Dangote Petroleum Refinery (DPR) recently announced a strategic partnership with Honeywell International Inc. The collaboration brings together the world’s largest single-train refinery and Honeywell, the world’s current 155th most valuable company by market capitalisation (a Fortune 100 industrial and technology leader with a diversified portfolio spanning aviation, automotive systems, industrial automation, and advanced materials).

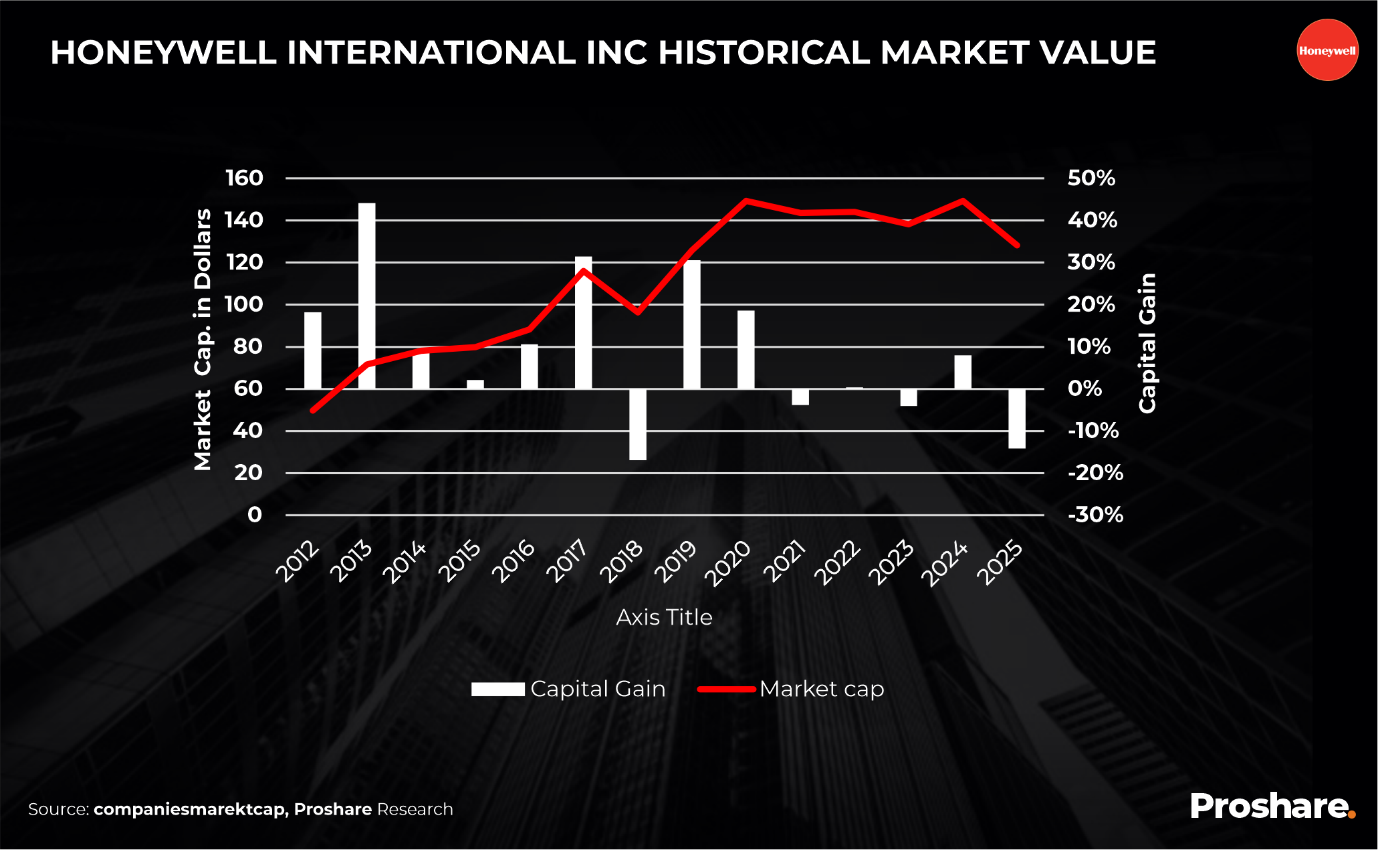

According to a disclosuremade by Honeywell International Inc. on its website, “Dangote Petroleum Refinery and Petrochemicals FZE has selected Honeywell to supply advanced technology, services, proprietary catalysts and equipment to help enable the refinery to process a wider range of crude and double the production capacity at Africa’s largest refinery in Lekki, Nigeria by 2028.” As of December 9, 2025, Honeywell’s market cap stood at US$128.14bn, approximately 2.9x Nigeria’s current gross external reserves (see chart below).

