldn’t possibly afford to acquire one in the first place. It was not until 2001, the same year that Access launched its public offer, that Imoukhuede and Wigwe began to set their sights on the bank.

Why Access?

According to Imoukhuede, they chose the bank for these three reasons:

(1.) “Its Board of Directors included men of integrity who were well-respected in business circles.” As earlier stated, the Chairman of the bank was a highly regarded former President of ICAN.

(2.) “The Bank was quoted on the Nigerian Stock Exchange, which implied some minimum standards of governance.”

(3.) “The financial safety indicators did not point to an institution that was on the verge of failure.” Perhaps, that helps in further making the point that Access Bank was not dead or defunct at the time of the takeover, as some have argued.

In what is suggested to have been a stroke of fortune, Access Bank launched a N1 billion public offer the same year Imoukhuede and Wigwe began to turn their lenses on it. The timing of the 2002 offer was said to have been poor, with the subdued interest it elicited leading it towards likely under-subscription. Even though the offer was underwritten by the issuing house, the advisers were said to have been in panic mode, as the closure date drew nearer, in terms of finding buyers. That was the case until Imoukhuede and Wigwe stepped in to mop up the yet to be subscribed shares through their jointly owned United Alliance Company. That offer ended up being oversubscribed to the tune of 110.98 per cent.

It was more of an instinctive leap for the duo: “…our decision to take up the unsubscribed shares was in effect a leap of faith (endorsed, I would like to point out, by the pastor of my church), it was our belief that since we would be controlling the management of the Bank we were recapitalising, the risk of losing our investment was almost entirely in our own hands.” According to Imoukhuede, they “…conducted no due diligence, doing little more than a ‘back of the envelope’ analysis.”

Deciding on the acquisition of the shares was the easy part, raising the N1 billion needed for the acquisition was the next challenge. Between the two men, they had assets worth N200 million, but how to raise the balance was the hurdle. According to their accounts, they put together a list of investors, made up of friends and family, who helped with cash deposits and land, through which they eventually raised the funds with which they financed the acquisition. As they made progress, news began to fly around. Soon, rumours of the deal got to their bosses at GTBank – Fola Adeola and Tayo Aderinokun, which prompted a meeting with the duo and eventually a demand for their resignations from the bank. That started them on the journey to officially taking over the management of Access Bank.

Frosty Reception at Access

As to be expected, the board and management at Access Bank were anything but excited at this development. They could not have imagined that a public offer launched of their own volition would unexpectedly upturn the ownership structure of the bank, such that it would lead to a shakeup in the composition of the Board and management. This was an unprecedented move in the industry. “Never before had there been a case where ‘mere banking professionals’ could have the temerity to take on established captains of industry and buy their bank. It was unheard of,” Imoukhuede recollects.

What they had done was remarkably different from what Keem Belo-Osagie had done with United Bank for Africa (UBA), taking over publicly owned shares in the bank put up for sale by government or what Tony Elumelu had done, buying over the shares from Belo-Osagie to take control over the bank. This was not a case of taking over a terminally distressed or liquidated bank from the regulators (CBN/NDIC), as others had done, but an unsolicited acquisition. It was seen by the board and management of the bank as ‘taking over through the back door.’ It was deemed a hostile takeover, with the reception from the Access boardroom predictably frosty. Imoukhuede and Wigwe were not welcomed with open arms.

That is understandable, as what transpired was technically a takeover, which by its very nature is not supposed to be a friendly gesture. Section 99(1) of the Investment Securities Act (ISA) defines this as “the acquisition by one company of sufficient shares in the company to give the acquiring company control over the company. The acquisition is usually at the instance of the acquirer and MOST OFTEN WITHOUT THE AGREEMENT OF THE ACQUIRED COMPANY.” (Emphasis added). Unprecedented as it was, it is a valid and legally recognised method of acquisition. The acquirer simply needed to report to the Securities Exchange Commission (SEC) and follow the laid-down procedure for formalising the takeover. Perhaps, it is the lack of understanding of the legal protocols that govern such transactions and the processing of such through the purview of the traditional business culture and ethics that has given the transaction the colouration of impropriety, even when that might not have been the case, with a trove of conspiracy theories still flying around, more than two decades after.

