In 2023, the NGX Banking Index showcased remarkable growth, registering a robust 114.9%, solidifying its position as the second-best performing index on the NGX, narrowly trailing the oil and gas index.

Throughout the year, Nigerian banks emerged as formidable profit generators, propelled by a substantial upswing in interest income and gains resulting from the Naira’s devaluation in Q2 2023.

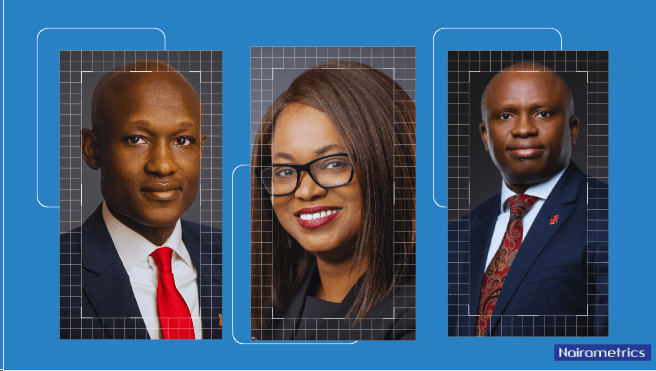

The financial upswing also translated into commendable market performance, with Chief Financial Officers (CFOs) strategically positioned at the forefront of guiding financial operations.

These CFOs sit at the helm of their company’s financial management for success, overseeing critical areas such as financial planning, analysis, accounting, tax, risk management and audited financial statements.

Their responsibilities include managing the finance and accounting divisions, and ensuring accurate and timely completion of the company’s financial reports.

CFOs, often integral members of the C-suite, were handpicked for this list based on criteria such as the bank’s market capitalization, the depth of experience evidenced by relevant financial certifications, and the strength of their work portfolio across listed banks on the NGX.

Recognizing their indispensable roles, Nairametrics tracked the performance of leading banking stocks on the NGX in 2023, and so far, in 2024.

This effort shines a spotlight on CFOs entrusted with navigating the financial future of these companies in the medium to long term.

10. Adebimpe Olambiwonnu – Chief Finance Officer at Sterling Bank

Bimpe Olambiwonnu is a vital figure in Sterling Bank’s finance group, playing a key role in shaping processes for monitoring the bank’s financial outcomes. Formerly with NAL Bank, she transitioned to Sterling Bank following the merger.

As a fellow of the Institute of Chartered Accountants of Nigeria and an associate member of various prestigious institutions, including the Chartered Institute of Taxation, Bimpe brings extensive expertise.

Sterling Bank witnessed an impressive 206.4% share price appreciation in 2023, closing at N4.29 from N1.40. The bank reported a commendable net income of N16.5 billion in the first nine months of 2023, reflecting a 23.04% YoY growth.

Its asset base stands at N2.24 trillion according to its 9-month ended September statement, a significant 20.9% increase from N1.85 trillion recorded within the same period in 2022.

Sterling Bank has a market capitalization of N201 billion as of January 19, 2024.

9. Deji Fayose, Chief Financial Officer Group at First City Monument Bank Limited

Deji Fayose, Chief Financial Officer at FCMB, boasts over 18 years of diverse banking experience. He commenced his career in the Treasury Department of FCMB Plc and later worked with notable institutions in the UK before rejoining FCMB Group Plc.

Holder of a master’s in business administration and a Fellow of the ACCA and FICA, Fayose oversees FCMB’s strategic financial management.

FCMB Group recorded a remarkable 108% YoY growth in pre-tax profit, reaching N55.1 billion in the first nine months of 2023.

Additionally, in the first nine months of 2023, the group achieved a profit after tax of N49.15 billion, representing a YoY growth of 114.4% from the corresponding period in 2022, and a total asset base of N3.88 trillion, indicating an increase of 30.03% as of Q3, 2023.

FCMB has a market capitalization of N210 billion as of January 19, 2024

8. Victor Abejegah, Chief Financial Officer & General Manager at Fidelity Bank Plc

Victor Abejegah, serving as the Chief Financial Officer & General Manager at Fidelity Bank Plc, is a distinguished professional with a graduate degree and an MBA from the University of Nigeria.

Under Abejegah’s financial stewardship, Fidelity Bank’s Q3 2023 results showcased remarkable growth, with pre-tax profits surging by 172.60% year on year to reach N34.658 billion.

The Q3 profits took the nine-month pre-tax profit to N110.992 billion, a substantial 193.69% increase from N37.792 billion in the same period of 2022.

