Debates over amending the CBN Act have quickly taken on political overtones. Yet beneath the noise lies a more consequential question: can Nigeria modernise its monetary governance architecture to keep pace with the complexity of today’s economy? This analysis argues that credibility is not built through personalities but through institutional design, clear mandates, enforceable limits, transparent reporting, and insulation from fiscal dominance. Drawing on lessons from Brazil, Ghana, Kenya, Indonesia, and South Africa, the piece frames the reform not as a partisan exercise but as a generational opportunity to anchor macroeconomic stability in stricter rules, not stronger rhetoric. A look at global best practices suggests the reforms are both overdue and essential.

The ongoing debate surrounding the proposed amendments to the Central Bank of Nigeria (CBN) Act transcends routine political discourse. At its core lies a fundamental policy question: whether enhanced governance structures, clearer statutory mandates, and more robust institutional safeguards can generate the credibility required to stabilise Nigeria’s macroeconomic environment. Comparative evidence from international central banking practice suggests that such reforms are not merely desirable. They are essential components of effective and modern monetary governance.

Reframing Nigeria’s Policy Challenges

Nigeria’s recurring macroeconomic fragilities are frequently attributed to poor policy formulation or implementation. However, such explanations overlook a more foundational issue: the institutional architecture within which policies are conceived and executed. Persistent inflationary pressures, exchange‑rate instability, weak monetary‑policy transmission, and abrupt policy reversals seldom arise solely from technical shortcomings. They often reflect structural deficiencies in governance and accountability frameworks.

It is within this context that the amendments proposed by Hon. Jesse Okey‑Joe Onuakalusi and co-sponsored by Prof. Julius Ihonvbere warrant careful, non-partisan scrutiny. The central analytical question is whether these reforms align Nigeria’s monetary governance with established international norms and with reform trajectories already undertaken by peer economies across the Global South.

Convergence with Global Standards in Monetary Governance

A preliminary examination suggests that the proposed amendments correspond closely with contemporary global trends in central bank governance. Enhanced transparency obligations, strengthened reporting requirements to the National Assembly, and clearer provisions governing the appointment and removal of senior leadership reflect the international movement toward rules-based and transparent monetary governance. Particularly noteworthy is the clarification that policy disagreement does not constitute grounds for removing the CBN Governor or deputy governors. This is a safeguard widely embedded in mature central banking systems to shield monetary authorities from short-term political pressures.

Equally significant is the broader updating of the CBN’s statutory mandate. The explicit inclusion of systemic financial risk, consumer protection, digital legal tender, payment‑system oversight, and climate-related financial exposures mirrors the evolving responsibilities of central banks globally. Monetary authorities are no longer confined to narrow price‑stability objectives. They now play pivotal roles in safeguarding financial‑system resilience and managing the implications of technological and environmental transformations.

Comparative Insights from Peer Economies

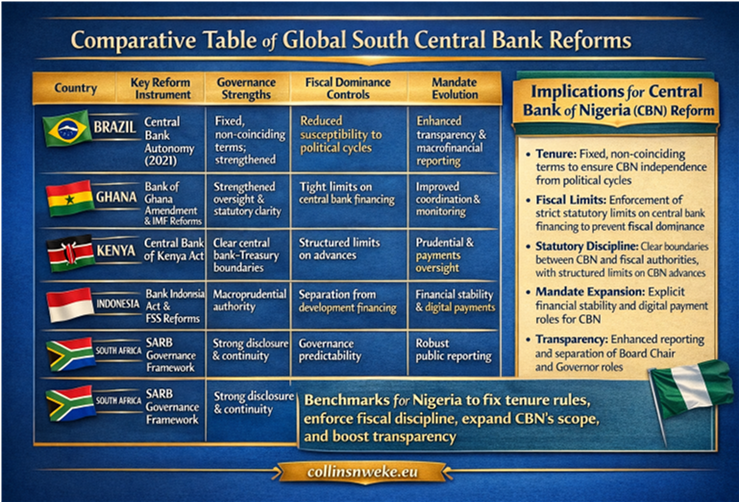

When viewed alongside comparable central bank reforms in Brazil, Ghana, Kenya, Indonesia, and South Africa, the Nigerian reform trajectory appears both consistent and overdue.

