Nigeria’s P2P volumes on two major P2P platforms currently stand at $400 million.

Exactly a year ago, Nigeria’s central bank prohibited crypto transactions in Nigeria’s financial ecosystem.

Even though the central bank has been fighting fiercely against crypto transactions in its financial ecosystem, crypto transactions are still on the rise in Africa’s biggest crypto market.

Nigeria’s peer-to-peer transactions rose by 16% on an annual basis. Nigeria’s P2P volumes on two major P2P platforms (Paxful and Localbitcoins) currently stand at $400 million, followed by Kenya with more than $160 million and South Africa with $117 million.

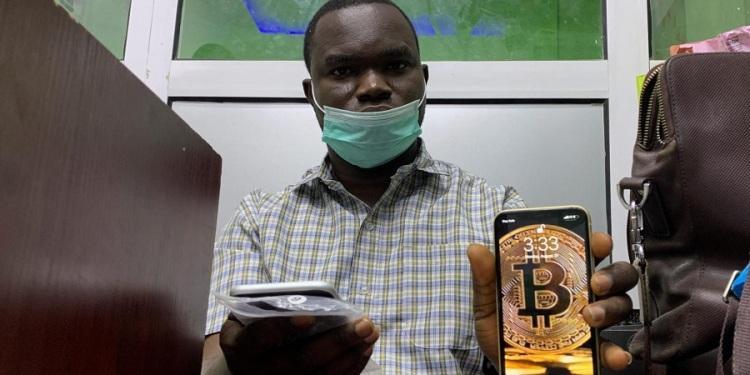

An exchange of BTC using peer-to-peer technology does not require a central authority and is between parties (such as individuals).

Even though peer-to-peer trading of Bitcoins takes a decentralized approach, an increasing number of Nigerians still use their banks to settle in cash while engaging in this form of trading.

There are about 17,000+ digital currencies around the world today, most of which are known as altcoins. Cryptocurrency has become a mainstream concept, and if you are reading this, it’s likely you already know something about Bitcoin.

Nigerian government’s reservation for crypto

- Nigeria, however, has taken an anti-crypto stance similar to many other countries in the world. At times, it has even reacted proactively and harshly against digital currencies.

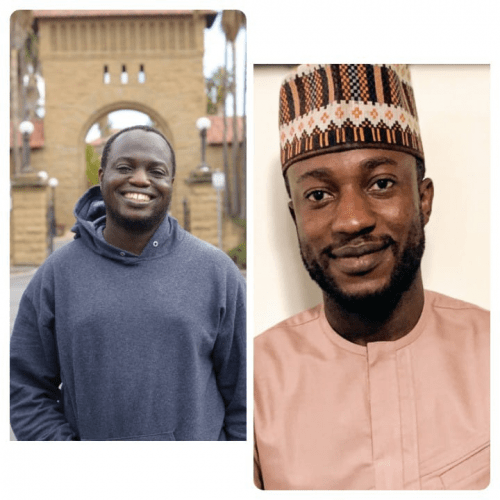

- Godwin Emefiele, Governor of the Central Bank of Nigeria (CBN), insisted that the bank’s decision in February 2021 not to allow deposit money banks, non-banking institutions, and other financial institutions to facilitate cryptocurrency trading had been in the best interests of Nigerians.

- “The Nigerian banking system should not handle cryptocurrency transactions since cryptocurrencies do not have a place in our monetary system at this time,” he said.

- Tukur Moddibo, the head of the Nigerian Financial Intelligence Unit (NFIU), also said crypto failed critical tests of vulnerability and risks, noting that his agency prevented a $3 million fraud involving 20 bank accounts.

Crypto enthusiasts across the country responded negatively to this ban with much backlash. In response, the Central Bank of Nigeria announced the launch of its own digital currency – the electronic naira, popularly known as the eNaira, on October 25, 2021.

Even so, Nigerians are now paying a premium to get their hands on these digital assets, since the only legal option is P2P trading as the most popular crypto in the world is available on Africa’s largest crypto market.

As a result of the directive of the Central Bank of Nigeria, young Nigerians are particularly affected as payment partners transacting in the local currency are no longer willing to deal with crypto exchanges.

Recent data from Nairametrics shows that bitcoin traded at more than 40% premium on some P2P exchanges as well as other non-traditional channels (N580 to $1) in comparison with the official Nigerian exchange rate.

Bottomline

Africa’s most populated country is not giving up on the Crypto market yet, therefore, willing to pay a premium to hold and buy Bitcoin regardless of Nigeria’s central bank’s ban on crypto transactions via its financial institutions.

Nairametrics