What was once an elite-only investment landscape in Nigeria has transformed dramatically.

Today, mobile apps are democratizing access to wealth-building opportunities, with millions of Nigerians embracing digital platforms to invest in stocks, bonds, mutual funds, and even cryptocurrencies.

Driven by growing financial literacy, reduced capital entry barriers, and fintech innovation, investors—both seasoned and new—can now start with just a smartphone and minimal funds.

However, choosing the right platform requires assessing various factors: investment goals, risk appetite, product offerings, user experience, fees, security, regulation, and customer support.

Based on download figures and user ratings as of June 2025, here are Nigeria’s top 10 investment platforms:

10. GetEquity — 4.3 ⭐ | 10k+ Downloads

Initially launched in 2021 to give retail investors access to startup equity, GetEquity has pivoted toward debt instruments amid reduced venture capital inflows.

The platform now offers commercial papers and debt notes, partnering with firms like ARM to provide access to corporate issuances, including Dangote Group notes.

It claims over N500 million processed since 2024, with a monthly growth of 10%.

According to CEO Jude Dike, commercial papers are already approved by Nigeria’s Securities and Exchange Commission (SEC), and the startup is also in the process of securing an Approval-in-Principle for digital asset issuance and trading from the regulatory agency.

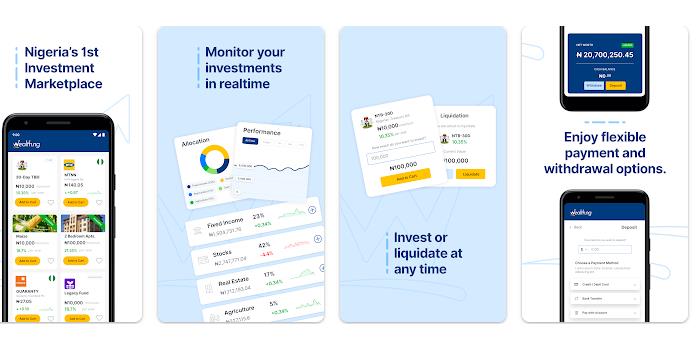

9. Wealth.ng — 2.3 ⭐ | 50k+ Downloads

Wealth.ng, backed by WealthTech Limited and affiliated with Sankore Securities Limited, offers fixed-income products, including treasury bills and bonds. Founded in 2014, it operates as an investment platform for fixed-income assets.

It enables consolidated investment management in one dashboard and ensures secure transactions through Flutterwave’s PCI DSS-certified infrastructure to ensure users’ transactions and financial information are kept safe at all times.

The platform offers access to multiple investment opportunities, making it easy for investors to have all their investments on a single platform.

It is the licensed entity within Sankore Global Investments that provides investment management and advisory services, specifically through the Wealth.ng platform.

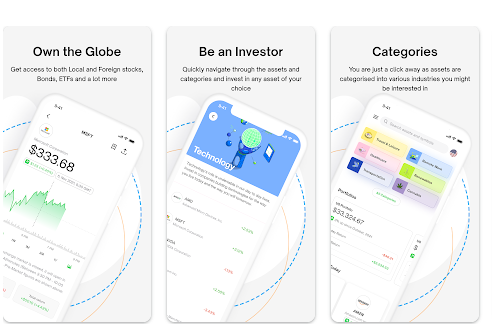

8. Chaka — 3.6 ⭐ | 100k+ Downloads

Chaka provides access to 5,000+ Nigerian and global stocks, allowing investors to diversify with both naira and dollar accounts. Regulated by Nigeria’s SEC, it offers curated investment portfolios and competitive trading fees (0.69%–1.5%). The platform changed leadership in early 2024 following its acquisition by Rise.

In January 2024, founder Tosin Osibodu left the company five months after Rise acquired the company. Following his exit, Osibodu joined Alpaca, a company that develops APIs for trading stocks and crypto, per his LinkedIn page.

The app provides its users with access to top-performing Naira portfolios curated by certified wealth management experts.

7. Quidax — 4.1 ⭐ | 100k+ Downloads

Quidax is a fast-growing cryptocurrency platform. With a 4.1-star rating and over 100,000 downloads, the user-friendly app allows individuals to buy, sell, and store cryptocurrencies, including Bitcoin, while offering real-time portfolio tracking and secure wallet services.