Strategic partnerships remain a defining feature of the global energy industry, enabling operators to bridge technological, financial, and operational constraints.

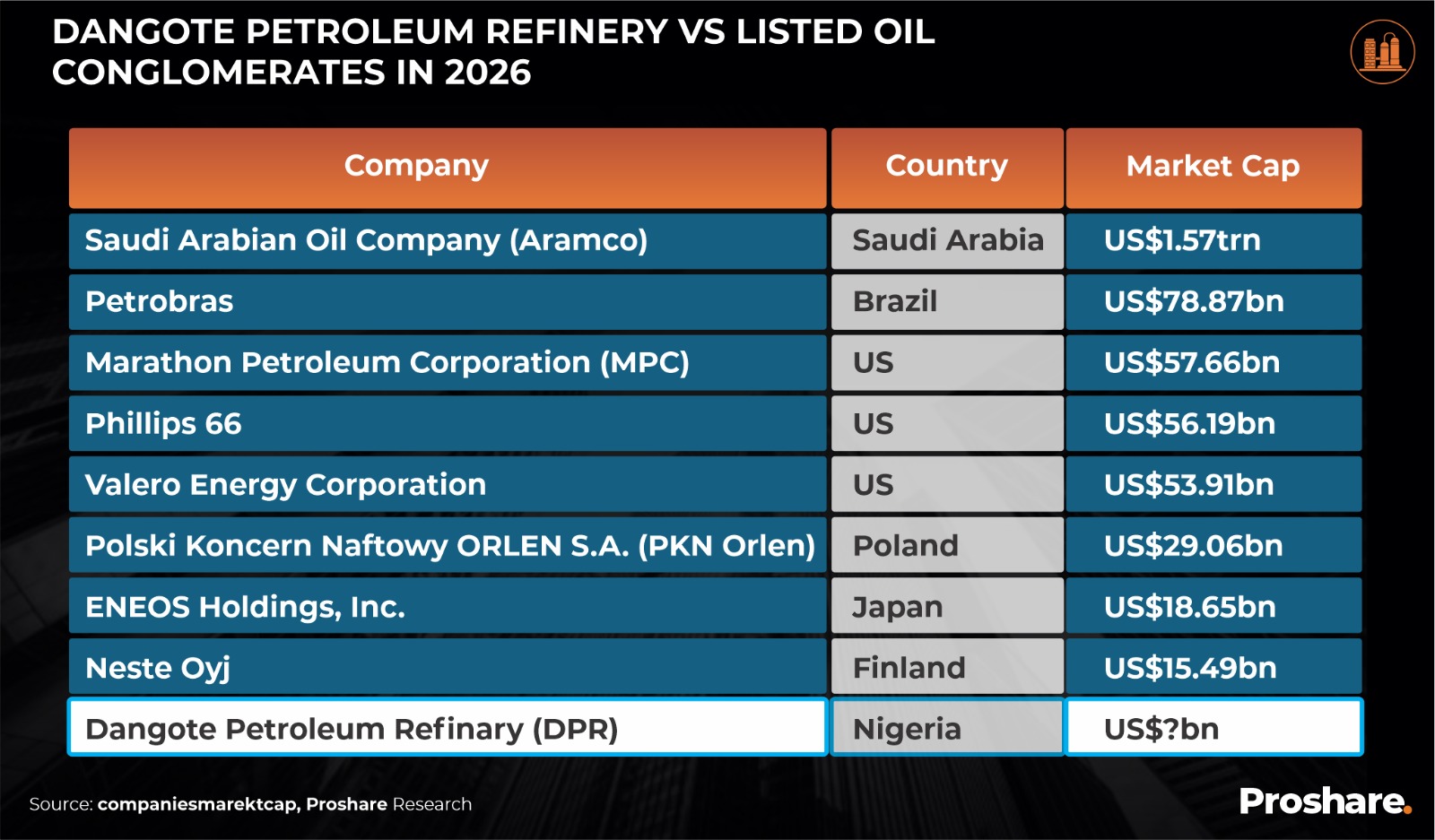

A notable precedent is Saudi Aramco’s 2018 partnership with TotalEnergies to develop the “Amiral” petrochemical complex integrated into the SATORP refinery in Jubail. Aramco brought the crude oil supply and local advantage, while TotalEnergies brought world-class petrochemical technology. The partners reached a final investment decision in December 2022 for the US$11bn project, with commercial operations expected in 2027. Aramco later listed on the Saudi Stock Exchange (Tadawul) in December 2019 and today ranks among the world’s top ten most valuable companies, with a market capitalisation exceeding US$1tn (see tables below).