Key highlights for Q3 2023 include gross earnings of N141.693 billion (+62.77% YoY), interest income of N134.915 billion (+82.01% YoY), and net interest income of N87.129 billion (+140.61% YoY).

The bank also closed with a total asset base of N5.414 trillion, indicating an increase of 35.71%.

Fidelity Bank has a market capitalization of N416 billion as of January 19, 2024.

7. Ayo Adepoju, Group CFO of Ecobank

Ayo Adepoju serves as the Group CFO of Ecobank, a prominent African banking group operating across 35 countries. Overseeing a finance organization of approximately 250 professionals, he manages aspects such as investor relations, business planning, treasury and capital management, tax, and financial control.

With a Ph.D. in Organizational Leadership from Regent University, Virginia, USA, an MBA from Warwick Business School, UK, and a first-class degree in accounting, Ayo brings extensive expertise to his role.

Ecobank Transnational Incorporated (ETI) reported a pre-tax profit of N262.2 billion for the nine months ending September 2023, reflecting robust 55% year-on-year growth.

In the 9 months to September 2023, it recorded gross revenue of N1.21 trillion, representing a 59% increase from the same period in 2022, and a total asset base of N20.7 trillion, a 55% increase when compared to 2022.

Ecobank has a market capitalization of N474 billion as of January 19, 2024.

6. Kunle Adedeji, Chief Financial Officer at Stanbic IBTC Group

Kunle Adedeji currently holds the role of Chief Financial Officer at Stanbic IBTC Group, boasting over 23 years of post-graduation experience, predominantly in the banking sector. With a bachelor’s degree in accounting and an MBA in Finance, Adedeji has attended various executive development programs, reflecting his commitment to continuous learning.

He is a Fellow of esteemed institutions like the Institute of Chartered Accountants of Nigeria (ICAN).

During his career, he has held significant financial positions, including CFO of Stanbic Ghana and roles in Ecobank Liberia and Nigeria.

Stanbic IBTC Holdings witnessed an 87.77% increase in pre-tax earnings for the 9 months to September 2023, reaching N129.46 billion from N68.95 billion. During the same period, its post-tax profits increased by 97.97% to reach N109.25 billion from N55.19 billion, with a total asset of N4.67 trillion, a 54.32% increase from 2022, under Adeniji’s leadership.

Stanbic IBTC has a market capitalization of N842 billion as of January 19, 2023,

5. Patrick Iyamabo, Chief Financial Officer at First Bank of Nigeria

Patrick Iyamabo became Chief Financial Officer at First Bank of Nigeria Limited in 2022, bringing over 27 years of extensive professional experience in assurance, risk management, business development, accounting, and finance.

Before joining First Bank in 2016, he served as Senior Vice President of Strategy and M&A at First City Monument Bank Limited and later as the Group Chief Financial Officer of FCMB Holdings Plc.

Patrick, a Fellow of the Institute of Chartered Accountants of Nigeria and Chartered Institute of Taxation of Nigeria, holds a Bachelor of Pharmacy from Ahmadu Bello University and an MBA from The Wharton School, University of Pennsylvania.

FBN Holdings Plc recently unveiled its third-quarter financial statements for the period ending September 30, 2023. The Group’s profit before tax surged by an impressive 156.3% to N270.3 billion from the previous year, driven by robust growth in interest income. The company’s profit after tax (PAT) reached N236.4 billion, marking a substantial 159.2% increase compared to the corresponding period in 2022. Their total assets increased 36.67% to N14.46 trillion as of September 2023.

FBN Holdings has a market capitalization of N955 billion as of January 19, 2024.

4. Ugo Nwaghodoh, Group CFO at United Bank for Africa Plc

Ugo Nwaghodoh currently holds the position of Group CFO at United Bank for Africa Plc (UBA). With a rich background in financial analysis, accounting, and strategic management, Ugo has been steering UBA’s financial helm since 2011. His responsibilities include overseeing performance, financial control, portfolio investment, and investor relations.

Ugo’s tenure at UBA also saw him serve in key roles such as Divisional Head, Financial Control and Investor Relations, Group Chief Compliance Officer, and Head of Special Projects (Corporate Mergers). Before joining UBA, he spent 8 years at PricewaterhouseCoopers Nigeria and an additional 2 years in Kenya on secondment.

He holds a degree in Accounting and Finance, along with an MSc in Finance & Management from Cranfield School of Management, Cranfield University. A fellow of the Institute of Chartered Accountants of Nigeria (FCA), Ugo brings a wealth of experience to his role.

