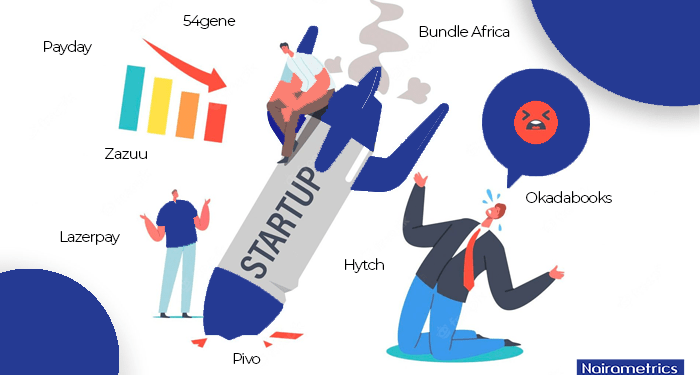

- Nine Nigerian startups that collectively raised over $70 million in the last two years have shut down in 2023.

- The closures have raised concerns about the fate of other young and innovative companies seeking funding in the coming years.

- While the companies shut down under different circumstances, Venture capitalists argue that many of the failed startups received funding without sufficient due diligence.

- The VCs also suggest that past investment decisions were rushed, emphasizing the need for startups to demonstrate stronger viability and meet higher standards before securing investment in the future.

Amid dwindling funding 9 Nigerian startups that have shut down this year went under with over $70 million investor funds raised in the last two years.

While the companies caved in under different circumstances, their exit is already raising concerns over the fate of many young innovative companies that are nursing the ambition of raising funds in the coming years.

For one, venture capitalists have agreed that enough due diligence was not carried out in the past before funds were committed to most of the startups that have now failed.

This presupposes that any startup that will raise funds in the coming year would have to work harder and tick many boxes on the investors’ table before a cheque could be signed.

From 54Gene, which had raised $45 million to Pivo Africa, which packed up after raising $2.6 million from investors, the 9 startups went under with millions of investors’ funds that may never be recovered.

The Failed Startups of 2023

While the startup shutdown is not peculiar to Nigerian startups as several companies across Africa and globally collapsed this year, Nigeria leads Africa in terms of the number of companies that shut down this year. As of the time of filing this report, these 8 Nigerian startups have shut down this year:

Pivo

Earlier this month, Pivo, a Nigerian fintech that offered banking services to small supply chain businesses, announced it was shutting. This came one year after raising more than $2.6 million from Y Combinator, Ventures Platform, Mercy Corp Ventures, and over 15 other investors.

Founded by Nkiru Amadi-Emina (CEO) and Ijeoma Akwiwu (COO) in July 2021, Pivo raised a $100,000 pre-seed round from investors like Microtraction, FirstCheck Africa, and Rally Cap Ventures two months after its launch.

It later raised a $2 million seed round in November 2022; at the time, Amadi-Emina said the funds would be used to expand to East Africa and launch new products around payments, a major pain point for supply chain SMEs. Different accounts point to the founders’ conflict as the major cause of the company’s collapse.

Lazerpay

After making the headlines as a company founded by 19-year-old Njoku Emmanuel and went on to raise $1.1 million, Lazerpay, a web3 crypto payments company, on April 13, 2023, announced it was shutting down, to everyone’s surprise. This came a few months after the startup had laid off some of its staff to extend its runway as it sought investors.

However, the expected additional investment did not come.

- “Today, we announce the difficult decision to cease operations at Lazerpay. Despite our team’s tireless efforts to secure the necessary funding to keep Lazerpay going, we were unable to close a successful fundraising round. We fought hard to keep the lights on as long as possible, but unfortunately, we are now at a point where we need to shut down,” Njoku said as the company wound down.

54gene

54gene, a genomics research company that had raised US$45 million across three funding rounds, revealed in September that it had started winding down its operations.

Less than four years into its creation, the company fell into disarray, and Abasi Ene-Obong, its CEO, was replaced in October 2022. Over the past year, 54gene had three CEOs, including Teresia Bost and Ron Chiarello, who took office in March 2023. Chiarello left the role in July. Davidson Oturu, a venture capitalist, said some founders started with good intentions but along the way, the need to survive pushed them towards unethical practices.

Bundle Africa

Nigerian crypto startup Bundle Africa announced that it would shut down its social payments app Bundle Africa. In a tweet announcing the shutdown, CEO Emmanuel Babalola said that the shutdown was a decision made by stakeholders who want a restructuring of the company.

This came after the company had raised $450,000 in a pre-seed that had participation from two investors.

However, unlike others, investors in Bundle Africa may not have lost it all as the startup now focuses on Cashlink, its peer-to-peer platform. The company reportedly hit 50,000 monthly active users and a $50 million monthly volume on Bundle and crossed over 3 million transactions on Cashlink.

Payday

Similarly, fintech company, Payday, ran into a problem barely 6 months after raising $3 million in a seed round led by Moniepoint. The company’s founder and CEO, Favour Ori, was alleged to be paying himself a monthly salary of $15,000 at the expense of the company’s survival while employees were made to take pay cuts. The company had also faced serious allegations of fraud from customers as their accounts were restricted without any explanation until they cried out on social media.

Early this month, it was announced that Payday has been acquired by Blockchain payments platform, Bitmama Inc.

Zazuu

Zazuu, a fintech company founded in 2018 by four Nigerian entrepreneurs, Kay Akinwunmi (CEO), Korede Fanilola (COO), Tosin Ekolie (CTO) and Tola Alade (CDO), shocked the tech and finance industry when it announced on November 17, 2023, that it was shutting down operations.

The firm’s management attributed the shutdown to its inability to secure additional growth funding from investors.

