On May 29th, President Muhammadu Buhari’s administration handed over to President Bola Ahmed Tinubu. The handover marked the continuous transfer of democratic power since 1999, a milestone in the history of Nigeria.

Despite the excitement that has heralded President Tinubu’s inauguration, the truth remains that he has inherited a very troubled economy. And he has his job cut out for him, as far as the economy is concerned.

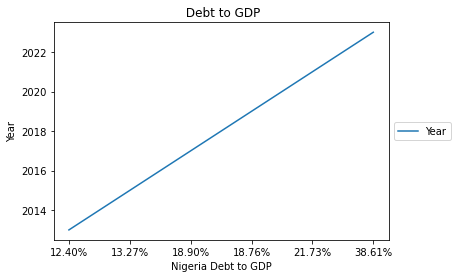

One lingering theme that characterised President Muhammadu Buhari’s administration was Nigeria’s rising debt profile. Although many Nigerians raised concerns about it, the Debt Management Office (DMO) insisted that Nigeria’s debt was sustainable as long as it was within the World Bank threshold of 40% debt to GDP.

Nigeria currently sits at a Debt to GDP ratio of 38%, according to available data. However, given the rising debt service spending, the Tinubu administration will have a lot of work to do in order to prevent debt levels from rising further than this.

Ways and Means Securitization

Earlier this month, the National Assembly approved the securitization of N22.7 trillion worth of Ways and Means loans. The securitization is expected to improve debt transparency, reduce debt service costs, and help reduce the budget deficit.

According to the latest data from the Debt Management Office, the tenor of the securitization is a whopping forty (40) years with a moratorium on the principal for three years and an interest rate of 9% per annum.

- Tenor: Forty (40) years

- Moratorium (on Principal only): Three (3) years

- Interest Rate: 9% p.a.

- Repayment: Amortising over thirty-seven (37) years

- Holder of the Securities: The Securities will be issued to the Central Bank of Nigeria (CBN) by the Federal Government of Nigeria (FGN).

- The Securities will not be issued to the public by the FGN to raise funds.

- It will reduce the Debt Service Cost as the new interest Rate is 9% p.a. compared to the Monetary Policy Rate plus 3% which translates to 20.5%6 p.a. (MPR – 18.5% +3%) currently being charged on the Ways and Means Advances.

- The large savings arising from the much lower Interest Rate will help reduce the deficit in the Budget and expectedly, the level of New Borrowings.

In addition, the provisions for interest on the securitized Ways and Means Advances (starting from 2023) and principal repayments starting from year four (4), will be made in the Annual FGN Budgets. Securitization will not lead to new loans.

Debt to GDP

Between 2007 and 2015, previous administrations only took a combined total of N869 billion from the Ways and Means window.

However, in the last eight years, the current administration has collected N23.7 trillion. Total public debt at the end of 2022 was N46.3 trillion while the expected borrowings for 2023 come to N8.8trn (domestic and foreign). If we include the ways and means of N22.7 trillion to be securitized, the total expected public debt for 2023 comes to 77.8 trillion.

A total debt stock rising to N77.8 trillion will take the country’s debt-to-GDP ratio to 38.4%. This increase in public debt may require the DMO to raise the public debt ceiling from its current level of 40% of GDP contained in the medium-term debt management strategy paper.

Using data from the DMO, at the Naira exchange rate for December 2022, Nigeria’s Debt to GDP ratio in dollar terms comes out as:

Fiscal Responsibility Extension

On Saturday, May 27, The Nigerian Senate amended the Central Bank of Nigeria (CBN) Act to increase the total CBN advances (Ways and Means provision) to the Federal Government from 5% to a maximum of 15%.

The Senate leader, Abdullahi Gobir, who read the lead debate on the bill, said the proposed amendment is to enable the Federal Government to meet its immediate and future obligation in the approval of the ways and means by the National Assembly and advances to the Federal Government by the Central Bank of Nigeria.

This means, that the incoming administration will seek to increase funding from the Central Bank, and with the precedent already set in by Buhari’s administration, surpass Nigeria’s 40% debt to GDP ratio.

Tax Increase for the debt burden

To deal with the haemorrhaging revenue-to-debt service ratio, the Nigerian government last month, in a last-ditch attempt, introduced a new set of taxes on alcoholic beverages, imported vehicles and single-use plastics in its new tax regime.

Under the newly introduced taxes, the Federal Government will charge N75 per litre of beer, stout or wine imported into Nigeria.

FG pointed out that N75 per litre will be charged on “beer and stout including all alcoholic beverages and beer not made from malt- whether fermented or not fermented” in 2023, adding that this new excise duty on beer and stout will be increased to N100 per litre in 2024.

The Federal Government also introduced a Green Tax by way of excise duty on Single Use Plastics (SUPs) including plastic containers, films and bags at the rate of 10 per cent and an Import Adjustment Tax (IAT) levy on motor vehicles of the 2-litre engine (2000 cc to 3999 ccs) at 2%, while vehicles with 4-litre engines (4000 ccs) and above will attract 4% IAT with effect from June 1, 2023.

Short Term Solution

Meanwhile, Tax advisory firm, KPMG Nigeria, has urged the federal government to increase oil revenues to increase the country’s earnings. The company stated this in a May 2023 report on the Assessment of the 2023 Fiscal Policy Measures.

In the report, KPMG noted that the federal government had recently implemented new taxes on beer, imported vehicles, single-use plastics, mobile telephone services, fixed telephone, and internet services.

KPMG advised the government to look beyond creating an additional burden on business margins and work to increase oil revenues.

According to KPMG Nigeria, the federal government can work to increase oil revenues in the following ways:

- Renegotiating or reconsidering Nigeria’s relationship with the Organization of Petroleum Exporting Countries (OPEC) like Indonesia, and Qatar did, to avoid being capped to a limit when and if the output exceeds the quota, given the country’s need for urgent revenues for development.

- Developing joint ventures between the Nigerian National Petroleum Company Limited (NNPCL) and companies building modular refineries to process crude oil into derivatives as a means of increasing the revenues generated from selling extracts like premium motor spirit, low-pour fuel oil, and kerosene. aviation fuel, diesel, pet coke, bitumen binders, and marine fuel. These could multiply revenues generated from selling crude oil as a raw commodity.

- The Government needs to consider an independent Joint Venture model for its production-sharing contract and encourage NNPCL to raise cash calls independently. This will help to raise Nigeria’s revenue-to-GDP ratio to the emerging markets average of 18%, as a tool to reduce deficit financing that comes from unsustainable debt cycles without sacrificing the country’s urgent need for huge development expenditure.

- The KPMG report also advises NNPCL to secure oil output by installing high-pressure sensors on all feeder lines that take crude oil through flow stations from well-heads to terminals to be able to track and detect spikes, pulsations, surges that might occur from vandalization, and pressure tapping.

- The NNPCL also needs to mobilize the office of the National Security Adviser, the Nigerian Army, the Marine Police, and the Nigerian Navy to arrest culprits and their back-end sponsors and accomplices. Meanwhile, all the security personnel responsible for detecting and acting on oil theft detections should be replaced every 3 months to avoid being compromised.

- The NNPC also needs to install modern metering technology at all 33 export terminals to avoid siphoning off crude oil inventories and reduce the difference between inventory delivered by feeder lines through flow stations from well-head to terminals.

Source: Nairametrics