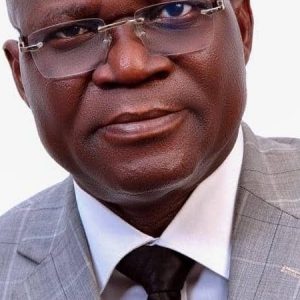

Head of Tax, PwC Nigeria, Mr Taiwo Oyedele

•Pension assets, minimum wage earners, capital gains, education, agriculture, others to enjoy exemptions

Chairman, Presidential Fiscal Policy and Tax Reforms Committee, Mr. Taiwo Oyedele, has said the new tax laws will provide several reliefs and exemptions for low-income earners, average taxpayers, and small businesses, from January next year.

In general, Oyedele said there were about 50 tax exemptions and reliefs designed to benefit the masses.

He said pension funds and assets under the Pension Reform Act (PRA) were tax-exempt, including pension, gratuity or any retirement benefits granted in line with PRA.

Compensation for loss of employment up to N50 million will also not be liable to tax under the new regime, he said.

In addition, under the Capital Gains Tax (CGT), sale of an owner-occupied house, and personal effects or chattels worth N5 million are tax exempt, he said.

Others, according to Oyedele, included sale of two private vehicles per year, gains on shares below N150 million per year or gains of about N10 million, pension funds, charities, and religious institutions (non-commercial), as well as gains on shares above exemption threshold, if the proceeds were reinvested.

An update by the presidential tax reforms committee further clarified that the new tax dispensation also provided for allowance deductions and reliefs for individuals.

Among others things, pension contribution to Pension Fund Administrators (PFAs), National Health Insurance Scheme, and National Housing Fund contributions will not be subjected to tax.

Similarly, interest on loans for owner-occupied residential housing, life insurance or annuity premiums are tax free.

Also, 20 per cent of annual rent of up to N500,000 will be exempted from tax obligations.

Furthermore, effective January, individuals earning the national minimum wage or less, and annual gross income of N1.2 million (translating to about N800,000 taxable income) are tax exempt.

Oyedele said the reforms further reduced PAYE tax for those earning annual gross income up to N20 million as well as exempted gifts from tax.

Small companies whose turnover are not more than N100 million and total fixed assets N250 million will pay zero tax, while eligible start-ups are tax exempt, he said.

He said there was also compensation relief – 50 per cent additional deduction for salary increases, wage awards, or transport subsidies for low-income workers, as well as employment relief, involving 50 per cent deduction for salaries of new employees hired and retained for at least three years.

Under the proposed tax regime, there is provision for holiday for the first five years for agricultural businesses (crop production, livestock, dairy among others), Oyedele said.

Also free from tax are gains from investment in a labelled start-up by venture capitalist, private equity fund, accelerators or incubators.

Others are exemptions of small companies from four per cent development levy as well as exemptions of manufacturers and agriculture businesses from withholding tax deduction on their income.

Small companies are further exempted from deduction on their payments to suppliers.

Oyedele stressed that the tax reforms also granted zero per cent exemptions on basic food items, rent, education services and materials, health and medical services, and pharmaceutical products.

He said small companies will enjoy VAT exemptions on turnover less than N100 million, diesel, petrol, and solar power equipment among others.

Electronic money transfers below N10,000, salary payments, intra-bank transfers, transfers of government securities or shares and all documents for transfer of stocks and shares are not subject to tax, Oyedele said.

Stay ahead with the latest updates!

Join The Podium Media on WhatsApp for real-time news alerts, breaking stories, and exclusive content delivered straight to your phone. Don’t miss a headline — subscribe now!

Chat with Us on WhatsApp