With the takeover of the bank, Aigboje Aig-Imoukhuede stepped in as managing director and Herbert Wigwe as deputy managing director of Access Bank in March 2002. That, however, came with its challenge, as the Central Bank of Nigeria (CBN) which, as the regulator, must sanction such appointments, refused to confirm the appointment of Aig-Imoukhuede as managing director, but he was allowed to continue to run the bank. It was not until 17 April, 2003, more than a year after taking over the bank, that his appointment in acting capacity received a nod from the CBN, with the confirmation only coming in 2005. That would eventually work in Imoukhuede’s favour, as that enabled him to serve till 2013, counting his 10-year tenure from 2003 to December 2013, before handing over to his friend, Herbert Wigwe.

- Growth, Mergers and Acquisitions

Starting with Imoukhuede and especially under Wigwe, Access Bank has witnessed a turnaround and transformation from a bit player in the industry into the behemoth that it is today, becoming Nigeria’s biggest bank by assets, operating under the umbrella of Access Holdings, which ranks as the largest financial services company in the country. The phenomenal growth of the bank has been largely achieved through mergers and acquisitions, which has seen it serially acquire banks, starting with Marina International Bank and then Capital Bank (formerly Commercial Bank Crédit Lyonnais Nigeria). It acquired Intercontinental Bank in 2011 and Diamond Bank in 2018. Across Africa, it has been the same story for Access Bank – a string of acquisitions that now sees Access Holdings Plc as the 14th most valuable stock on the Nigerian Stock Exchange, with a market capitalisation of N 818 billion, 15 subsidiaries and three representative offices in India, Lebanon and China.

- The Acquisition of Intercontinental Bank

Of all the mergers and acquisitions made by Access Bank, none has been as controversial as that between it and the defunct Intercontinental Bank Plc. Different stories are making the rounds, even if some have been out there for years. The main thrust of the allegations that have trailed the acquisition of Intercontinental Bank by Access Bank is that it was one tainted with irregularities. On the main street, it has been queried as an improbable transaction, likened to a tilapia swallowing a whale. While state of health of the big fish does not appear to matter to those putting forward this analogy, beyond that, even if all of what might have transpired in boardrooms and are not in the public space, here is what we know:

Intercontinental Bank Plc, founded in 1989 and originally licensed as Nigerian Intercontinental Merchant Bank (NIMB), was a merchant bank until 1999 when it made the crossover to commercial banking. In 2004, the Central Bank of Nigeria (CBN), under the leadership of Professor Charles Soludo, mandated all banks in the country to increase their minimum capital base from N1 billion to N25 billion within 18 months, with December, 2005 as deadline. That prompted a flurry of activities within the industry. Access Bank too had to pull out all stops to be able to meet the N25 billion minimum capital base requirement. It had to raise N15 billion through a public offer, carry out a merger with Marina International Bank and Capital Bank, and persuading FMO, the Dutch public-private development bank, in a last-minute bid, to convert a $15 million debt instrument into equity, before it could meet up with the requirement.

In response to that directive, Intercontinental Bank Plc in 2005 merged with Equity Bank of Nigeria, Gateway Bank and Global Bank, in which it already had interests, collapsing the group structure into a single entity. For a variety of reasons, the post-consolidation period was not as smooth-sailing as might have been envisaged for a number of the banks. Some appeared to have bitten more than they could chew and with that began a slip down a slope from which some never recovered. Intercontinental Bank was one of those in that category.

A ‘stress test’ of all banks in Nigeria was conducted by the Central Bank of Nigeria (CBN) in 2008. Findings from the test, according to the CBN, indicated that while some of the banks were healthy, others were not so healthy, with a few highly distressed. Intercontinental Bank Plc was one of those categorised as distressed. This led to further examination of the bank which, according to the CBN, revealed that there was entrenched insider abuse and fraud by the key men in the bank, with directors and senior management indicted. The scale of the malfeasance uncovered was such that the bank’s shareholders’ fund was said to have been completely eroded. Four other banks – Afribank Plc, Union Bank of Nigeria Plc, Oceanic International Bank Plc and Finbank Plc – were found in a similar shape to Intercontinental Bank. The boards of the banks were sacked by the Central Bank of Nigeria and replaced with interim boards, with the mandate to fashion ways out to rescue and recapitalise the banks.

