There is a consensus among industry experts that the twin problems of e-fraud and exorbitant charges hinder financial inclusion in Nigeria and across West Africa.

On a Sunday morning in March, Emmanuella Olofu, a journalist based in Abuja, Nigeria’s capital city, boarded a taxi from her residence in the Lugbe area to church.

Upon arriving at her destination, Ms Olofu grabbed her handbag and picked up her mobile phone to log onto her mobile banking application to pay the taxi driver.

She punched in N2,200, the taxi fare, but the transaction failed.

“I received a message that I had insufficient balance in my account,” Emmanuel said, recalling how she shockingly realised that her savings had been creamed off.

Desperate to sort out the waiting driver, she reached out to a friend who sent N5,000 into the same bank account. Again, the money vanished within seconds after it landed.

Ms Olofu’s plight is one of the many complaints about fraudulent electronic banking transactions Nigerians are grappling with.

This year alone, over 248 financial fraud-related complaints were lodged with the Nigerian Deposit Insurance Corporation (NDIC) from bank customers, Bashir Alhassan, the Director of Communications and Public Affairs at NDIC, said.

This figure is a far cry from reality.

The Nigeria Electronic Fraud Forum (NeFF) said the incidence of accumulated electronic fraud (e-fraud) within the banking sector and payment systems network peaked in the first six months of the year in May 2020 with 11,716 cases, while the lowest count was in June with 6,240.

The NeFF membership, drawn from the CBN, commercial banks, fintech, the Economic and Financial Crimes Commission (EFCC), and the National Security Adviser (NSA), among others, said electronic fraud had led to a loss of N9.5 billion as of June in 2023.

Many of these complaints are not resolved. Ms Olofu did not report the fraudulent transactions on her account to the NDIC but to her bank. The step has not yielded any results as of the time of this report.

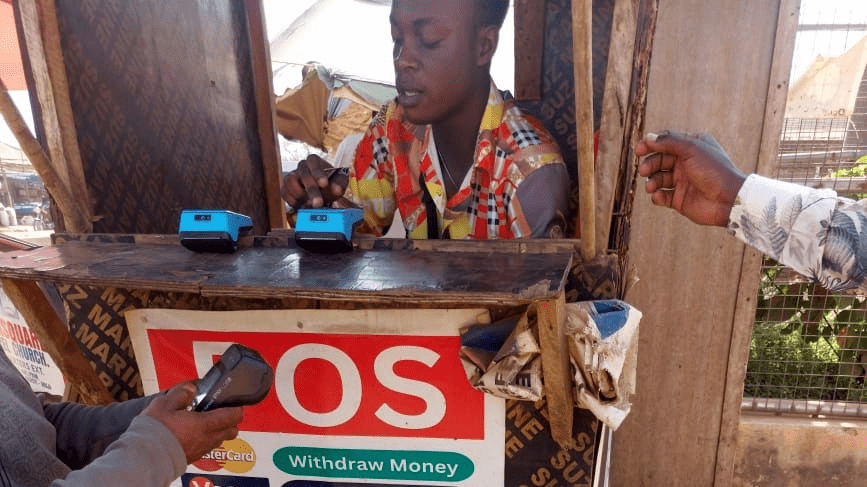

“When I complained at my bank, I was asked if I used a point of sale (POS) agent, which I answered in the affirmative; the bank customer care officer ignored my subsequent follow-ups on the issue,” she recalled her experience in trying to recover the stolen money.

The growth of fintech companies has enhanced financial inclusion, especially in hard-to-reach places in Nigeria’s rural areas, where conventional banks are not available.

However, the rise in fraudulent financial transactions constitutes a major setback in the progress of digital banking services in the country, particularly when fraud complaints remain unresolved.

The Central Bank of Nigeria (CBN) and the various deposit money banks are channels of filing complaints over financial crimes but bank users say the regulatory authorities like the CBN and NDIC are failing in their duties of safeguarding customers’ funds.

Though the NDIC boasted about helping depositors to recover N8.3 billion from online fraudulent schemes from January to November in 2023, many victims of the crime like Mr Olofu criticise the CBN for not coming to their aid in recovering stolen monies.

While featuring on the Brekete Radio and Television magazine programme in Abuja on 7 December, Mr Bashir said the CBN and the NDIC had resolved several complaints relating to electronic banking services, amongst others.

In Nigeria, fintech companies like Opay, Moniepoint, Firstmonie, and several others were licensed by the CBN to assist conventional banks in providing financial services; thereby fostering financial inclusion in rural communities.

But issues of fraudulent financial transactions against fintech companies are difficult to resolve because they largely have their physical offices only in Lagos, Nigeria’s commercial capital, Michael Johnson, a resident of Abuja who was defrauded in an online transaction in October, told PREMIUM TIMES.

Ms Olofu and Mr Johnson are among many Nigerians whose fraudulent withdrawals of funds from their bank accounts have not been resolved.

For Mr Johnson, it is goodbye to digital payment services. “I have had two nasty experiences with the POS services; after withdrawing money from an agent in October, a week after the transaction, about N25,000 was stolen from my bank account. I filed a complaint but it was never resolved. For me, it’s goodbye to online banking services.”

