The recent bull run on the NGX has boosted liquidity and earnings, and policy changes, including currency and subsidy reforms, have created significant “paper wealth” from listed holdings.

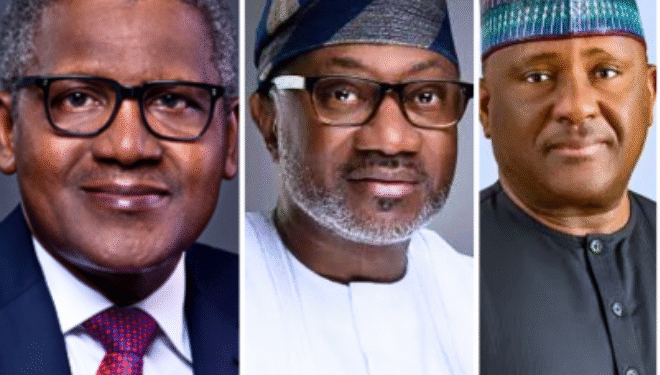

Nigeria’s billionaires, including Aliko Dangote, the world’s richest Black man, gained several trillion naira in equity value in 2025, and this momentum continued into 2026.

The Nigerian stock market experienced its biggest surge in 2026, recently reaching a record market cap of N125 trillion. Stock market wealth increased by N25 trillion in the past two months, the fastest surge in Nigerian stock market history.

Dangote and Rabiu gained several billion dollars in the first weeks of the year. Bloomberg reports that Dangote increased his wealth by $1.84 billion, valuing him at $32.8 billion.

Rabiu, Nigeria’s second-richest individual, has seen a year-to-date gain of $2.33 billion, valuing him at $12.5 billion.

A notable success story is BUA Foods, which has become Nigeria’s second most valuable listed company, surpassing Dangote Cement in market valuation.

BUA Foods is now the most valuable company on the Nigerian Exchange, with a market cap of N15.2 trillion. Rabiu, Nigeria’s second-richest man on the Nigerian stock exchange, is bullish on the Central Bank of Nigeria’s (CBN) current policy of monetary discipline and its control of the forex market. Rabiu owns 92.6% of the company.

The billionaires recognize that the current state of the Nigerian economy favors them.

High interest rates: The Nigerian economy has seen increased foreign exchange inflows from foreign portfolio investors, with the benchmark rate held high (around 27% in 2025) and demand for naira-denominated fixed-income instruments increasing.

Foreign reserves: The naira became safer for those with substantial cash in domestic currency, with reserves near $50 billion in 2026, reducing the risk of sudden devaluation.

Dangote’s wealth, surpassing $32 billion, is historic, making him the first African to reach that milestone.

His wealth is driven by the Dangote Refinery, now at full capacity, the most expensive private-sector project in African history at $20 billion and the largest asset in his empire.

Dangote Cement: He maintains significant control over much of the African construction market, holding nearly 86% of the company. His urea plant has become one of the largest fertilizer exporters worldwide.

Bullish naira

The Nigerian currency maintained its bullish run in 2026. The local currency posted week-on-week gains in the official foreign exchange market, settling at N1,348 per dollar to cap a week of steady gains against the U.S. dollar and boosting the wealth of Nigeria’s richest men. The latest data showed that the naira maintained a largely positive trajectory throughout the month.

Nigeria’s fourth-wealthiest individual, Femi Otedola, has been very positive about the naira.

He said, “I am optimistic that the naira will strengthen meaningfully, and trading below ₦1,000/$1 before year-end is increasingly within reach.”

If what Otedola is saying is correct, this means the naira will appreciate more than 25–26% from its level at the time, around N1,340 to the U.S. dollar officially.

A more stable and stronger naira (reaching better levels in early 2026) means no more losses in the forex value of naira-denominated holdings.

The FirstHoldCo Chairman believes the naira will appreciate with structural changes such as decreased dollar demand for fuel imports, improved investor confidence, and greater economic stability.

Tony Elumelu, Chairman of UBA and Heirs Holdings, states that for large businesses, stability outweighs the actual exchange rate.

Elumelu’s recent briefings in 2026 show that he has overcome his fear of “FX scarcity.” He asserts that Nigeria’s corporate elite has successfully “de-dollarized” their mindset due to drastic reforms over the past two years.

He emphasizes the importance of predictability in currency value, noting that the naira’s stability within a consistent range in early 2026 has allowed his group to resume aggressive five-year capital expenditure cycles halted during 2024’s volatility.

He supports the Central Bank’s move to keep interest rates high to drain liquidity, calling it “painful but professional” medicine that prevented the Nigerian currency from collapsing.

Stay ahead with the latest updates!

Join The Podium Media on WhatsApp for real-time news alerts, breaking stories, and exclusive content delivered straight to your phone. Don’t miss a headline — subscribe now!

Chat with Us on WhatsApp