Nigeria’s total public debt may hit N118.37tn in the next three years, findings by The PUNCH have shown.

The figure was based on analysing Nigeria’s current debt profile and the debt projections in the Medium Term Expenditure Framework and Fiscal Strategy Paper 2024-2026.

According to the new MTEF/FSP, the Federal Government plans to take N26.42tn loans between 2024 and 2026.

The fiscal policy also indicates that debt servicing will gulp N29.92tn in three years.

The data show that the national government plans to borrow N7.81tn in 2024, slightly less than the N8.84tn targeted for the same year in the previous MTEF/FSP.

A breakdown for 2024 shows that the Federal Government plans to get N6.04tn from domestic lenders and N1.77tn from foreign creditors.

By 2025, the Federal Government plans to borrow N8.54tn, which is also less than the N10.62tn targeted for the same year in the previous MTEF/FSP.

A breakdown for 2025 showed that the Federal Government plans to get N6.42tn from domestic lenders and N2.12tn from foreign creditors.

The Federal Government plans to borrow N10.07tn by 2026, which consists of N8.94tn domestic loans and N1.13tn external debt.

Based on our analysis, the Federal Government is reducing its appetite for foreign loans to focus more on borrowing from domestic lenders.

The PUNCH also found that the country had borrowed about N5.05tn between January and June from its N9.62tn borrowing plan for 2023, which means that the Federal Government will likely still borrow at least N4.57tn more this year.

The Debt Management Office recently said Nigeria’s total public debt hit N87.38tn at the end of the second quarter.

The figure represents an increase of 75.29 per cent or N37.53tn compared to N49.85tn recorded at the end of March 2023.

The increase was primarily due to the N22.7tn Ways and Means Advances of the Central Bank of Nigeria to the Federal Government and the naira devaluation that added about N13.38tn to the external debt figure.

With an N87.38tn debt as of June 2023, the likelihood of N4.57tn new debt before the end of this year, and a plan to borrow N26.42tn in three years, Nigeria’s total public debt is expected to hit and even exceed (due to subnational borrowing) N118.37tn by the end of 2026.

Despite the rising debt, the Federal Government has insisted that it will stick to its borrowing plan.

Over the years, Nigeria’s low revenue generation has pushed the government to borrow more.

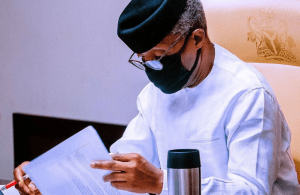

However, President Bola Tinubu recently expressed his administration’s commitment to breaking the cycle of overreliance on borrowing for public spending and the resultant burden of debt servicing it placed on the management of limited government revenues.

Tinubu recently said the country could not continue to service its debt with 90 per cent of its revenue.

He noted that the country was heading for destruction if that continued.

The President said, “Can we continue to service external debts with 90 per cent of our revenue? It is a path to destruction. It is not sustainable. We must make the very difficult changes necessary for our country to get (wake) up from slumber and be respected among the world’s great nations.

“To build a great nation, we must make bold decisions; even though it may be painful, it is not about you and me. It is about generations yet unborn.”

However, the Federal Government said although it could not keep borrowing, it would still maintain its borrowing plan.

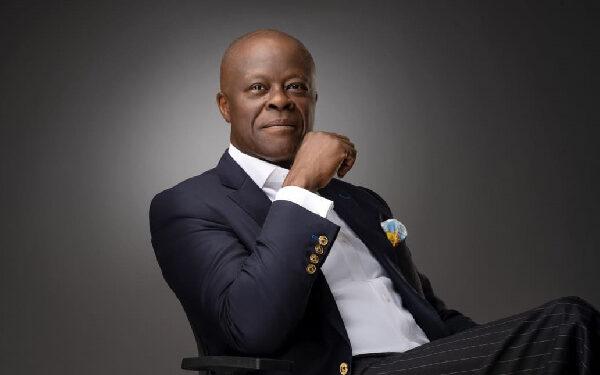

Recently, the Minister of Finance and Coordinating Minister for the Economy, Wale Edun, while unveiling an eight-point agenda for the economy, said, “The government is not in a position to borrow if you consider 90 per cent debt service to revenue, and behind that, a rising debt to GDP ratio. If you look at the last budget, you will see a borrowing requirement built into it and appropriated by the National Assembly. And that is ongoing.”

Debt servicing

The rising debt has led to an increasing cost of debt servicing over the years for the Federal Government.

The World Bank recently projected that debt servicing would gulp 123.4 per cent of the Federal Government’s revenue in 2023.

The Federal Government has already spent 75.92 per cent of its aggregate revenue on debt servicing between January and July 2023.

The MTEF/FSP 2024-2026 showed that the Federal Government had an aggregate revenue of N5.19tn in the first seven months of 2023 but spent N3.94tn on debt servicing within the same period.

The document added, “The aggregate expenditure for FY 2023 is estimated at N21.83tn, with a pro-rata spending target of N12.29tn at the end of July. The actual spending was N8.60tn. Of this amount, N3.94tn was for debt service, and N2.68tn for personnel costs, including pensions. Only about N857.08bn (25 per cent of the pro-rata budget) has been released for MDAs’ capital expenditure as of July 2023.”

The debt servicing cost breakdown showed that the Federal Government spent N1.71tn on domestic debt, N530.48bn on external debt, and N1.7tn on interests on ways and means advances.

The PUNCH also observed that the Federal Government spent N109.99bn more than its debt servicing budget of N3.83tn for the period under review.

An analysis by The PUNCH also shows that debt servicing will gulp about N29.92tn in three years.