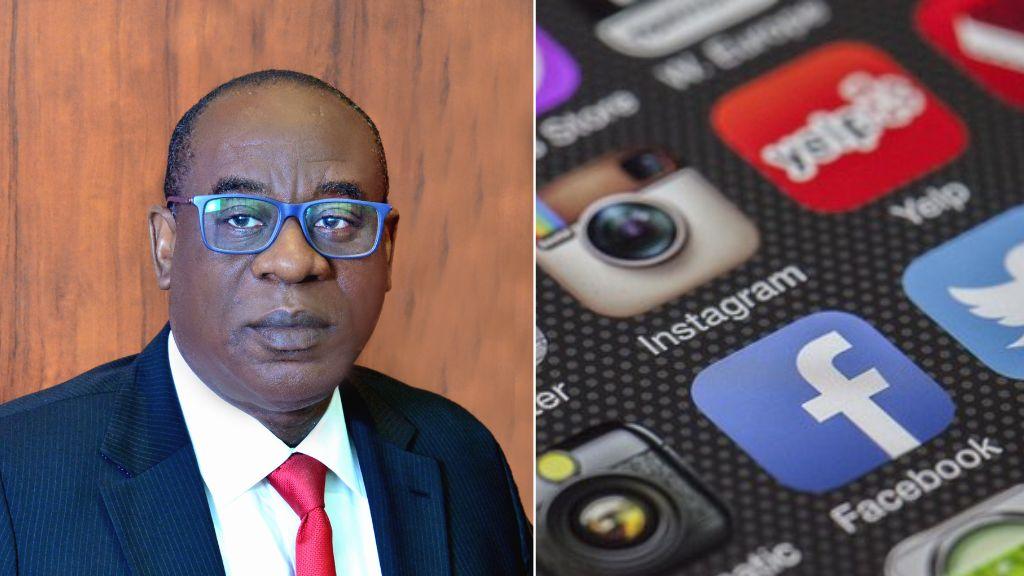

Some Nigerians have criticised the Central Bank of Nigeria (CBN) for ordering commercial banks to obtain customers’ social media handles for identification.

The CBN in its new customer due diligence regulations with a view to further deepen the identification process in the banking system, mandated financial institutions to obtain the social media handles of customers.

The apex bank published the ‘Central Bank of Nigeria (Customer Due Diligence) Regulations, 2023’ document on its website on Friday.

According to the CBN, the new regulation was designed to provide additional customer due diligence measures for financial institutions under its regulatory purview.

The objective of the regulations the apex bank noted includes, “To provide additional customer due diligence measures for financial institutions under the regulatory purview of the Central Bank of Nigeria to further their compliance with relevant provisions of the Money Laundering (Prevention and Prohibition) Act (MLPPA), 2022, Terrorism (Prevention and Prohibition) Act (TPPA), 2022, Central Bank of Nigeria (Anti-Money Laundering, Combating the Financing of Terrorism and Countering Proliferation Financing of Weapons of Mass Destruction in Financial Institutions) Regulations, 2022 (CBN AML, CFT and CPF Regulations) and international best practices.

“And enable the CBN to enforce compliance with customer due diligence measures in line with the CBN AML, CFT and CPF Regulations.”

The apex bank, under its customer identification column, said financial institutions must identify their customers (whether permanent or occasional, and whether natural or legal persons or legal arrangements) and obtain the following information:

“For Individuals — legal name and any other names used (such as maiden name), permanent address (full physical address), residential address (where the customer can be located), telephone number, e-mail address, and social media handle; date and place of birth, Bank Verification number; Tax Identification number; nationality; occupation; public position held; and name of employer.”

It also noted that an individual must have “an official personal identification number or other unique identifier contained in an unexpired document issued by a government agency that bears the name, photograph, and signature of the customer, such as a passport, national identification card, residence permit, social security records, or drivers’ license.”

Part of the requirement includes “Type of account and nature of the banking relationship, and signature, and politically exposed person status.

The regulator also maintained that financial institutions shall not establish or keep anonymous accounts, numbered accounts, or accounts in fictitious names.

These regulations shall apply to all financial institutions under the purview of the CBN, as noted in the document.

However, Nigerians, especially the social media users reacting to the development said National Identification Number (NIN), Bank Verification Number (BVN), and others are enough for identification.

They also argued that it is against the data protection bill which was recently signed into law by President Bola Ahmed Tinubu.

@EthelMEthel said; “Such identification that can’t be done with customers NIN and BVN, how successful can they get the exact information needed with people using a different username, no profile picture & no personal details? It seems you guys are daily lacking orientation of managing Nigerians.”

@palmerjoel88 said; “So what is the purpose of NIN and BVN that is attached to our accounts? So much for the data protection bill, as its true purpose has been decleared. If not I don’t get why we have national id card NIN and BVN.”

Esther-Osato Chinemerem Imudia wrote; “I saw this coming with Tinubu as President. Expect more attempt to gag the youth through seizing/controlling the access to browsing.

Source: Intelregion