Nigeria’s oil and gas sector has long been the backbone of government revenue and foreign exchange, but investors on the Nigerian Exchange (NGX) are increasingly shunning its listed companies.

The divergence is stark: while crude prices have stayed relatively firm globally at an average of $65 per barrel this year, Nigerian energy equities have delivered negative returns, leaving them among the market’s biggest laggards in 2025.

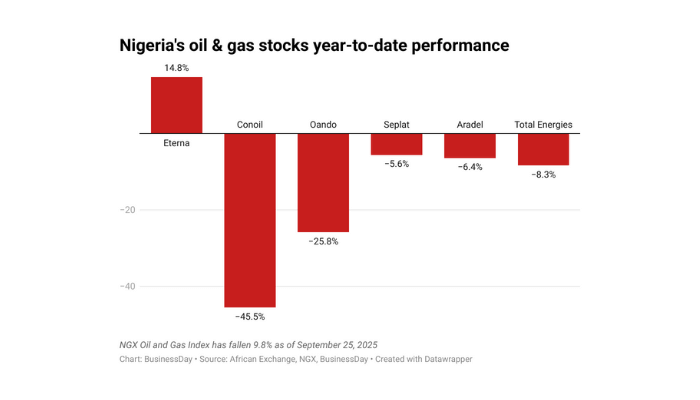

The NGX Oil and Gas Index has fallen 9.8 percent year-to-date, even as the All-Share Index gained 37.1 percent. The underperformance is even more glaring compared with sector peers: the Banking Index has surged 38.9 percent, while Consumer Goods has nearly doubled, up 93.9 percent, according to data compiled by BusinessDay as of Thursday, 25th September 2025.

Winners and losers

Within the oil and gas index, fortunes have been uneven. Eterna Plc is the sole gainer, rising 14.8 percent. Conoil Plc has tumbled 45.5 percent, while Oando Plc is down 25.8 percent.

Upstream majors have disappointed too: Seplat Energy Plc is down 5.6 percent, Aradel Holdings has shed 6.4 percent, and TotalEnergies Marketing Nigeria fell 8.3 percent.

The dispersion reflects a mix of company-specific challenges and broader structural bottlenecks.

“For me, the weakness in Nigerian oil company stocks isn’t just about the soft quarterly results. The downstream players are facing a tougher reality,” said Nathan Olaniyi, US-based capital market analyst.

“The rise of the Dangote refinery has reshaped pricing and margins, squeezing marketers like TotalEnergies and Conoil, making the stock less attractive to investors.”

Profits tell a mixed story

Earnings from the first half of 2025 reveal why investors are not convinced by headline profits.

Eterna Plc returned to profitability for the first time in two years, posting N573.8 million net income, compared with a N4.8 billion loss a year earlier. Management projects full-year profit could hit N1 billion. That turnaround has underpinned its share price rally, but investors remain cautious given its small scale and thin margins.

Conoil Plc, controlled by one of Nigeria’s billionaires, Mike Adenuga, reported its weakest half-year profit in five years at just N900 million, a sharp fall from N8.02 billion in the same period last year. Finance costs more than doubled to N4.76 billion, eating into earnings and sending the stock into a tailspin.

Oando Plc declared a half-year profit of N63.3 billion, only marginally higher than last year’s N62.7 billion. But beneath the headline number, it suffered a bruising N49.7 billion Q2 loss, compared with N3.3 billion in the same period last year. That volatility has unnerved investors and weighed heavily on its valuation.

Aradel Holdings delivered one of the strongest results, with profit up to N146.4 billion from N104.4 billion a year earlier. Crude exports accounted for N232.8 billion, or 63 percent of revenue, compared with N171.1 billion last year. Yet despite the profit growth, its stock has still fallen, underscoring the broader sentiment drag across the sector.

The results show that even when companies report healthy earnings, investors are unwilling to reward them, signaling deeper structural concerns.

High interest rates squeezing margins

Until the recent pivot to monetary easing when the central bank lowered the key interest rate by half point to 27 percent, Nigeria’s borrowing rate was at a record high, pushing up finance costs and squeezing earnings.

All the downstream players saw their finance costs rise sharply in what continues to burden the firms’ financials.

“High interest rates or borrowing costs mean finance costs quickly eat through whatever gross profit they make. Conoil, for example, saw its finance costs more than double year-on-year in H1 2025, showing how rising rates are eating into earnings.”

Read also: Nigeria is finally selling more than oil

Why the disconnect?

Analysts say the main culprit is Nigeria’s persistent inability to translate global oil prices into stable, attractive returns. Production has repeatedly fallen short of OPEC quotas due to crude theft, pipeline vandalism, and underinvestment, a situation that is now improving as oil output increased to 1.68 million per barrel in the second quarter of 2025, according to the National Bureau of Statistics.

The companies are equally still grappling with foreign-exchange crisis even though stability has returned. Upstream firms reporting in dollars, such as Seplat and Aradel, face translation losses, while downstream players struggle with import costs.

Subsidy reforms, though positive for fiscal health, have exposed marketers to consumer price sensitivity and margin compression. Conoil’s sharp earnings decline illustrates how finance costs and regulatory pressures can swamp revenues.

Olaniyi told BusinessDay that the sector’s unimpressive performance are structural pressures, not short-term setbacks, stressing that there is uncertainty about how fuel pricing, new surcharges, and distribution rules will settle in a post-subsidy environment, which leaves companies hesitant and investors cautious.

“Another thing is the steady delisting of downstream names like Ardova and MRS Oil, and shrinking investor choice, and it is no surprise the market remains skeptical. Beyond the unimpressive results, investors don’t trust the stability and predictability of the sector.”

Investors find safe haven in FMCGs, banks

Given the risks, both domestic and foreign investors are rotating into sectors with clearer earnings visibility. Banks have been boosted by elevated interest rates, which fattened net interest margins, even though profits are slowing as revaluation gains fade, while consumer goods firms have leveraged pricing power to protect demand.

“There is no compelling reason to overweight oil and gas in Nigeria right now,” said a Lagos-based equity analyst. “The sector looks fundamentally riskier than banks or FMCGs, where earnings are more predictable.”

Regulatory and policy overhang

Nigeria’s Petroleum Industry Act (PIA) was meant to unlock new investment and streamline governance. Yet implementation has been slow, and international oil companies continue divesting onshore assets, citing security and policy risks. The uncertainty has depressed valuations and deterred inflows.

Meanwhile, regulatory interventions and opaque fuel-pricing policies leave downstream players struggling to plan. Even companies posting profit growth, such as Aradel, face questions over the sustainability of their earnings.

“Potential catalysts could improve sentiment. The Dangote Refinery’s gradual ramp-up may reduce dependence on fuel imports and stabilise downstream margins,” an energy analyst who would not want to be mentioned said.

“Efforts to secure pipelines could lift crude production, while faster PIA enforcement may eventually attract fresh capital.”

Still, investors are unlikely to return in force until FX liquidity improves and policy execution becomes more predictable. In the near term, oil and gas equities look set to remain laggards in Nigeria’s market rally.

As one portfolio manager puts it: “Oil still pays Nigeria’s bills, but in the equity market, it is paying fewer dividends.”

Stay ahead with the latest updates!

Join The Podium Media on WhatsApp for real-time news alerts, breaking stories, and exclusive content delivered straight to your phone. Don’t miss a headline — subscribe now!

Chat with Us on WhatsApp