To deepen financial inclusion and provide Nigerians long excluded from credit opportunities with access to affordable loans, the Federal Government has unveiled a new pension-backed loan initiative targeting retirees and the middle class.

The scheme, part of President Bola Tinubu’s economic agenda, aims to transform Nigeria’s consumer credit landscape by ensuring that pensioners, often overlooked in the financial system, can access safe, transparent, and sustainable loans.

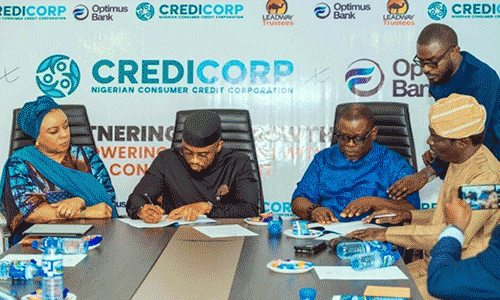

Speaking at the signing of a Memorandum of Understanding (MoU) with partner financial institutions in Abuja, the Managing Director/CEO of the Nigeria Consumer Credit Corporation (CREDICORP), Uzoma Nwagba, described the programme as a transformative milestone.

“Annuitants are the backbone of Nigeria’s progress, yet they’ve been sidelined in the credit ecosystem. This programme changes that narrative. By partnering with Leadway Trustees’ expertise in pension management, we’re delivering a credit solution that is safe, affordable, and transparent. This is consumer credit redefined—inclusive, equitable, and empowering,” Nwagba said.

The scheme introduces pension-secured, low-interest loans, enabling retirees to fund urgent needs such as healthcare, home improvements, small businesses, or family obligations without being burdened by high lending rates or complex procedures.

“For decades, consumer credit accessibility has been a privilege reserved for active workers, leaving retirees struggling to fund critical needs. This programme addresses that by leveraging pension income, offering retirees tailored loans that are both secure and sustainable,” he added.

Under the initiative, retirees can borrow as little as N50,000, with upper limits based on their pension income. Repayment schedules are directly linked to pension inflows, ensuring that borrowers can manage credit responsibly and with peace of mind.

The launch featured heartfelt testimonies from beneficiaries. Mrs. Amina Sule, a 68-year-old retired teacher, described the programme as a lifeline.

“For years, I’ve wanted to start a small poultry business to stay active and support my family. This programme gives me the confidence to borrow affordably, knowing my pension secures my loan. It’s not just credit—it’s hope and independence,” she said.

Mr. Chukwuemeka Okeke, a former civil servant, said the loan would ease medical expenses. “Medical bills can be overwhelming. With this loan, I can cover my healthcare needs without stress. The process was straightforward, and I feel respected as a retiree,” he noted.

CREDICORP has set a target of reaching 100 million subscribers under the programme, a move Nwagba described as pivotal for universal financial inclusion in Nigeria. “By extending consumer credit to retirees, CREDICORP and its partners are setting a new standard for equity in Nigeria’s financial system,” he said.

Stay ahead with the latest updates!

Join The Podium Media on WhatsApp for real-time news alerts, breaking stories, and exclusive content delivered straight to your phone. Don’t miss a headline — subscribe now!

Chat with Us on WhatsApp