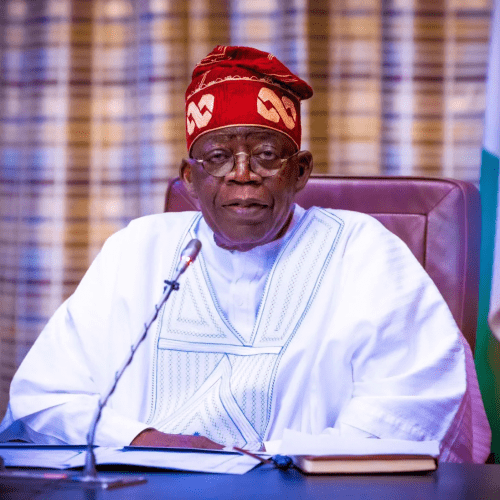

Morgan Stanley, a global leader in investment banking has revealed that President Bola Tinubu’s policies that put an end to fuel subsidies and the unification of the naira’s exchange rate, could fuel economic growth for Nigeria.

This declaration is contained in a recently published article titled, “Investment Outlook: Nigeria’s New Dawn” on the website of the American multinational investment banking firm.

According to the report by Morgan Stanley, the interventionist policies of former president Muhammadu Buhari -namely, multiple foreign exchange rates and fuel subsidies- led to economic bottlenecks and hindered the private sector’s ability to grow.

The report further explained that during the last eight years of the past administration, Nigeria, which was one of the fastest-growing economies in the world from 2001 to 2014, grew only 1.4% on average despite a 2.8% growth in the working-age population.

Opportunities for investors that could spark Nigeria’s economic growth

The report by Morgan Stanley further reiterated that the removal of fuel subsidies, which cost the country a whopping $10 billion in 2022 and benefited only 3% of the poorest 40% of Nigerians, could revive Nigeria’s growth in the next two to three years.

Also, the unification of Nigeria’s exchange rate by President Tinubu’s administration would reverse the 60% decline in foreign direct investment witnessed under Buhari.

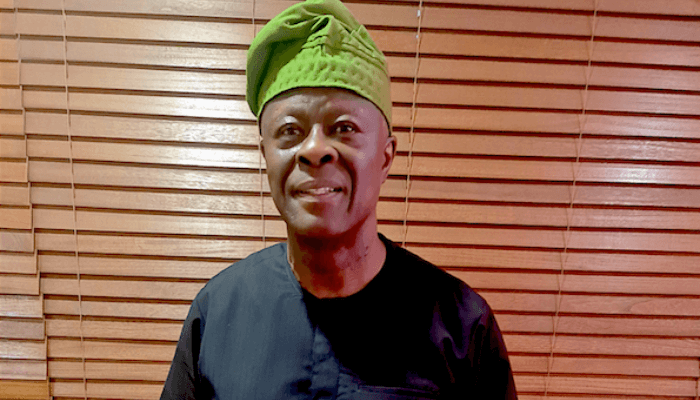

According to Morgan Stanley, President Tinubu’s intention to grow the economy primarily through private investment could lead to a strong rise in incomes, which, combined with a young and fast-growing population, could usher in a new consumer class and several investment opportunities.

The report noted that the mobile banking and consumer segments are two sectors that present unique opportunities for investors seeking to invest in Nigeria.

Nigeria’s low mobile data penetration and usage levels, which is one-tenth of South Africa’s internet usage when compared, presents opportunities for providers of telecommunications-led mobile-money services, which are still in the near stages of growth.

- “Although more than 85% of the adult population has a mobile phone, around 55% have no bank account, and only 10% have a mobile money account.

- “Should mobile money penetration levels in Nigeria climb to the 75% to 95% levels seen in Senegal, Ghana, and Kenya, it would drastically increase financial inclusion and present an attractive investment opportunity, particularly in telecom operators,” the report read in part.

Furthermore, Morgan Stanley suggested that investable opportunities in several consumer segments in Nigeria are likely to arise as well.

The report asserts that should the economic policies of the current administration result in households having ample income to cover essential needs, Nigerians would be able to gradually afford more discretionary purchases.

If the policies of President Tinubu work as intended, such a dynamic in Nigeria could help the consumer goods market grow 150% from an estimated $240 billion in 2023 to about $603 billion in 2030.

This could present investment opportunities in several sectors, including packaged food and beverages, household and personal care products, education, healthcare, and even durable goods like appliances and transportation.

More Insights

Morgan Stanley also notes that the export of services offers Nigeria untapped opportunities. According to the report, the 125 million Nigerians who speak English underpin successful service-export industries.

The report further reveals that the music and film industries offer another potential avenue for service exports.

- “Nigeria is home to two of the most well-known “Afrobeats” artists, in a music genre that has amassed more than 16 billion plays on popular streaming platforms.

- Meanwhile, the Nigerian film industry, affectionately known as “Nollywood,” produces around 2,500 films per year and is attracting investments from major global media companies.

- By 2030, Africa’s film and music industries—which are dominated by Nigerian productions—could be worth 20 billion dollars and create 20 million jobs,” the report stated.

Morgan Stanley noted that once the current administration had succeeded in reversing the harmful policies and economic malaise of the past administration, Nigeria could witness a sharp upturn in economic growth in the next two to three years.

Nairametrics