The company, an end-to-end money transfer marketplace that facilitated remittance payments into Sub-Saharan Africa, had in July 2023, raised $2 million to deepen its cross-border payment offering and also build the world’s first non-biased payment platform.

Angel investors that participated in the fundraising round are Babs Ogundeyi, chief executive officer of Kuda Bank and Jason Njoku, chief executive officer of IrokoTV.

Other angel investors include Launch Africa, Founders Factory Africa, HoaQ Club and Tinie Tempah.

While raising the funds last year, the startup assured that it would continue to grow its user base, hire more talent, and scale its pay with the Zazuu feature that allows users to complete transactions in-app.

Vibra

Exactly two years ago in December 2021, Nigeria-based African Blockchain Lab, Vibra raised $6 million in a pre-Series A round co-led by a consortium of global investors, including renowned African venture capital firms Lateral Frontiers VC, CRE Venture Capital and Musha Ventures, as well as international blockchain investors Dragonfly Capital, Hashkey Capital, SNZ Capital, Fenbushi, Cadenza Capital, Head & Shoulder X, LeadBlock, Hash Global, Bonfire, Krypital, Despace and more.

The funding was to see Africa Blockchain Lab roll add new features like VIBRA Earn, a crypto asset saving product that lets users earn interest on a variety of crypto assets. However, in July this year, the company shut down its operations, not only in Nigeria but also in Kenya and Ghana.

Okadabooks

Founded in 2013 and a pioneer in digital publishing and bookselling, Okada Books, closed down in November this year after 10 years of operation, citing rough macroeconomic conditions.

- “We explored various avenues to keep our virtual bookshelves alive but, unfortunately, the challenges we face are insurmountable,” said Okechukwu Ofili, the company’s CEO, in a social media statement.

In 2017, Okadabooks was among 12 startups selected for Google’s Launchpad Accelerator Africa.

Hytch

In February, Nigerian logistics startup Hytch confirmed it had shut down barely nine months after launch.

- “It has been a tough one but we are shutting down operations finally,” the company said in a social media post. We would no longer be providing our services to businesses or individuals,” the company said in a statement.

The closure came about after it failed to secure further funding.

Time for due diligence

Disturbed by the rate of startup failure witnessed in Nigeria this year, venture capitalists are blaming the development on the poor decisions made by investors in the last two years.

According to a Partner at TLCom Capital, Eloho Omame, most of the deals announced between 2021/2022 were hurriedly sealed.

Indicating that most of the recently failed startups were backed by foreign investors and not African VCs, she noted that “in the last couple of years, Africa-focused investors became relatively less popular than our US/global counterparts, many investing on the continent for the first time, often without an Africa mandate per se.”Attributing the recent failures to the lack of due diligence on some of the startups by the investors, Omame said:

- “We often heard from founders that they weren’t asking ‘so many’ questions. They moved ‘fast’…from a conversation on a Friday to funds in the bank by Monday. It became hard to ask curious questions and to take your time to get to know founders and their businesses before writing a check.

- “Reasonable inquiries were a bother, and reasonable timelines were perceived as a power play. You risked losing the deal. Or you spent a week and a lot of resources doing ‘real work’ only to get a call that the round was full. Now that the dust is settling, I hope we can go back to a better dynamic—one that’s grounded in trust, openness, and mutual respect.”

She added that the narrative that “African investors ask more questions than US/global investors” would not help the industry. According to her, founders should probably wonder if they matter if an investor doesn’t take the time to ask good questions.

While advising African founders to see due diligence as a necessary process in their business interest, Omame said:

- “A good due diligence process shoots to understand your business and you as a founder. Good investors aim to balance that with optimizing for materiality, reasonableness, and, yes, pace. The process is also your chance to get to know the character and expertise of the investor. Nobody is helped — not you or the investor — by optimizing for speed.“Times are tougher, yes, but if nothing else, this fundraising winter is also a good chance to reset and rediscover a healthier, more sustainable long-term dynamic between founders and investors in Africa tech & VC.”

Corroborating Omame’s views, Founding Partner at Future Africa, Iyinolwa Aboyeji, noted that most of the huge startup failures in Africa are from those backed by global VCs and not those led by African VCs.

- “They are imported deals where SV thought they could buy their way to success in Africa with enough capital. I also think we VCs can really help founders by helping them understand what we are looking for in the diligence. Part of the danger of the last two years of cheap capital is that a lot of founders think building a company is a great pitch but there is just so much more to it,” he said.

Other African startups that have shut down in 2023

Across Africa, the number of startups that are shutting down has continued to rise. In August, Kenyan end-to-end fulfillment startup Sendy shut down operations and announced an assets sale with reports saying reduced order volumes and fuel price hikes meant it was making deliveries at a loss, and had a monthly burn rate of US$1 million.

Sendy raised US$20 million in capital as recently as January 2020, but in the current climate, further funding was not to be found.

Ghanaian payments startup Dash, founded in 2019, had raised a whopping US$86 million, but folded in October amid allegations of financial impropriety and false reporting.

South African mobility startup WhereIsMyTransport, bankrolled to the tune of over US$27 million by investors such as Naspers in recent years, announced it was closing down in October after failing to secure more investment.

Kenyan B2B e-commerce startup Zumi had earlier in March announced it had closed down after failing to secure the necessary funding to continue operations. Launched in 2016, Zumi began life as a female-focused digital magazine, before pivoting into e-commerce in 2020.

According to co-founder and CEO William McCarren, the startup achieved over US$20 million in sales, acquired 5,000 customers and built a team of 150 people, but closed after failing to secure investment.

Another Kenyan e-commerce company Copia, which raised US$50 million Series C funding last year, announced it was pulling out of Uganda, “consistent with many of the best companies in Africa and across the world which are responding to the market environment and prioritising profit.”