UBA’s third-quarter results for 2023 showcase a remarkable 86.64% year-on-year growth in pre-tax profits, totalling N98.444 billion. The nine-month pre-tax profits surged to N502.901 billion, a substantial increase from N138.493 billion in the corresponding period last year. The bank’s gross earnings reached N327.086 billion, marking a 38.64% year-on-year increase, with interest income reaching N237.999 billion, up by 46.13% year-on-year. Their total assets increased 49.54% to N16.236 trillion as of September 2023.

UBA has a market capitalization of N1.06 trillion as of January 19, 2024.

3. Morounke Olufemi CFO at Access Bank Holdings

Morounke Olufemi, a seasoned financial strategist with nearly 20 years of diverse experience, has navigated through various facets of Finance & Strategy within multinational organizations.

Beginning her professional journey with the UK Home Office, she later joined Lehman Brothers Investment Bank Europe in 2006 as the Emerging Markets Finance Manager for Fixed Income. In 2011, Morounke became the Senior Finance Business Partner at Barclays Corporate and Investment Bank, overseeing the Barclays Corporate business across Western Europe.

Morounke Olufemi holds a Second-Class Upper bachelor’s degree in economics & accounting from CASS Business School London. She became a Chartered Accountant in 2005 and later obtained an MBA from Durham Business School UK.

Access Holding’s nine-month pre-tax profit stood at N294.4 billion, marking a substantial year-on-year increase of 100.2% from the corresponding period last year. The group’s profit after tax reached N250.4 billion during the nine months, showcasing an 83% year-on-year surge from the same period in 2022. Their total assets increased 49.98% to N21.257 trillion as of September 2023.

Access Holdings has a market capitalization of N1.07 trillion as of January 19, 2023.

2. Banji Adeniyi CFO at Guaranty Trust Bank

Banji Adeniyi, with over 24 years of experience, honed his skills at Coopers & Lybrand, PricewaterhouseCoopers, and Arthur Andersen, specializing in financial statement audit, assurance, and advisory services across diverse industries. Transitioning to banking in 2001, he ascended to Deputy Manager/Head of internal Audit at Lead Bank before joining GTBank in 2006 as General Manager & Chief Financial Officer.

Instrumental in pivotal projects like GTBank’s Eurobonds issuance and IFRS transition, Adeniyi, an alumnus of the University of Ibadan, demonstrated analytical prowess. GTCO Holdings, GT Bank’s parent group, witnessed a remarkable Q3 2023 financial performance.

The pre-tax profit soared to N105.8 billion, a 59.17% YoY surge, with Q3 2023 PAT reaching N86.93 billion, marking a 64.68% YoY increase. This stellar performance propelled the group’s pre-tax profit in the first nine months of 2023 to N433.20 billion, a staggering 155.24% YoY growth from N169.72 billion in the corresponding 2022 period.

Their total assets increased 33.65% to N8.616 trillion as of September 2023.

GTCO has a market capitalization of N1.30 trillion as of January 19, 2023.

1. Mukhtar Adam Group CFO at Zenith Bank

Mukhtar Adam, a distinguished finance professional, boasts over two decades of expertise. With a Ph.D. in Finance from Leeds Beckett University, an M.Sc. in Finance from the University of London, an MBA in Finance from the University of Leicester, and a B.Ed. in Social Sciences from the University of Cape Coast in Ghana, his academic foundation is robust.

Zenith Bank demonstrated the highest performance in the 2023 third-quarter results. The pre-tax profits for the three months ended September 30 reached N154.67 billion, a 113% YoY quarter growth, propelling the nine-month pre-tax profit to N505.036 billion, a 149.34% increase when compared to the period in 2022.

Gross earnings reached N1.329 trillion, a 114.17% increase from the previous year, while the group’s profit after tax hit N434.17 billion, a 149.05% increase compared to N174.33 billion recorded within the same period in 2022.

Their total assets increased 47.82% to N18.161 trillion as of September 2023.

Zenith Bank’s market cap stands at N1.43 trillion as of January 19, 2023.

Note: The individuals featured in this compilation have been selected based on the market capitalization and stock performance of their publicly listed banks on the Nigerian Stock Exchange in 2023.

It is important to note that none of the individuals listed have solicited their inclusion. While this list aims to be comprehensive, it is by no means exhaustive; numerous other contributors have played significant roles in advancing the banking industry’s performance on the Nigerian Capital Market in Nigeria.

In partnership with Nairametrics