Brazil’s autonomy law emphasises fixed, non-overlapping terms for monetary authorities to mitigate electoral interference. Ghana and Kenya have strengthened statutory limits on the central bank’s financing of the government in response to past inflationary pressures linked to fiscal dominance.

Indonesia has progressively expanded its mandate to incorporate macroprudential oversight while carefully delineating the boundary between monetary stability and developmental ambitions. South Africa’s governance framework emphasizes continuity, disclosure, and institutional predictability over reliance on a single governance model.

Nigeria’s proposed amendments draw from these varied experiences, seeking to embed continuity, clarity, and institutional discipline without adopting any single foreign template wholesale.

Areas Requiring Refinement and Precision

1. Ways and Means Financing

A central lesson from global experience is that statutory limits on central bank financing of government must be enforceable in practice, not merely symbolic. A numerical cap that is routinely breached undermines, rather than reinforces, institutional credibility. Effective reforms require:

- A narrowly defined purpose for temporary financing, restricted to managing short-term cash‑flow mismatches rather than funding structural deficits.

- Automatic amortisation schedules and time-bound repayment requirements.

- Mandatory quarterly disclosures to the National Assembly detailing compliance with statutory limits.

- Emergency clauses governed by high thresholds and accompanied by sunset provisions and ex‑post legislative ratification.

Such mechanisms transform statutory limits into credible constraints, aligning Nigeria with international best practice and with lessons learned in Ghana and Kenya.

2. Exchange‑Rate Policy and FX Market Governance

The aspiration toward a unified and transparent exchange‑rate regime is broadly consistent with evidence from successful reformers. However, legislating rigid exchange‑rate uniformity or imposing blanket prohibitions on domestic FX usage risks undermining policy effectiveness if introduced without regard to market readiness or sequencing.

Effective statutory design should therefore prioritise principle‑based guidance, while delegating operational details to regulation. This includes:

- A statutory commitment to transparent, market‑consistent exchange‑rate management.

- A phased unification process guided by macro‑financial indicators such as market depth, spreads, and reserve adequacy.

- Semiannual disclosures of FX operations, interventions, and market conditions.

- Transitional measures, including temporary safeguards, implemented through regulation rather than statute.

Such an approach permits flexibility while preserving transparency and accountability.

3. Digital Legal Tender, Consumer Protection, and Emerging Risks

Modern central banking mandates increasingly extend to digital currencies, payment‑system oversight, and climate-related financial risks. The CBN Act should therefore:

- Provide statutory authority for issuing a central bank digital currency (CBDC) with clear legal‑tender status.

- Integrate CBDC development with monetary‑policy transmission, financial‑stability objectives, and payments‑system efficiency.

- Establish privacy, cybersecurity, and consumer‑protection standards consistent with global norms.

- Incorporate climate-related financial risks into supervisory expectations and scenario‑analysis frameworks.

Given Nigeria’s rapid digital uptake and financial‑inclusion priorities, these provisions are not optional add-ons; they are essential components of a modern monetary framework.

Conclusion: A Generational Moment for Reform

Nigeria’s recurring monetary and financial vulnerabilities are rooted not merely in technical policy failings but in the deeper institutional structures that shape policymaking. The proposed amendments to the CBN Act offer an opportunity, though not a final solution, to strengthen those foundations. Their effectiveness, however, hinges on legislative precision, credible enforcement mechanisms, and sustained political commitment to institutional integrity.

Central bank legislation is a generational instrument. Its design shapes economic outcomes long after present political actors have departed. The task before Nigeria is therefore not to seek perfection, but to commit to an open, evidence-based process of refinement, guided by comparative experience, grounded in national interest, and anchored in the pursuit of long-term economic stability.

Comparative Table of Global South Central Bank Reforms

Stay ahead with the latest updates!

Join The Podium Media on WhatsApp for real-time news alerts, breaking stories, and exclusive content delivered straight to your phone. Don’t miss a headline — subscribe now!

Chat with Us on WhatsApp