Designed with simplicity in mind, Quidax enables both beginners and experienced traders to navigate the complex crypto ecosystem with ease. The intuitive interface, along with robust security protocols, positions it as a preferred gateway for Nigerians venturing into digital currencies.

Quidax is licensed by the Securities and Exchange Commission of Nigeria.

6. Trove Finance — 4.2 ⭐ | 100k+ Downloads

Trove offers extensive product diversity, from stocks and bonds to ETFs and crypto. Users can start investing with as little as N1,000 or $10, and earn returns up to 20% on Naira savings.

This platform caters to investors looking for a mix of traditional and digital assets, allowing for a diversified investment approach within one app.

Features include Trove Social, Earn by Trove, a USD virtual card, and stock gifting, all secured by encryption and two-factor authentication.

5. I-Invest — 4.3 ⭐ | 100k+ Downloads

Initially focused on treasury bills, I-Invest now includes Eurobonds, mutual funds, insurance, commercial papers, and stocks. Known for its user-friendly interface, it caters to Nigerians seeking reliable fixed-income options and low-risk opportunities with stable returns.

The seven-year-old platform makes it accessible to both seasoned investors and beginners, putting financial security and profitability at their fingertips.

The app offers access to shares on the Nigerian Stock Exchange, making it versatile for different investment needs.

I-invest is the flagship product of Parthian Partners Limited, a financial services firm licensed by the Nigerian Securities and Exchange Commission (SEC).

4. Bamboo — 4.3 ⭐ | 1M+ Downloads

Bamboo enables users to buy, sell, and monitor Nigerian and US stocks (NASDAQ, NYSE) with real-time data. It supports fractional share purchases for US equities and global access via BVN authentication.

Founded in 2019 by Richmond Bassey and Yanmo Omorogbe, Bamboo is tailored to investors seeking exposure to foreign markets.

With a BVN, the app can be used from anywhere in the world with access to real-time market data and news updates.

3. Cowrywise — 4.4 ⭐ | 1M+ Downloads

Cowrywise specializes in mutual fund investments across risk tiers, offering savings automation alongside investment options.

The platform uses industry-standard encryption technology to protect user data, as well ass two-factor authentication to verify all customer accounts.

SEC-licensed and security-conscious, it caters to Nigerians seeking structured financial planning. The platform plans to expand into Nigerian stock investments soon.

2. PiggyVest — 4.5 ⭐ | 1M+ Downloads

Piggyvest is a secure online savings platform that makes saving possible by combining discipline plus flexibility to help users grow their savings.

PiggyVest blends disciplined saving with light investment options, including bonds and real estate. Known for tools like SafeLock and Flex Dollar, it’s ideal for beginners.

In the first half of 2025, PiggyVest reported N2.6 trillion payouts, and added that with almost seven million customers who have taken their first step toward financial freedom, over N47,000 was saved every second in the period under review.

It was co-founded by Odunayo Eweniyi, Somto Ifezue, and Joshua Chibueze.

1. Carbon — 4.0 ⭐ | 5M+ Downloads

Carbon, formerly Paylater, leads the rankings with over five million downloads, offering investment plans alongside digital banking services.

Users can choose from: Cash Vault: A fixed deposit product yielding up to 11% interest; FlexSave: A flexible plan with returns up to 9%; or Goals Plan: A structured plan that encourages saving towards a target with up to 9.5% in returns

Co-founded in 2012 by brothers Ngozi and Chijioke Dozie, Carbon combines savings, lending, payments, and investments in one intuitive app. It’s best suited for users seeking simplicity, access to credit, and steady returns without delving too deep into complex financial markets.

Summary

Nigeria’s digital investment ecosystem has evolved into a dynamic marketplace catering to every kind of investor, from cautious savers using PiggyVest and Carbon, to diversified traders leveraging Trove and Bamboo, and passive wealth builders on platforms like Risevest.

What’s clear across these top 10 platforms is that convenience, accessibility, and trust are driving mass adoption. With millions of downloads and steadily improving user ratings, fintechs are proving that investing is no longer an exclusive club—it’s a public playground primed for financial empowerment.

Stay ahead with the latest updates!

Join The Podium Media on WhatsApp for real-time news alerts, breaking stories, and exclusive content delivered straight to your phone. Don’t miss a headline — subscribe now!

Chat with Us on WhatsApp