Unlike in the past when intervention in banks by the Central Bank of Nigeria simply shepherded them towards eventual liquidation, this particular set of interventions heralded the setting up of the Asset Management Company of Nigeria (AMCON) by the CBN, with the mandate thrust upon it to absorb toxic assets (non-performing loans) from the books of the banks, recapitalise the banks, if feasible, and/or sell them to investors to recapitalise. The coming of AMCON also brought to an end the era in which depositors were left with the shorter end of the stick in the case of bank failure, with depositors’ protection cover from the National Deposit Insurance Corporation (NDIC) capped at N200,000.

Intercontinental Bank was one of the first beneficiaries of this new regime. The bank had the highest number of loans acquired by AMCON, making up 14.62 per cent of the agency’s portfolio at the time. After an initial injection of N562 billion into the bank by AMCON, it was eventually determined to pursue the option of opening the recapitalisation window for shareholders and investors to strike a deal by 30th September, 2011, failure of which would lead to nationalisation. That led to the bank being put up for sale in 2011, about two years after the board and management team led by Dr Erastus Akingbola had been sacked. To further put it into perspective, this was almost 10 years after Aigboje Aig-Imoukhuede and Herbert Wigwe had taken over at Access Bank. The bid by Access Bank for the acquisition of Intercontinental Bank only came when AMCON put it up for sale.

According to Mustafa Chike-Obi, who was the managing director of AMCON at the time of the acquisition, contrary to the claim that Intercontinental Bank was offered to Access Bank on a platter, he says that no other entity expressed interest in the acquisition of the bank apart from Access Bank. That might have had to do with the state of the bank at the time. It had declared an after-tax loss of N321 billion for the year ended September 2009, which was about the largest in the industry then. Access Bank, which some had likened to a tilapia in comparison to the whale, which they saw Intercontinental Bank as, declared a profit before tax of N28 billion for the year ended March 2009. While Intercontinental Bank’s ratios were in the red at the time of its acquisition, Access Bank’s were indeed strong, which makes the analogy of tilapia swallowing the whale a rather preposterous one.

In October 2011, having received judicial, regulatory and shareholders approvals, Access Bank announced the completion of the recapitalisation of Intercontinental Bank and the acquisition of a 75 per cent majority interest in the bank. According to Access Bank, “the combined effect of the restoration of Net Asset Value (NAV) to zero by AMCON and N50 billion capital injection by Access Bank Plc is that Intercontinental Bank now operates as a well capitalized bank, with shareholders funds of N50 billion and Capital Adequacy Ratio (CAR) of 24 per cent, well above the 10 per cent regulatory threshold.” By the completion of the acquisition and merger of both entities in January, 2012, Access Bank became Nigeria’s third largest bank by assets, with a combined customer base of 5.7 million.

In the years during which this transaction occurred, other distressed banks in the same category were also acquired by other players in the industry. Oceanic Bank was absorbed by Ecobank Transnational Incorporation, while Union Bank was acquired by Union Global Partners Limited (UGPL), a consortium of local and international investors which acquired 65 per cent of the bank’s shares. FinBank was acquired by First City Monument Bank (FCMB), while Equatorial Trust Bank was taken up by Sterling Bank. United Bank for Africa (UBA) had likewise acquired Liberty Bank, City Express Bank, Gulf Bank, Trade Bank, Afex Bank and Metropolitan Bank.