Table 1:

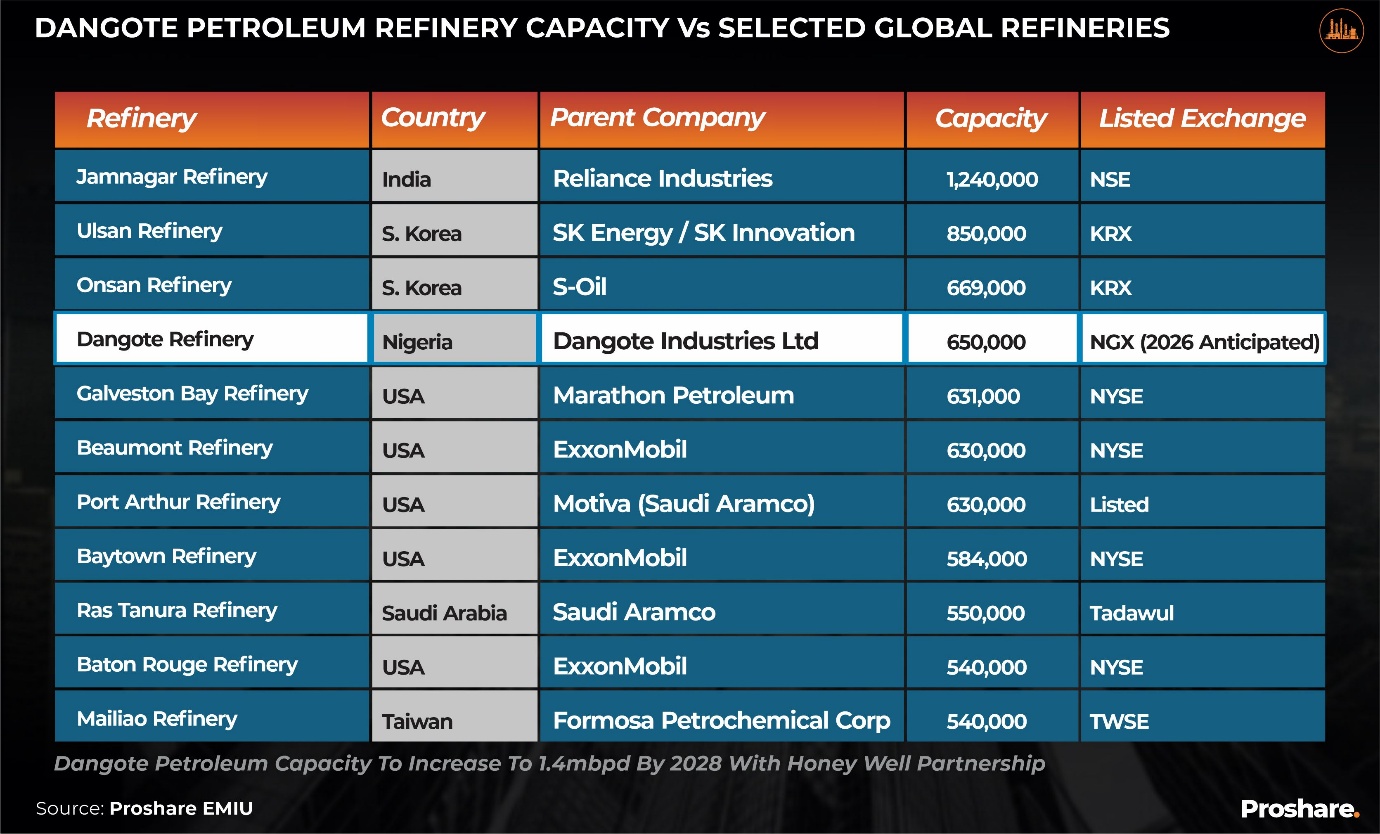

The Dangote-Honeywell collaboration builds on a commercial relationship dating back to 2017. Under the new agreement, Honeywell will supply advanced process technologies-including its Oleflex technology, along with proprietary catalysts, engineering services, and equipment. These technologies will allow DPR to broaden its feedstock slate, enabling the refinery to expand processing capacity to 1.4mbpd by 2028, and scale polypropylene output to 2.4 million metric tonnes (mmt) annually from current 0.9mmt/annum. Honeywell, notes that its “process technologies and catalysts have been licensed to more than 6,000 refineries and industrial facilities globally,” underscoring the significance of the partnership for Dangote’s upgrading, conversion, and petrochemical ambitions.

