Access Holdings Plc, Zenith Bank Plc, and First Bank Holdings may suspend dividend payments until 2028, as Nigeria’s top banks confront regulatory pressure to rebuild capital buffers to fully provide for legacy forbearance exposures, according to a new report by Renaissance Capital.

The report, released June 16, follows a directive by the Central Bank of Nigeria (CBN) on June 13, which instructed banks to pause dividends, defer executive bonuses, and halt offshore expansion until they’ve adequately provisioned for forbearance loans and resolved breaches of single obligor limits.

Renaissance analysts say the order could result in a multi-year dividend drought for some of the country’s largest lender

“Our base case is that the banking arms of AccessCorp, ZenithBank, and FirstHoldco will not resume dividend payments before 2028,” the note said. “Most of their near-term cash flows will be directed towards absorbing provisioning costs and recapitalisation.”

Although these lenders reported strong accounting profits in 2024 — N635 billion for Access and N867 billion for Zenith — both posted negative cash profits, largely due to unrealised interest income on Stage 2 loans and FX revaluation gains.

FirstHoldco’s cash position also turned negative in Q1 2025, following challenges with a single large non-performing loan.

GTCO, by contrast, fully provisioned its exposures earlier and is expected to maintain uninterrupted dividend payments, supported by positive cash profits of N1.2 trillion in FY24.

UBA is also expected to resume payouts by 2026, given its manageable exposure and steady liquidity.

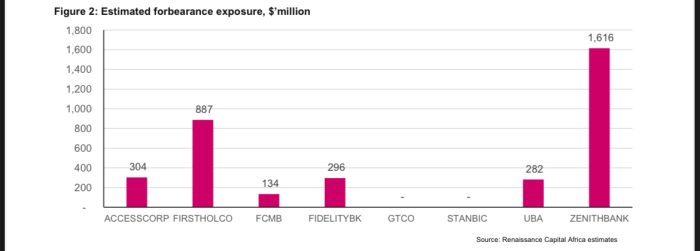

According to the report, six lenders hold a combined forbearance exposure of $3.5 billion with Zenith Bank being the most exposed.

“We estimate regulatory forbearance exposures at $304 million, $887 million, $134 million, $296 million, $282 million, and $1.6 billion for ACCESSCORP, FIRSTHOLDCO, FCMB, FIDELITYBK, UBA, and ZENITHBANK, respectively,” the report shows.

The dividend suspension comes amid additional strain from the CBN’s move to raise the Cash Reserve Ratio (CRR) to 50 percent, which Renaissance estimates cost the banking sector N840 billion in income last year alone.

With just 20 percent of customer deposits left deployable for lending, analysts warn the capital build-up may not translate into real credit growth.

“The 50% CRR regime is proving more detrimental to banks’ profitability and liquidity,” the analysts said in the report.

”From an operational perspective, a CRR reduction would enhance banking sector liquidity, reduce reliance on commercial paper issuance for liquidity management, and improve overall financial system efficiency.”

Stay ahead with the latest updates!

Join The Podium Media on WhatsApp for real-time news alerts, breaking stories, and exclusive content delivered straight to your phone. Don’t miss a headline — subscribe now!

Chat with Us on WhatsApp