But the deal between Access Bank and Intercontinental Bank has remained a source of controversy till date. Two red flags have been raised. First, on the ‘purchase price’ of N50 billion, which Access Bank paid to acquire a 75 per cent stake in the rescued Intercontinental Bank. Some have argued that what was paid by Access was too little for what was gotten, alleging that it was a case of undervaluation. Some of the commentary that toe this line appear not to aver their mind to the state of the books of the bank, with some touting the number of branches in the network as if it is the brick and mortar that takes pre-eminence. With the bank already in the negative territory, what AMCON did was to restore its Net Asset Value (NAV) to zero, by taking off its books the non-performing loans. These NPLs, some of which had been highly discounted, were featherweights in comparison to their ascribed values. The mandate of AMCON is to absorb non-performing loans from rescued banks and return them to zero shareholders funds, for new investors to bring them to minimum capital levels, to be able to function on a new slate. This was the case in the transaction, with AMCON taking on N600 billion NPLs, much of which there was no guarantee of recovery. AMCON was funded by a debt obligation of N4.65 trillion (as at December, 2018) and has injected a total sum of N2.2 trillion into 10 banks. From the 12,743 NPLs worth N3.797 trillion from 22 Eligible Financial Institutions, which it purchased, AMCON has only been able to recover about N1.8 trillion as at December, 2023.

Without access to the books and the details of the negotiation process that culminated in the acquisition, it is difficult to conclude on the fair value of the asset. Some have even made the claim that contrary to the impression that it was a sweet deal for Access Bank that it actually met Intercontinental Bank in “a far deeper hole” than it had actually thought to be the case. Placing the Access-Intercontinental deal side-by-side with the UGPL-Union Bank deal, while Access paid N50 billion (about $323 million at the time) for 75 per cent of the shares in an Intercontinental Bank that had declared an after-tax loss of N321 billion for the year ended September 2009. At about the same period, Union Global Partners Limited (UGPL) had injected $500 million to acquire 65 per cent shares in a Union Bank that had posted an after-tax loss of N286 billion. The jury can hardly ever come to an agreement on the fair value of these deals.

The second red flag that continues to be waived is that of the relationship between Imoukhuede/Wigwe and Intercontinental Bank before they took over the management of Access Bank Plc, culminating in the acquisition of Intercontinental Bank. There is so much that yet remains unclear or unknown, but this is what we know: Aigboje Aig-Imoukhuede and Herbert Wigwe were directors of United Alliance Company of Nigeria Limited, with each having subscribed to 450,000,000 shares in the company, which at some point obtained a term loan from Intercontinental Bank Plc. According to the Central Bank of Nigeria Advertorial of 18th August, 2009, United Alliance Company of Nigeria Limited defaulted in the repayment of its loan to Intercontinental Bank Plc, with an outstanding balance of N16,247,686,168.18 as at 31st May, 2009. Even then, there is a report which declared that a witness in court had testified that Aigboje Aig-Imoukhuede and Herbert Wigwe claimed to have resigned as directors of United Alliance Company of Nigeria Limited since 2008.

From documents in the public domain, United Alliance Company of Nigeria Limited was yet to settle its indebtedness as at 2011, with letters from the company addressed to the bank requesting for an extension in the date of payment for a portion of the term loan that was due, with a promise to liquidate the loan within the tenor specified in the offer letter. It is unknown if that promise was ever kept. What is however known is that the company was the vehicle through which Aigboje Aig-Imoukhuede and Herbert Wigwe acquired the shares that enabled them take control of the management of Access Bank Plc. As at 2004, Aigboje Aig-Imoukhuede and Herbert Wigwe had 21. 18 per cent shareholding in Access Bank Plc through the 635, 441,208 shares held by United Alliance Company of Nigeria Limited in the bank. By the end of 2022, Herbert Wigwe had 201,231,713 direct shares and 1, 554, 369,017 indirect shares through United Alliance Company of Nigeria Limited, Trust and Capital Limited and Coronation Trustees Tengen Mauritius.

