The rest of the continent should be paying very close attention.

There is a moment in every industry when one player stops following the trend and starts setting it. For African fintech, that moment may have just arrived, and it is coming from Lagos, Nigeria

The Central Bank of Nigeria has just released its first dedicated fintech policy report, a sprawling, data-rich document that runs the full length of the continent’s most active innovation ecosystem.

On the surface it is a national policy paper. Underneath, it is something far more consequential: a declaration that Nigeria intends to stop being simply the fastest- growing fintech market in Africa and start becoming the one that writes the playbook that will guide structured and sustainable scale across the continent.

For regulators in Nairobi, Cape Town, Accra and Dakar, for investors watching where the next wave of capital will flow, and for the millions of Africans who still lack access to basic financial services, this report deserves more than a passing glance. It deserves a seat at the table.

THE BIGGER PICTURE

SO WHAT MAKES THIS REPORT A GAME CHANGER?

Nigeria is not the first African country to publish a fintech strategy. Kenya did it years ago, riding the M-Pesa wave. South Africa has long positioned itself as the continent’s financial gateway. Ghana and Senegal have quietly built some of the tightest regulatory sandboxes on the continent. Each of those countries has a legitimate claim to fintech leadership.

But none of them have done what Nigeria is now attempting to do in a single, consolidated document: lay out a comprehensive, sequenced, multi-stakeholder roadmap that stretches from regulatory plumbing all the way to cross-border passporting, and back to the last-mile farmer who still does not have a bank account. That ambition, paired with the institutional weight of the CBN behind it, is what makes this different.

The report is, in essence, Nigeria drawing a line in the sand. It is saying: we have the payments infrastructure, we have the ecosystem, we have the volume, and now we are going to build the governance architecture to match. If it delivers on even half of what it promises, the implications ripple across every other fintech market on this continent.

THE ARCHITECTURE OF AMBITION

THREE PILLARS. ONE AUDACIOUS VISION.

The CBN has organised its strategy around three pillars, and each one reveals a different dimension of Nigeria’s game-changing bet.

First: Innovation-Friendly Regulation. Nigeria is not pretending that its regulatory environment is already perfect. The report is remarkably candid: 87.5% of fintech operators say compliance costs are materially dampening their ability to innovate. 37.5% say it takes more than a year to bring a new product to market, while 62.5%point to delays in approvals and ambiguity in guidelines as their top regulatory friction. The CBN’s answer is not a vague promise of “streamlining”. It is a concrete proposal for a Single Regulatory Window, a standing fintech engagement forum, and a Compliance-as-a-Service utility that would take the grinding weight of duplicative reporting off smaller firms. If those mechanisms land, time-to-market could compress dramatically, and the firms that benefit will not just be Nigerian.

Second: Inclusion Through Digital Infrastructure. This is where the report moves from clever policy design to genuinely transformative territory. Nigeria still has 26% of its adult population financially excluded, rising to 47% in the North. The CBN is not blaming mobile operators or blaming the market. It is diagnosing the problem with surgical precision: fragmented digital identity systems, API access that is too expensive, credit data that does not flow across platforms, and USSD infrastructure that remains the lifeline for hundreds of millions of feature-phone users across Africa. The proposals here, affordable digital-ID APIs, expanded digital banking licences, interoperable credit rails, read less like a Nigerian policy document and more like a continental infrastructure blueprint.

Third: System Integrity and Reputation. This is the pillar that turns this report into something other countries cannot easily replicate, because it requires a particular kind of honesty. Nigeria carries a reputational burden in global finance. The CBN does not flinch from it. The report acknowledges the fraud problem head-on, but it also makes a case that is both evidence-based and compelling: a significant share of digital financial crimes attributed to Nigeria are orchestrated by foreign actors using the country as a proxy. Nigeria’s exit from the FATF grey list is the headline proof that the enforcement machinery is real. Pairing that enforcement credibility with transparent communication is, the report argues, the key to unlocking the next wave of international investment. It is a mature, unsentimental approach to reputation. Rare anywhere. Rarer still in Africa.

THE CONTINENTAL VIEW

WHAT NIGERIA’S MOVE MEANS FOR THE REST OF AFRICA

The temptation, when a single country makes a bold policy play, is to treat it as a local story. A regulatory reshuffle here, a new sandbox there. But Nigeria’s report is not a local story. It is a strategic repositioning with direct consequences for every other fintech market on this continent, and the logic is worth tracing carefully.