“Since the stealing of monies from my bank account without help from regulatory agencies like the CBN in recovering the funds, I have stopped using my online banking apps and POS services,” Ms Olofu said.

The spokesperson for the CBN, Hakama Ali, did not respond to phone calls and text messages asking for his comments on the bank’s measures put in place to resolve customers’ complaints over fraudulent financial transactions.

However, Mr Alhassan insists bank and fintech customers with issues of fraud on their accounts should approach the consumer protection department of the CBN for resolution.

High transaction charges are obstacles to e-banking

Ali Muhammed who sells beef at Karu Market, a suburb of Abuja, was forced into receiving payments from his customers via e-transfers.

Mr Muhammad acquired a POS machine for receiving payments from customers. However, transaction charges have made him reluctant to use the machine.

“A kilogram of beef sells for N3,500, but if a customer wants to pay with his Automated Teller Machine card, the charge per transaction is N100. This is where there is a problem – most customers don’t want to bear the cost of processing the fees,” Ali explained.

He said customers complain about the high cost of transactions as they prefer to pay in cash. However, Mr Muhammad agrees that the instant payment system removes delays that are often associated with conventional digital bank transfers.

The beef seller is not alone regarding complaints over charges in processing online payments.

Paul Omenka runs a POS business at Jikwoyi in Abuja, where he charges N100 per every N5000 transfer that is made for a customer. But, his customers are unhappy with the “high rates of the transaction fees.”

“Most of the transactions I execute are cash withdrawals by customers. So, when the volume of cash withdrawal is high, the processing fees also increase,” Mr Omenka explained amid the brewing cash crunch in some Nigerian cities.

He noted that patronage of e-banking services has reduced, except at weekends when banks do not open for business.

“Most of my customers who are civil servants told me that they prefer to withdraw cash or do e-transfers during weekdays from the banks due to the exorbitant charges involved in withdrawals at POS,” he said.

During cash shortages, POS operators take advantage of the desperation for cash to charge excessively for financial services.

The Nigerian Inter-Bank Settlement System (NIBSS) in July reviewed the processing fees for transactions on its platform from N5 to N3.75 for instant payments.

NIBSS provides interconnectivity and interoperability of retail electronic payments in Nigeria across the country’s financial ecosystem.

Despite NIBSS’ reduction of transaction charges, banks still impose a N10 fee for e-transactions below N5,000, while N26 is charged for transactions between N5,000 and N50,000, and N50 for transactions exceeding N50,000.

However, POS agents charge much higher processing fees than commercial banks, depending on market forces of “demand and supply.”

Experts say only the CBN can direct banks to cut down their transaction fees because they are largely driven by profit motives.

Top commercial banks – Access, Zenith, Ecobank, and UBA – raked in N145.7 billion, N132.8 billion, N200.9 billion, and N128.2 billion, respectively, from transaction charges and commissions in 2022. The profits extensively came in from fees and commissions.

Even in 2023, the banks continue to maximise profits relying on fintech to reap a total revenue of N265.269 billion from their electronic businesses in nine months.

How to avoid fraudulent transactions

But Babatunde Obrimah, the CEO of the FinTech Association of Nigeria, says it may be difficult to regulate transaction fees in the e-banking ecosystem owing to factors including, the large number of operators in the sector, cost of deploying telecommunications assets and transportation in remote places, and general infrastructure deficit in the telecoms industry.

Referencing the success story of Sweden’s cashless policy with just a two per cent cash economy, Mr Obrimah said many POS transaction services in Nigeria are still cash-based because people request cash from the operators.

“The Nigerian economy is still cash-based, and cash is free. So, the POS operators are charging for cash, because the cost of getting the cash is huge – the risk of carrying cash is enormous. So, you pay a premium for cash,” he told PREMIUM TIMES.

He suggested that to make Nigeria’s economy cashless, people should be charged for carrying cash, while the cost of transacting businesses on digital platforms should be lowered.

Dwelling on the issue of fraud in the fintech sector, he said customers must be wary of the status of fintech companies to be sure that they are licensed to operate.

He said many of the reported cases of fraud at POS were a result of “card swap and divulging information to third-party interests.”

“The issue of fraud is huge and we need to up our game by having up-to-date software to counter fraudulent financial activities in cyberspace.

“We need to drive a cashless environment; once we can take cash out of the system, corruption reduces drastically,” Mr Obrimah said.

Intersection of high cost and e-fraud

There is a consensus among industry experts that the twin problems of e-fraud and exorbitant charges are a hindrance to financial inclusion in Nigeria and across West African countries.

Robert Karanja, senior director in charge of Africa at Co-Develop, speaking recently at the West African Media Excellence Conference and Awards (WAMECA) 2023 ceremony in Accra, Ghana, called for urgent measures in tackling fraud and high transaction fees within the continent’s digital payment ecosystem.

Ken Ashigbey, who leads Ghana Telecoms Chamber in Accra, re-echoed Mr Karanja’s perspectives when he suggested African-centric solutions to addressing issues with the continent’s digital industry.

Mr Ashigbey specifically recommended the use of local Artificial Intelligence to dismantle language barriers and other challenges that inhibit the adoption of digital payment services across rural communities.

Premium Times