While it is unclear if or when United Alliance Company of Nigeria Limited settled its outstanding balance in favour of Intercontinental Bank Plc, it has to be noted that if it maintained its status as a non-performing loan as it was designated in the 2009 advertorial by the Central Bank of Nigeria, then it would have been absorbed by AMCON before Intercontinental Bank was put up for sale and acquired by Access Bank Plc. Whatever balance that was outstanding from United Alliance Company of Nigeria Limited was in favour of AMCON, which would (should) have done its duty to recover the loan. Access Bank could not have been indebted to Intercontinental Bank, as some claim, as Access Bank did not take any facility from Intercontinental Bank on the face of what is available. If indeed the facility obtained by United Alliance Company of Nigeria Limited was secured with 894,690,600 units of Access Bank shares, as has been alleged, it thus means that recovery of the outstanding would have been made easier by taking possession of the collateral. It is unlikely that AMCON will sit through meetings with Aigboje Aig-Imoukhuede and Herbert Wigwe and strike a deal approving acquisition of Intercontinental Bank by Access Bank, which they have substantial interest in and co-manage, knowing that United Alliance Company of Nigeria Limited, in which both men have interests in was indebted to AMCON through Intercontinental Bank Plc.

- Access Holdings and Transitions

With the return of Aigboje Aig-Imoukhuede to Access Holdings (parent company of Access Bank) as Chairman, the story of these two young men who took the industry by storm in 2002 through their audacious takeover of Access Bank has come full circle. The return and transition within the group might not have followed the script to the letter, but the timing of the transition into a Holding Company, which a few other Banks had adopted, has proved fortuitous in the light of the sudden death of Herbert Wigwe. He had vacated his position as the Managing Director of the Bank before the end of his tenure to take on the position of Group Managing Director/CEO, Access Holdings Plc. With that, Roosevelt Ogbonna was appointed Managing Director of the Bank while other subsidiaries also came under new management teams. Setting up that structure two years back must have helped in easing the process of transition that the death of Herbert Wigwe has forced on Access Holdings.

- Co-Founders and Brothers

Before FinTechs and the signature leadership model of co-founders became commonplace in Nigeria, there were a few entrepreneurs who had successfully worked with the same model. It is difficult to tell though if any of the two-man teams has worked as seamlessly and efficiently as that of Aigboje Aig-Imoukhuede and Herbert Wigwe. No doubt, the duo must have benefited from working at close quarters with the two-man team of Fola Adeola and Tayo Aderinokun, who apart from being their mentors and bosses at GTBank, must have inspired them to forge this formidable team that even caught the GTBank duo by surprise in the manner of its pursuit of the vision to make the transition from top-level employees in one bank to becoming owner-managers in another. It is remarkable to see the quality of friendship and brotherhood between both men, which also translated to that between their wives and families. Everyone who knew them referred to them as brothers, and it was obvious to see. To have succeeded in maintaining that quality of relationship over many years in the face of the pressures that come with success, power, influence and ambition in the treacherous world of banking and business in Nigeria is remarkable.

The story of Access is that of two audacious young men who chose to dream, follow up on their dreams by taking on the industry in a different and unprecedented way. They could have chosen to stay in their comfort zone at GTBank, being executive directors at the age of 36, with the pathway to the top position somewhat assured. Imoukhuede had at a point served as acting Managing Director of the bank. That would have surely come with the 10-year tenure limit that the Central Bank of Nigeria had instituted, following on a template that had been voluntarily institutionalised by GTBank. But they chose to take on a different path. Imoukhuede’s fear was that of being left behind on the tarmac, as was once his experience flying with Nigeria Airways. Wigwe’s fear was that of failure. Between both men, they took on a path that paid off and won for them a fair mix of admirers and adversaries. What is not in doubt is that they have made their marks, not only in banking but in other areas of life they chose to apply themselves to after making a success of their endeavour at Access. They have also successfully made the transition from regular bankers, who they were, into men with a burden and passion for their country, which propelled them to make interventions in the governance, health, arts, and education sectors, among others. In only two decades, two men took to their own path and have turned a struggling bank into one of the largest in Nigeria. Whatever questions that others might have of them, which they will do well, as well clear up, what they have done in these 22 years was absolutely phenomenal.

Simbo Olorunfemi works for Hoofbeatdotcom, a Nigerian communications consultancy and publisher of Africa Enterprise. Twitter: @simboolorunfemi