In a bold move that has sent ripples through the traditional banking sector, Uchi Uchibeke’s Chimoney has announced its acquisition of Scrim, a Gen-z led social payment app.

This strategic move not only signals a significant shift in global money movement but also positions Chimoney as a powerhouse in the fintech ecosystem, enabling startups to launch and scale with unprecedented speed with a single Payment Infrastructure and API: Chimoney.

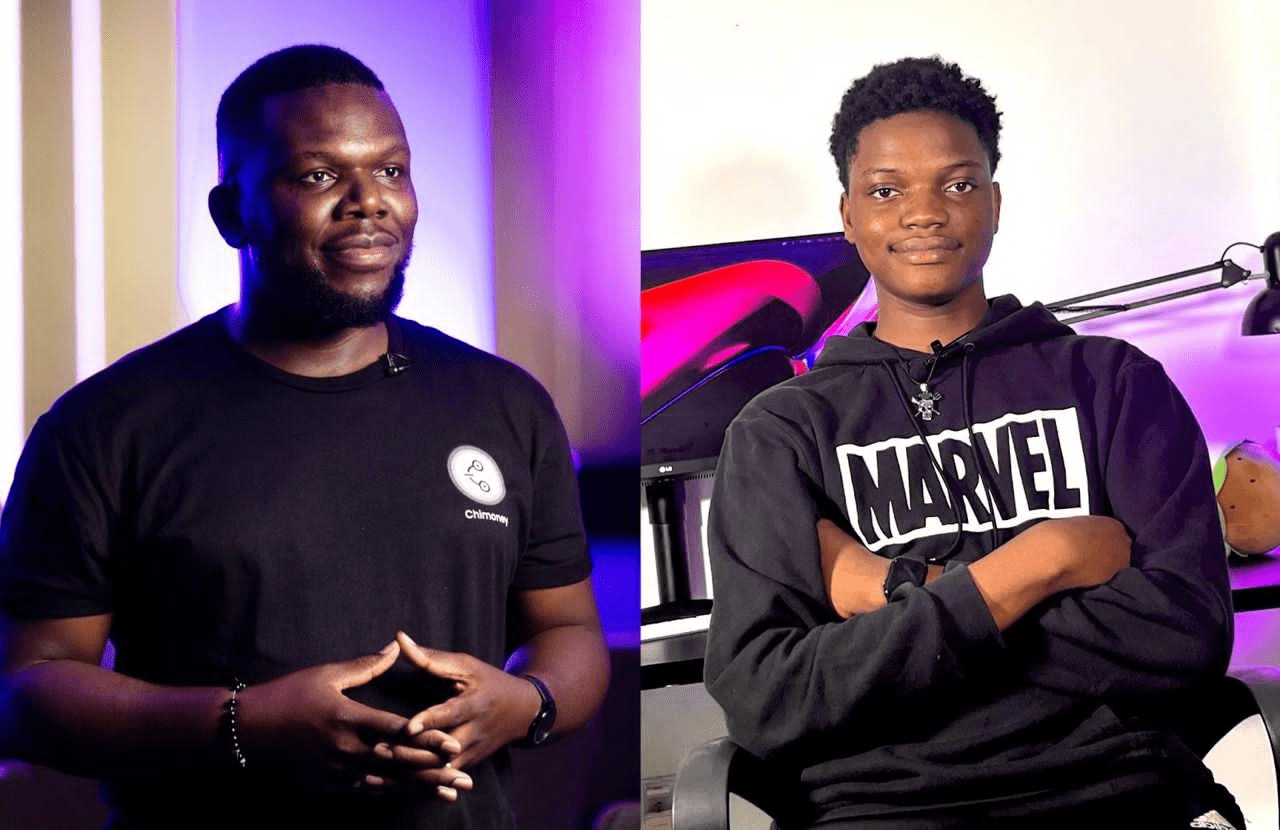

Chimoney’s latest acquisition is more than just a merger; it’s a statement. Spearheaded by Uchi Uchibeke, a visionary leader with Royal Bank of Canada and Shopify pedigree, the deal brings under its umbrella the innovative Scrim app, known for its unique approach to social payments. Founded by Nigerian prodigy Pleasant Balogun at just 17, Scrim has been redefining how money moves in the digital age.

Uchibeke, whose career spans groundbreaking work in AI and blockchain technology, sees the acquisition as a strategic step in Chimoney’s mission to revolutionize global payouts. “Our vision at Chimoney has always been to make value move as easily as information does in today’s connected world,” says Uchibeke. “Integrating Scrim’s innovative approach with our robust API and infrastructure propels us to the forefront of the upcoming shift in the Payments landscape.”

Scrim, initially powered by Chimoney’s API, allows users to send payments via social handles and direct messages – a feature that has caught the eye Gen Z globally. Pleasant Balogun, now working on Scrim at Chimoney, brings a unique Gen Z perspective, blending youthful innovation with Chimoney’s technological prowess. “Joining forces with Chimoney is a dream come true,” says Balogun. “It’s a testament to what young African minds can achieve in the global tech space.”

This acquisition is a clear challenge to traditional banking models, which have long been criticized for their slow and cumbersome processes in global remittance. Chimoney’s agile approach, combined with Scrim’s social payment and Chimoney’s Email and Phone Payout functionalities, offers a seamless and rapid alternative, threatening the status quo of banks and established money transfer operators like Western Union.

Chimoney’s robust API and infrastructure are not just for Scrim. They represent a beacon for fintech startups and developers globally. “Our platform is a launchpad for anyone looking to break into the fintech space,” Uchibeke explains.

“We’re developers and open-source advocates and we’re democratizing access to global payment infrastructure, making it possible for startups to launch and scale at a speed previously unimaginable using One API to access multiple Products, Payment options and Countries.”

With Chimoney’s API, global payouts are no longer a challenge but an opportunity. Chimoney’s APIs enables payouts to Banks in 100 Countries, Mobile Money, Gift Cards, Airtime and Crypto on seven Blockcgains. Scrims integration with Chimoney’s API and Payment infrastructure exemplifies how versatile and powerful Chimoney’s solutions are in the evolving landscape of digital payments, onramp and offramps. This move is more than an acquisition; it’s a reshaping of the global remittance narrative and making launching a global Fintech as easy as hosting a website on the Cloud.

As banks and traditional financial institutions take note, Chimoney, led by Uchi Uchibeke, is not just redefining the future of money movement; it’s actively constructing it. With this acquisition, Chimoney sends a clear message: the future of fintech is here, and it’s more accessible, rapid, and user-friendly than ever before.