In the past decade, banking in Nigeria has witnessed a technological revolution. Traditional banks have been challenged by the emergence of fintech platforms like Opay, PalmPay, and Moniepoint, which now make it easy for business operations to be easier and more efficient for all.

Prior to this disruption, payments and transactions were primarily conducted with cash, and online infrastructure was limited—this restricted businesses from expanding beyond their local demand. Thankfully, payment and improved banking systems have now opened up boundless possibilities, enabling businesses to grow beyond their immediate area.

Among these disruptors, PalmPay and MoniePoint have risen to become reliable choices for Nigerians. Although both operate in the fintech space, providing financial services to consumers, they have different features that have helped them stand out among the many fintech platforms currently in the country.

Although some of their service offerings are comparable, these two financial platforms are distinct. But if there is one thing that research, comments from Nigerians, and observations have indicated, both platforms are making Nigerians and Nigerian businesses happy with their efficient services.

In this article, we reviewed both platforms and examined the similarities and uniqueness between them. We also considered the features that are similar and those that are different, and we made a decision on which was preferable based on ease of use and efficiency.

Read also: Palmpay vs Opay: What you need to know before you choose

Preview: PalmPay and MoniePoint

PalmPay and MoniePoint have a similar mission – to provide accessible and affordable financial services to the unbanked and underserved populations in Nigeria. They have introduced a new era of financial services that go beyond traditional banking, offering a wide range of features and benefits.

However, while Moniepoint Inc. operates a switching and banking licence in Nigeria which allows it to offer business banking services to merchants and individuals, Palmpay operates a mobile money operator (MMO) licence, allowing it to provide mobile money services, including mobile payment services, to both the banked and the unbanked in Nigeria.

Moniepoint has also evolved to become a microfinance bank. Over time, the company has expanded its operations and has now gone into the consumer market to provide personal and online banking through the launch of its app, thereby competing with the likes of Palmpay and Opay, which have established their footings in that space.

Moniepoint

Since receiving its licence, the MFB has helped over 600,000 businesses with banking, payment processing, access to loans, and business management tools. With these solutions, the Moniepoint platform processes over 400 billion transactions worth $12 billion on a monthly basis. With support offices in 33 states, Moniepoint MFB currently operates the largest distribution network for financial services in Nigeria.

But not just that, Moniepoint Microfinance Bank offers a range of banking services tailored to meet the needs of small, medium, and large enterprises. It provides POS (point of sale) terminals, enabling businesses to accept card payments from customers.

The MFB operates as a payment gateway with its Monnify infrastructure. Moniepoint’s Monnify system is a web-based payment gateway offered to provide businesses with a seamless and efficient way to accept payments from customers, whether on a recurring or one-time basis.

Palmpay

Palmpay, on the other hand, operates an MMO licence, and since its launch in 2019, it has experienced explosive growth, with 30 million users on its smartphone applications recorded this year. This milestone represents a tripling of its user base since the announcement of 10 million users in the previous year.

Currently, a pivotal component of PalmPay’s strategy is its extensive network of 1.1 million businesses utilizing its services. There are over 600,000 merchants who have embraced PalmPay’s POS (point of sale) and Pay With Transfer services and 500,000 dedicated agents who play a crucial role in extending PalmPay’s reach across Nigeria, providing millions of additional consumers with essential financial services.

In total, an impressive 40 million consumers, or 1 in 5 Nigerians, now use PalmPay via its smartphone apps, agents, and merchants for money transfers, bill payments, and savings.

Read also: Moniepoint enters Nigeria’s consumer banking segment, to rival Opay and PalmPay

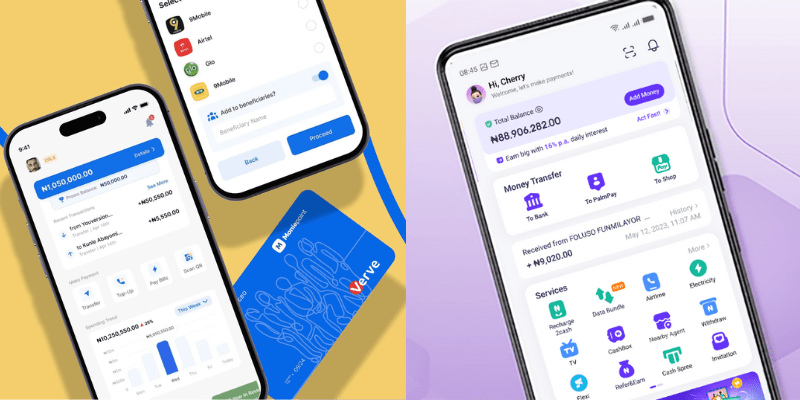

Palmpay app vs MoniePoint Personal

The journey begins with simplicity when it comes to signing up on the PalmPay mobile app and MoniePoint Personal. These platforms have designed their user experiences to be accessible to a wide range of individuals. Here’s a breakdown of how easy it is to get started with both apps:

PalmPay: Signing up for PalmPay takes just a few minutes. After downloading the app from the Google Play Store or Apple Store, you can sign up by providing the necessary details and verifying your account with a code sent to your mobile phone number.