In parallel, Dangote Group plans to extend the partnership to the next phase of its fertiliser expansion programme, with a target to increase urea production from 3mmt to 9mmt per annum. The current complex comprises two trains of 1.5mmt each, and the next phase will add four additional trains to meet rising demand across Africa and global markets.

More importantly, is the significance of the Dangote-Honeywell partnership to the planned 2026 listing of the Dangote Petroleum Refinery.

Table 2:

Plans to list about 10% of his $20bn refinery on the Nigerian capital market in 2026 is no longer news. According to Aliko Dangote, President of Dangote Group, in July, “…our main interest is to list on the exchange so that every living Nigerian can own part of the refinery.” This initiative aligns closely with the Dangote Group’s Vision 2030 roadmap, which outlines ambitious growth and capital-market objectives. Specifically

- The Dangote Group is targeting US$100bn in annual revenue by 2030, representing growth of more than 450% from its current revenue base of approximately US$18bn, and a significant increase from the US$3.3bn reported five years ago.

- The Group aims to rank among the world’s top 100 most valuable companies, with a targeted market capitalisation exceeding US$200bn by 2030.

- In support of these ambitions, Dangote has announced plans to list the refinery via an initial public offering (IPO) by 2026. The Group is working closely with the Federal Ministry of Finance, the Nigerian Exchange (NGX), and the Securities and Exchange Commission (SEC) to enable dollar-denominated dividends, supported by an estimated US$6.4bn in annual foreign exchange earnings from polypropylene and fertiliser operations, rather than reliance on the Central Bank of Nigeria.

Proshare analysts note that, the collaboration and refinery expansion will strengthen the refinery’s attractiveness to investors ahead of an eventual IPO;

1. Long Term Growth Potential

Dangote Refinery positions to move beyond crude oil sales into higher-value downstream products, which signals long-term growth. With an increased capacity to 1.4mbpd, DPR can execute large projects efficiently, reducing perceived execution risk for investors.

2. Strengthening of Valuation Drivers

The partnership plays a role in expansion to 1.4mbpd and boosting high-margin petrochemical output (such as aromatics, polypropylene, and polyethylene). This has potential to broaden DPR’s revenue base supporting margin resilience and stabilises cash flows, key drivers of valuation ahead of a listing.

3. Technological Credibility and De-Risking

The integration of Honeywell’s globally recognised refining and petrochemical technologies enhances operating efficiency and signals reduced operational and project-execution risk. For IPO investors, such partnerships help de-risk assumptions around throughput, yields, and long-term output reliability.

4. Improving Investor Appetite Ahead of 2026 IPO

A partnership with a Fortune 100 technology and industrial leader offers strong signalling value. It reinforces confidence in the refinery’s operational roadmap and increases DPR’s attractiveness to institutional investors seeking exposure to African industrial infrastructure with global technical backing.

5. Strengthening the Viability of Nigeria’s Domestic Investment Climate

Dangote’s projected annual revenue of US$55bn (N80.05trn at N1,455.88/US$) is poised to enhance Nigeria’s macroeconomic stability by improving the net-export position, boosting foreign-exchange inflows, and reducing reliance on imported refined products. With petroleum imports already falling from US$23.33bn in 2022 to US$14.75bn in 2024, the shift toward greater energy self-sufficiency supports lower naira volatility and strengthens investor confidence, thereby improving the attractiveness of Nigeria’s domestic investment landscape ahead of 2026.

Disclaimer

This report is prepared based on research, market information, and data gathered and analysed with the best global practices. It is provided for informational and educational purposes only.

It does not constitute investment advice, a recommendation to buy or sell any security, or an offer to solicit any transaction. Nothing herein shall create a client-advisor relationship between the reader and our Firm, its analysts, or any associated companies.

You should not construe any of this information as a substitute for investment financial advice. We are not registered investment advisors, and you should consult a qualified financial adviser before making any investment or trading decision.

Securities trading involves inherent risks, including the potential loss of capital. Readers of the Note assume full responsibility for all individual trading decisions and their outcomes.

Stay ahead with the latest updates!

Join The Podium Media on WhatsApp for real-time news alerts, breaking stories, and exclusive content delivered straight to your phone. Don’t miss a headline — subscribe now!

Chat with Us on WhatsApp