*Patronage of Construction-All-Risk insurance is 20% of GPW

*Insurers seek more awareness

By Rosemary Iwunze

Amidst incidences of building collapses across the country, financial statements of insurance firms have shown poor patronage of Construction-All-Risk, CAR, insurance policy by property owners and developers over the years, a development about which little has been done by concerned regulators.

CAR policy caters to buildings under construction and insurance companies underwrite the risks under fire or engineering insurance policies in their financial reports.

Though Financial Vanguard findings from 13 insurance companies show steady growth in both fire and engineering policies, industry operators said that the source of growth is mainly from direct fire and machinery insurance and not from CAR.

An insurance expert told financial vanguard that CAR policies represent only about 20 per cent of total premium realized from fire and engineering businesses.

The companies reporting on the policy income are Axa Mansard, Cornerstone, Coronation, Linkage, Lasaco, Niger, Universal, Veritas Kapital, Nem, Consolidated Hallmark, Regency, Prestige and Mutual Benefits.

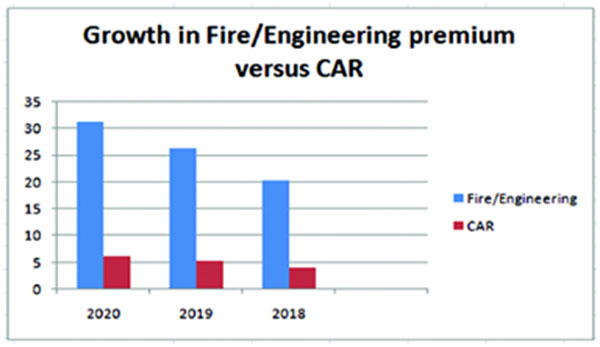

Financial Vanguard findings from the insurance firms’ financial statements show that in 2020, while the cumulative Gross Premium Written, GPW, by the 13 insurance firms was N173.1 billion, fire and engineering insurance cumulatively was N31.4 billion. The CAR insurance component was about N6.28 billion.

In 2019, while GPW was N151.9 billion, cumulative fire and engineering insurance was N26.4 billion. CAR insurance was N5.28 billion.

In 2018, while GPW was N133.8 billion, cumulative fire and engineering insurance was N20.5 billion. Accordingly, CAR insurance was N4.1 billion.

Industry operators speak

Speaking on the situation, Managing Director of Universal Insurance Plc, Mr. Ben Ujoatuonu, said: “Most contractors handling buildings under construction shy away from insurance. Most of the growth we see in fire and engineering insurance is not related to CAR business as that line of business is yet to garner the level of acceptability that will hugely impact on premium growth.”

What the law says

Section 64 of the Insurance Act, 2003, stipulates that for insurance of buildings under construction, every owner or contractor of any building under construction with more than two floors must take an insurance policy to cover liability against construction risks caused by his negligence or that of his servants, agents or consultants which may result in death, bodily injury or property damage to workers on site or members of the public.

This insurance policy also covers liability for collapse of buildings under construction.

Section 65 of the Insurance Act 2003 stipulates that all public buildings shall be adequately insured, while Section 64 of the Act provides that all buildings under construction above two floors shall be adequately insured with a registered insurance company.

The law explains further that every public building should be insured against the hazards of collapse, fire, earthquake, storm and flood.

Ikoyi collapsed building

Financial Vanguard findings reveal that the developers of the collapsed 21-storey building in Ikoyi area of Lagos, ignored a directive by the Lagos State Physical Planning Permit Authority, LAPPPA, to insure the structure.

It was gathered that the developer was directed to insure the liabilities associated with construction of the building.

According to the development permit no-DCB/DO/2442IV, dated 09/04/2019, the developers were duly directed by the Lagos State government to insure the construction risks of the building but they continued with the project without the insurance cover.

Part G of the permit reads: “A developer of any building above two floors shall insure his/her liability in respect of construction risks and submit a Certified True Copy, CTC, of such insurance policy certification with his/her development permit to Lagos State Building Control Agency, LASBCA.”

Similarly, Part E said: “Non-compliance with the approved planning permit as designed will void the permit, and the development will be regarded as illegal.”

Operators’ reaction

Speaking to Financial Vanguard, Ujoatuonu said: “Had the building been insured, the amount that should have been paid out to the victims would depend on the amount of cover they bought.

“First of all, if the contractor handling the project, for instance, had taken out a contractors-all-risk cover with different sections of cover where section one will cover the contract work which is the building itself.

“We also have a section that will cover third party liability and that is the aspect which affect the people who are there as third parties working. So it depends on the limit of liability the contractor has taken.

“But one thing you have to know about third party liability is that the insurance policy does not extinguish the liability of the insured or the principal. For instance, if you have a limit of say N20 million, and the cover has granted accumulated liability of say N100 million to the people, the insurance policy can only pay N20 million to take care of the situation. So it depends on limit of liability the contractor has regarding that.”

Regarding the apathy to insurance, Ujoatuonu stated: “In this part of the world, insurance is sold not bought. People think they can do away with it. In situations like this it is not even only the contractor that should focus on insurance. I expect that for a project of that magnitude, the principal would have requested the contractor to effect a contractors-all-risk as part of the contract insurance while he is on site. So the accident is just a general attitude of our people of not embracing insurance.”

Speaking on the condition of anonimity, an expert said that operators must boost awareness drive on the importance of building insurance even as more partnerships with relevant bodies must be formed.

He said: “There is a potential of over a trillion naira income in the compulsory building insurance and other products for the industry and there is need for strict enforcement of that line of business.”

He also said that the sector needs to up its game in propagating the benefits inherent in the compulsory insurance products, adding that it offers the industry a huge opportunity to increase insurance penetration as well as grow the economy.

Also speaking on the issue prior to now, Director General of Nigerian Insurers Association, NIA, Mrs. Yetunde Ilori, stated that building without insurance means violation of the insurance law.

While observing the worrisome recurrence of building collapse in the country, Ilori emphasised the need for the general public to comply with all building rules and adopt insurance in the protection of lives and property to curb further incidences of building collapse.

Awareness challenge

Speaking on efforts by the insurance industry to curb the menace of building collapse, Commissioner for Insurance, Mr. Sunday Thomas, said that the industry will commence moves to strengthen implementation of compulsory insurance for public buildings and buildings under construction.

Thomas said: “The Commission will go full force on the implementation of compulsory insurance for public buildings and buildings under construction.

“Owners of public buildings must desist from the act of constructing high-rise buildings without the regulatory building insurance coverage. Building without building insurance coverage means violation of the insurance law.”

Ilori on her part said that the NIA is putting modalities in place to ensure that stakeholders in the construction industry take appropriate steps to ensure compliance with the extant laws to stop the needless loss of life and property.

Ilori said: “Insurance Act 2003 in its Section 64(1) states that no person shall construct any building of more than two floors without insuring with a registered insurer his liability in respect of construction risks caused by his negligence or the negligence of his servants, agents or consultants which may result in bodily injury or loss of life to or damage to property of any workman on the site or of any member of the public.

“We are collaborating with those who are vested with the power to enforce the laws of the land because it is our duty to ensure that laws are obeyed.”

The NIA DG assured the insuring public of the industry’s capacity and readiness to respond to the needs of Nigerians through the provision of insurance protection to the citizens.