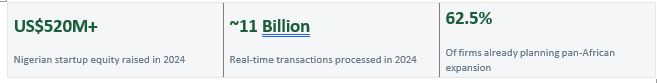

For regulators across Africa, the most consequential proposal in the CBN report may be the one that gets the least headline attention: regulatory passporting. Nigeria is proposing bilateral pilots with Ghana, Kenya, Senegal and South Africa, frameworks that would allow mutual recognition of licences across borders. If those pilots work, they do not just ease expansion for Nigerian fintechs. They create a template. They lower the bar for every startup on this continent that has ever been told, “You need a separate licence in every single market.” For investors, the report sends a signal that Nigeria is serious about reducing the risk premium that has historically attached to African fintech. A Fintech Credit Guarantee Window, secondary-market mechanisms for fintech debt, and the kind of regulatory predictability that the Single Regulatory Window promises, these are the building blocks of an ecosystem that institutional capital can actually scale into. The numbers already tell part of the story: Nigerian startups raised over US$520 million in 2024. That figure could look very different if the infrastructure underneath it finally catches up.

For the unbanked, the report’s language about inclusion is not aspirational fluff. It is operationally specific in a way that matters. Tiered KYC. Affordable digital-ID APIs. USSD channels that actually work. Digital banking licences that allow new entrants to offer credit, not just payments. The shift the CBN is signalling, from payments penetration to productive finance, from transactions to credit, savings and capital formation for informal enterprises, is the kind of policy evolution that other African central banks have been circling for years without committing.

THE TURNING POINT

WHEN THE MOMENTUM KICKS IN, THIS IS WHAT CHANGES.

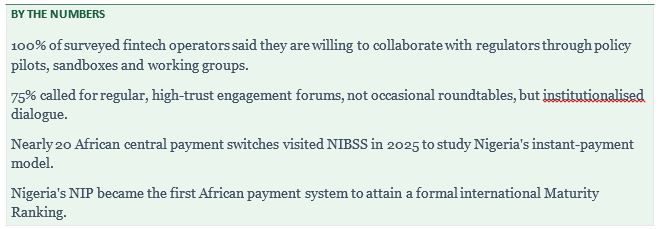

Something rare is happening inside this report, and it is worth pausing on. The CBN is not writing policy in a vacuum. This document is the direct product of a quantitative survey of fintech operators, a closed-door workshop where industry leaders spoke candidly, and a high- level roundtable held in October 2025. The ecosystem did not just get consulted, it co-authored the agenda. That kind of genuine, structured partnership between regulator and industry is exactly the condition under which African fintech policy has historically stalled. Nigeria is breaking that pattern.

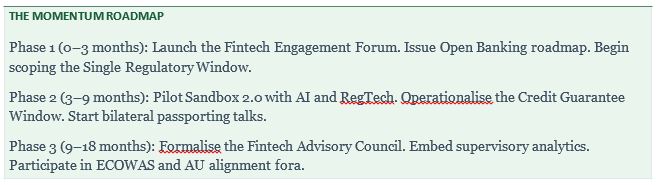

And the groundwork is already laid in ways that matter. The policy frameworks are not aspirational, they are in place. PSV2025, the AML regulations, the cybersecurity guidelines, the open banking rules: these are not future intentions. They are operational foundations. What the CBN is now doing is turning foundations into momentum. The phased roadmap, three months, nine months, eighteen, is specific enough to be credible and ambitious enough to be transformative. A Fintech Advisory Council to oversee execution. A dedicated implementation secretariat to sustain it. System-level indicators to measure it. These are the scaffolding of an ecosystem that is not just planning to move, it is built to accelerate.

Once that momentum takes hold, and the signals strongly suggest it will, the effects will compound fast. A Single Regulatory Window does not just save time for Nigerian startups. It creates a model that every other African regulator will be under pressure to replicate.

Passporting pilots with Ghana, Kenya and Senegal do not just ease one corridor. They open a door that, once opened, is very difficult to close. And a Fintech Credit Guarantee Window backed by development finance institutions does not just de-risk one cohort of MSME lenders. It proves that inclusive finance can be commercially viable at scale. Each piece of this architecture reinforces the others. That is not incremental reform. That is a system designed to tip.

THE BOTTOM LINE

THIS IS NOT JUST NIGERIA’S STORY. IT IS AFRICA’S.

Every fintech operator on this continent has felt, at some point, the weight of fragmentation. Different rules in every market. Compliance costs that eat into margins before a product even launches. Identity systems that do not talk to each other. Credit data that disappears at the border. Nigeria’s CBN report does not solve all of those problems. Nothing written in a single document ever could. But it does something that no other African regulator has done at this scale and with this degree of specificity: it names the problems, proposes the solutions, sets the timeline, and invites the ecosystem to hold it accountable.

That is what a game changer looks like, not a revolution overnight, but a credible, sequenced bet that Nigeria is going to stop waiting for the continent to catch up and start building the infrastructure that lets everyone move faster together.

The rest of Africa should not just be watching. It should be taking notes.

Credit: www.the-star.co.ke

Stay ahead with the latest updates!

Join The Podium Media on WhatsApp for real-time news alerts, breaking stories, and exclusive content delivered straight to your phone. Don’t miss a headline — subscribe now!

Chat with Us on WhatsApp

mgm sports betting promo online mgm casino betmgm Wyoming