The 20 years between 1985 and 2005, especially the 90s in between, must pass as the most consequential years in the history of modern-day Banking in Nigeria.

It was during those years that Banking, as it used to be, was fundamentally redefined, with the institution, held back by traditional approach to book-keeping and sluggish service delivery was forced to shed weight and take on new form. Who remembers the era of tally numbers, which one bank cashed upon for an iconic Gringory TV Commercial with a mat under his arms as he headed for a bank.

Of course, that came with some downsides as well, but by and large, that era redefined for good, giving birth to a long list of Banking institutions that are there today, even if many had also fallen by the side and others subsumed in the name of mergers, acquisitions and the ‘Soludo consolidation’.

That was the era when young men and women took over banking. Men in their 30s emerged as Founders and CEO of Banks reshaping the space, bringing glamour and technology to redefine the institution. Fresh out of school in the late 80s and early 90s, the dream for many young men and women was to get into Banking. Such was the dream that people ditched Engineering for Banking. Some of these people would eventually become the top dogs in Banking post-2000.

The thirties should be the most auspicious time in the lives of most people in taking on their big dreams. Many of the people behind the redefinition of Banking in that era were in their 30s. Fola Adeola, Tayo Aderinokun and others who came together to found the Guaranty Trust Bank were in their 30s. I remember walking into the banking hall of one of the first branches on Broad Street, with my mouth open. A colleague who had visited brought me the gist. My office was only just a walk away, so I strolled down to see what we were pushing the bank to be, but those who mattered couldn’t see. A massive piano in the banking hall, serving of cake and coke for everyone who walked in! It was not about these things. It was the thought that gave birth to them. That was the era! The dream was huge. It was good to see the dreams, for many of them, come true.

There were many men of that era, still standing today – Jim Ovia (Zenith), Aig Imoukhuede and Herbert Wigwe (Access) and Atedo Peterside (IBTC) and others, including those like Erastus Akingbola, Cecilia Ibru, whose careers took a different turn as well as a long list of giants of that era whose names won’t even ring a bell today. Then, there were some of the older generation – Subomi Balogun, Ebitimi Banigo.

At a time, Ebitimi Banigo, who is now a traditional ruler, the Amanyanabo of Okpoama Kingdom, who had been one of the foremost merchant bankers, having served as the Managing Director of the iconic International Merchant Bank (IMB) and then founder and Managing Director of All States Trust Bank, was named the Godfather of Banking. He was so named for the fact an enviable list of his protégées, those who had passed through him, were now at the helm of affairs in some of the major banks. This was in the 90s.

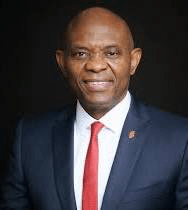

Tony Elumelu was one of the Banigo ‘boys’ who rose to the top in the 90s, while still in his 30s. In a way, it is difficult to find anyone whose story better captures the essence of these two decades than Tony Elumelu. In a way, given all that he has achieved in comparison with others from that era, we might even call him ‘the last man standing’.

The story of how he had applied to join Banigo’s All States Trust Bank, even when he did not meet the criteria set out in the advertisement and how that audacity paid off, with his employment by the bank for daring to act in faith speaks, in part, to the audacity of young men of that era and Tony himself. He would seize the opportunity offered with both hands, distinguishing himself and becoming one of the bank’s youngest Branch Managers at the age of 26.

But it was the move he made just about 8 years after that brought him into the fore, becoming one of the youngest CEOs in the Banking industry at the age of 34. It was his leading other investors to acquire the distressed Crystal Bank, becoming its CEO and renaming it Standard Trust Bank (STB). People in the industry began to pay more attention to Tony Elumelu when the bank began an expansion plan at a time when many banks had either just gone under or were on their way down. It was obvious he was playing by a different book.

Nothing prepared many for what would happen next. The Federal Government had, in the name of a privatisation and commercialisation programme had in the late 90s sold off its shares in enterprises, including the leading banks at the time. One of these was the United Bank for Africa (UBA), one of the 3 big banks in the country. That brought in Keem Bello-Osagie who had a bit of rough time trying to redirect an institution steeped in direction. That was until 2004, when for other reasons, he was forced out as Chairman of the Bank by the CBN.

Tony took the industry by storm in 2005 as he led his ‘little’ Standard Trust Bank to acquire the older, more established United Bank for Africa (UBA), which at the time was Nigeria’s 3rd largest financial services institution. He was 42 at the time. Not many saw it coming. He would further shock many, especially those of us in the business of communication, with his decision to let UBA, which did not quite have a ‘great’ reputation swallow STB, which at the time was a good brand, reputation-wise.

But he not only knew what he was doing, he had a clear eye on where he was headed. That would become clearer years later as he shifted attention to Africa, to make UBA the bank for Africa, not only in name, but in terms of footprints on the continent.

In Nigeria, he started with an expansion plan, taking advantage of distress in the sector to acquire Continental Trust Bank, Trade Bank, City Express Bank, Metropolitan Bank, and African Express Bank

It didn’t take long for UBA to become a pan-African institution of Tony’s dream with over one million customers, operations in 20 African countries, and offices in Paris, London, and New York and recently Dubai.

In 2010, a policy pronouncement by the Central Bank of Nigeria (CBN) which pegged a 10-year tenure on bank CEOs will lead to early retirement as Managing Director of UBA, but has come back as Chairman of the Board since 2014. He owns 2,380,941,756 ordinary shares, which gives him about 7% of the shareholding, which is quite significant.

Rather than for his leaving UBA in 2010 to diminish Tony’s influence, his stock has actually risen significantly higher. In business, he has through his Heirs Holdings diversified into other sectors, with strong footing

in hospitality, power, energy, technology and healthcare.

Tony Elumelu has Indeed redefined himself through philanthropy, especially his promotion of entrepreneurship across Africa through his Tony Elumelu Foundation. The Entrepreneurship Programme, which is a 10-year $100 million commitment to identify, train, mentor and fund 10,000 young African entrepreneurs across 54 African countries is credited with the funding of about 10,000 entrepreneurs and the creation of a digital ecosystem of over one million Africans since inception.

There is no doubt that Tony Elumelu has done well for himself and the country. He has not only been a model entrepreneur, in giving back in practical terms, funding entrepreneurship, and putting himself out there, sharing his walk and journey with millions of youths, he is inspiring millions to believe, dare to dream, hold onto them and work smart, knowing it is possible.

Happy 60th Birthday to the last man standing, Tony Elumelu.