MoniePoint: Similarly, MoniePoint Personal offers a straightforward sign-up process. Download the app from the app store, fill in your details, and verify your account with a mobile verification code.

Features to Compare

While both PalmPay and MoniePoint share several common features, they also have unique offerings that set them apart. Let’s explore these features:

Rated 4.6/5 on the Google Play store with over 10 million downloads, Palmpay has an array of features on its app which has established it as a go-to app for everything online payment in the country. Recently, it introduced a 20% annual interest savings plan, a notable feature that can help users grow their savings.

Additionally, the platform offers various rewards. They include Refer to Earn, Naira deals, Palm coins, Lucky Money game, Cash spree, Palm force, and check-in rewards. These incentives are tied to services such as electricity and water bill payments, cable TV subscriptions, airtime and data purchases, school and travel fee payments, and more.

On the other hand, the Moniepoint app is rated 4.2/5 on the Google Play Store with over 500,000 downloads, which is not bad for a platform that launched about a month ago.

MoniePoint Personal charges a nominal fee of N10 per transfer and rewards customers with points for every transaction. While more work needs to be done so that users can enjoy the features of paying for electricity bills and funding betting wallets, the Personal lacks some of the referral bonuses and other cash benefits that Palmpay offers.

However, Moniepoint plans to roll out a salary advance feature, adding an extra dimension to its offerings in the future. It is important to note that the platform also incorporated digital games that provided points to customers, which was used to play games for a chance to win substantial rewards during the recently concluded Big Brother Naija All-Stars.

Reviews of Nigerians

Although a recency bias might apply to Moniepoint, seeing that it just launched its platform, we will still look at what Nigerians have been saying about the platform after their attempts to use it.

A particular Caleb Ephraim, giving his comment on the app says, “One of the worst apps in Play Store. I successfully registered and funded my account. Behold, my money was trapped, I couldn’t make any transactions. I received an error message that I should try again later. I tried to reach the customer care, it was a very slow process and very frustrating. As I am typing this, my money is still trapped in the useless account.”

Another user, who downloaded the Moniepoint app, had nothing but good words and commendations for the ease and user interface. The user by the name Precious Williams says;

“I’m thoroughly impressed with this app’s design and user-friendly interface. Onboarding new users is a breeze, and the verification process is swift and reliable…Overall, this app is smooth and hassle-free, deserving of a solid 5-star rating!”

However, a user also expressing his disappointment with the app and rating it just one star says the app still has its irregularities. “I’ve been trying to register on the App for quite some time, but whenever I get to the video verification part, it just never goes past it,” he says.

For the Palmpay app, users expressed their delight in the features and ease of use of the app. While commending it, they assert it has helped lessen their financial burdens and problems.

“Good app Easy and fast transactions Like the daily coupons too. I do all possible banking on this app,” a particular Kelvin said.

A particular user while describing the issues he has with the recent update, says, “I love Palmpay, their transaction is always smooth and fast.”

Read also: Moniepoint personal banking app says all we need to know about the future of fintech

Verdict

Choosing between PalmPay and MoniePoint depends on individual preferences and specific needs. Both platforms have their strengths, and the decision should align with your business goals and the features that matter most to you. Whether you are enticed by PalmPay’s attractive savings plan or MoniePoint’s transaction-based rewards, these fintech platforms are redefining financial services in Nigeria.

Moniepoint just entered the market of personal banking and might be ready to challenge. However, Palmpay has the advantage. The digital platform has established itself over time as a more trustworthy personal banking platform with its many rewards system and zero-transaction cost, which makes it attractive to its Nigerians, Its role during the Naira scarcity of 2023 cannot be overemphasized and Nigerians would remember how it stepped up to redefine online transactions when many other digital platforms failed to meet the demands.

However, business owners may prefer to use Moniepoint because of the payment gateway and its other services that are business-driven.

technext24.com

stress natural remedies [url= [Link deleted]] [Link deleted][/url] chafing remedies