Nigerian governors have urged the federal government to immediately end the Central Bank of Nigeria’s financing of the government’s budgetary expenditures as part of a coordinated effort to rescue the nation from fiscal collapse.

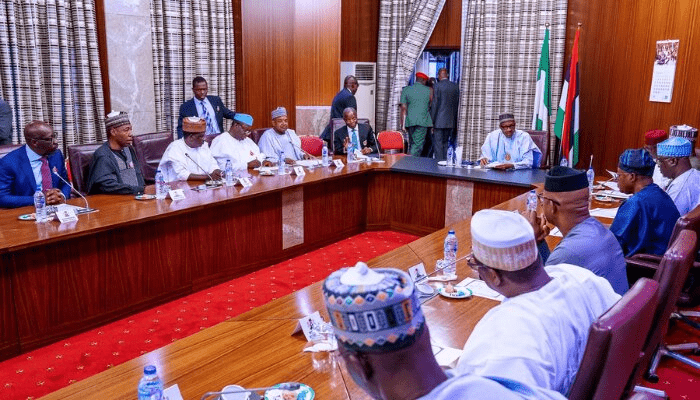

The governors, who made the proposal at a meeting with President Muhammadu Buhari in July, also urged the government to convert the N19 trillion Ways and Means outstanding loans obtained from the CBN into a 100-year bond with a proposed interest of one per cent.

Officials familiar with details of the meeting, who spoke to PREMIUM TIMES, explained that the governors were concerned about the deteriorating state of the economy and a proposal to restore fiscal discipline was presented to the federal government.

The governors lamented that the dollar exchange rate had deteriorated from N197 (and N300 at the parallel market) to N410 (and N652 at the parallel market) under the watch of the Buhari government.

One of the governors expressed worry on how the CBN has printed N19 trillion for federal government expenditures in gross violation of the law, noting that trillions of Naira chasing a few billion dollars will put pressure on the foreign reserves and the exchange rate. The governor also added that CBN’s ‘fixed exchange’ stance discouraged foreign investment (peak of $90bn investment commitments in 2018, to $20bn in 2021), and Diaspora inflows ($20 billion), just as petrol subsidy has wiped out all accruals to reserves.

The governor also lamented how the CBN has resorted to using swaps, deferred Letters of Credit (LCs) and other methods to hide the real levels of the nation’s reserves, which is $15 billion as against $36 billion it claimed as of end of June 2022.

Growing Crisis

The recommendations are among the several outlines the governors hope will help stem Nigeria’s economic slide. PREMIUM TIMES reported Thursday how the governors advised the Buhari administration to pay off civil servants who are older than 50 years. We also reported that Nigeria’s external reserves amount to only $15 billion, well below the $36 billion balance on the gross external reserves claimed by the bank. With the nation spending N5.9 trillion on imports in the first quarter of the year, reserves of $15 billion would barely cover four months of import.

Policy experts and financial analysts claim this would not have mattered much but for recent difficulties in different sectors of the economy, especially the export constraints that have seen the nation’s petroleum monopoly unable to add to the reserves in the last six months. Similarly, The NNPC’s inability to remit oil sales receipts to the CBN, despite elevated crude oil prices, is seen as one reason why the naira has nose-dived recently in the parallel market.

A banker who spoke under conditions of anonymity said the reported balance on the gross external reserves has long concealed problems. Not only is the gross balance on the external reserves not an accounting one (according to the CBN, the reserve is a 30-day moving average with effect November 2011), by not excluding the apex bank’s contingent liabilities, the report flatters the resources available to the central bank to defend the economy’s external position.

Data shows that the Nigerian government’s total borrowing from the CBN through Ways and Means Advances rose from N17.46tn as of December 2021 to N19.01tn as of April 2022, representing an increase of N1.55tn within the first four months of 2022.

The N19.01tn isn’t part of the country’s total public debt stock, which stood at N41.60tn as of March 2022, according to the Debt Management Office. The debt stock only captures the debts of the Federal Government of Nigeria, the 36 state governments, and the Federal Capital Territory.

Ways and Means

The Ways and Means Advances is a loan facility through which the CBN finances the government’s budget deficits. Section 38 of the CBN Act, 2007, allows the bank to grant temporary advances to the government, but the total amount of such advances outstanding shall not at any time exceed five per cent of the previous year’s actual revenue of the Federal Government.

In recent years, the Nigerian government has repeatedly violated this section of the CBN Act, raising concerns among policy experts and international rating agencies. But the Nigerian central bank governor, Godwin Emefiele, has consistently justified why the bank is printing more money to finance the federal government budget, saying “If the government cannot finance all its obligations, the central bank should offer support as a lender of last resort.”

Global institutions like the World Bank and rating agency, Fitch, have repeatedly warned against unchecked financing of the Nigerian government’s budget deficit by the CBN. In 2021, in a report titled ‘The perils of deficit monetisation in Nigeria’, Capital Economics, a London-based independent economic research outfit, said that over the past six years, around 55 per cent of Nigeria’s annual budget deficits have been financed by the CBN.

“Many of the problems plaguing Nigeria’s economy – from high inflation to a persistently overvalued currency – are tied to the government’s sustained reliance on the central bank to cover fiscal financing gaps,” it said.

Proposed Interventions

As part of suggestions put forward by the governors, the proposal identified that exchange rate policy now favors consumption by the rich in terms of cheaper medical tourism, education, and business and technical services.

The governors urged that CBN’s subsidized interventions in the real sector should be ended and the relevant institutions recapitalized to provide these services. They explained that institutions like the Bank of Agriculture, Bank of Industry, and Development Bank of Nigeria, among others, need recapitalization

Similarly, the governors warned that funds in the Nigeria Incentive-Based Risk Sharing system for Agricultural Lending (NIRSAL) controlled by CBN should be redirected to the development banks, while the apex bank should be directed to focus on its core and statutory mandates. These include exchange rate management, interest rate management, and inflation targeting.

Apart from the 100-year bond proposition, which isn’t exactly novel (in 2020, the Austrian government placed a €2bn bond issue with a yield of 0.88% – for 100 years), the governors also warned that the apex bank should desist from competing with development and commercial banks.

Premium Times

Stay ahead with the latest updates!

Join The Podium Media on WhatsApp for real-time news alerts, breaking stories, and exclusive content delivered straight to your phone. Don’t miss a headline — subscribe now!

Chat with Us on WhatsApp