Starting a business requires strategy, patience, and realistic projections. This is why any business that lacks this foresight is doomed to fail after a short while.

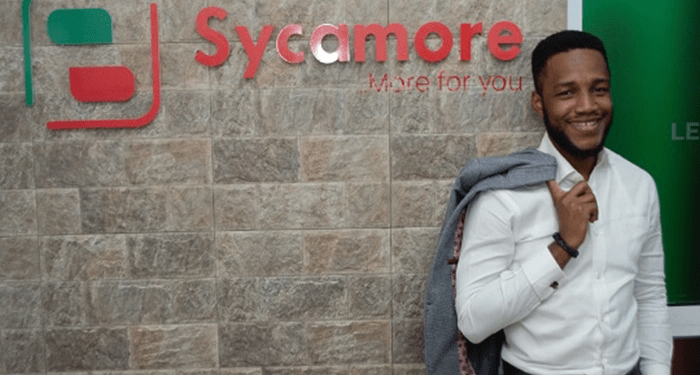

Babatunde Akin-Moses and his co-founders, Mayowa Adeosun and Onyinye Okonji, understood this when they started Sycamore in their living room four years ago.

How they started: Unlike others who started with fancy offices, luxurious cars and expensive suits, they believed in planting first before harvesting. For them, their strategy was dependent on procedures and starting was the very first phase they were not willing to compromise.

- “We could have rented an office back then, we could have done some PR and all, but we channel all the capital raised directly into the business and kept overheads as low as possible. Some people would say we were suffering then, but for us, that was the season of planting,” Akin-Moses said during Nairametric’s Business Half Hour Programme.

Beyond just making money available by connecting lenders to borrowers, the fintech is ensuring that customers (primarily SMEs that need quick access to working capital) are empowered. For Sycamore, empowering one SME means extending help to others. Akin-Moses explained:

- “If you are helping SMEs, you are helping their employees who are also helping their families and so there is a multiplier effect for every small business you assist.”

About the business: Explaining how the business works, Akin-Moses said that Sycamore embraces a partnership with a different set of people. For instance, they work with the bank to validate the signature of customers, they work with identity and verification companies, payment platforms and some partners to ensure efficiency and serve the customers.

He added that working with a credit bureau allows the lending company to access data on the credit history of customers. This means that if someone gets a loan with another loan company and then goes to Sycamore for more, data shows they are not eligible until previous loans are settled.

Sycamore, however, looks to strengthen collaboration with the government and traditional financial institutions and also has a lot of information about customers.

According to Akin-Moses, if there were more collaboration between all the banks and traditional financial institutions and all the fintech companies, the sky would be the starting point in terms of the provision of customer satisfaction.

Dealing with the risks: The loan business is typically a risky one seeing as borrowers may not pay back on time or pay back at all. And while other loan apps deal with this challenge by sending shaming messages to defaulters, Sycamore says it gives customers options that allow them to restructure their loans.

Challenges facing fintech: In terms of challenges fintechs face in Nigeria, Akin-Moses noted that the uncertain regulatory environment has been an issue and navigating that the hurdle has been the major hindrance where some rules just change suddenly and consequently changes the way businesses work – not because you didn’t do anything right or you did something wrong – and that could alter things within a second.

He however applauded the performance of fintechs in the country, quoting a report which says there are over 5,000 startups in Africa and over half of them are fintechs. To him, the industry has done pretty well.

- “If you look at the cash crunch in the last week, a lot of the platforms including Sycamore are even more reliable than the traditional platforms. You could easily have made a transaction on the sycamore app compared to others and that is the trend,” he said

He also added that there is still a lot that needs to be done in terms of implementation (of the start-up act) and more collaboration with traditional financial institutions.

Akin-Moses’ thoughts on japa trend: While the rate of emigration (Japa) increases by the day, a lot of businesses have been affected. Meanwhile, Akin-Moses sees the positive side of the trend; providing room for others that are here to grow in the system.

He believes that for companies to benefit from this however, they need to have a system in place that trains others who will take over the position when some key roles become vacant.

He pointed out that the Sycamore operation involves a pipeline of people that are willing to step into the key role. He noted that the company invests big in internships and graduate hires that allow for the empowerment and training of graduates.

Nairametrics