To confirm the veracity of this news, Falana wrote a letter of request to the apex bank to seek their reaction to the circulating news on the purported sale of Polaris Bank.

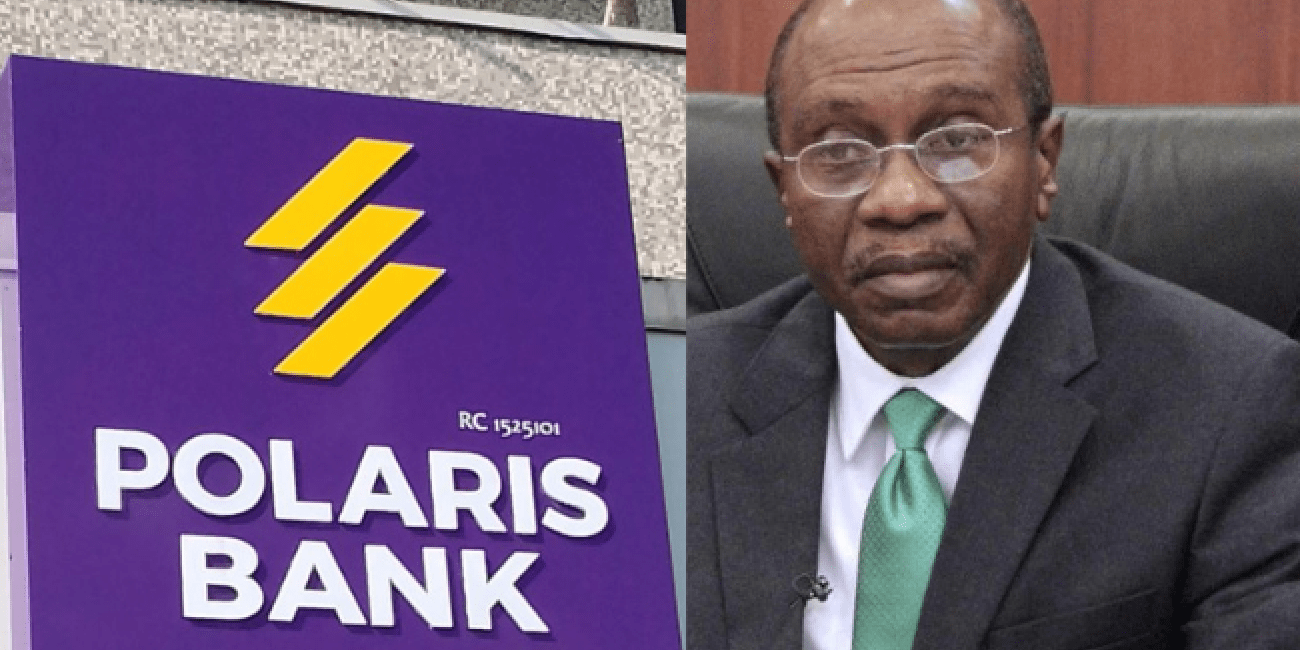

The Nigerian Central Bank has not denied the plan to sell Polaris Bank for N40 billion after the government had invested N1 trillion in the bank.

This was disclosed in a letter in response to the request made by a human rights lawyer, Femi Falana, SAN to the apex bank.

In August, the Central Bank of Nigeria (CBN) reportedly planned to sell Polaris Bank at the cost of N40 billion to Auwal Lawan Abdullahi, a commercial farmer in the Sarkin Sudan of Gombe State.

Polaris Bank has been under the management of the debt recovery agency, Asset Management Corporation of Nigeria (AMCON), since it was renamed from Skye Bank and nationalised in 2018.

Skype Bank became bankrupt in 2016 and was unable to meet the recapitalisation requirements, leading to the intervention of the CBN. The top executives at the firm, Chairman, Tunde Ayeni; and the Managing Director, Timothy Oguntayo, were prosecuted for money laundering.

The Economic and Financial Crimes Commission (EFCC) had filed a N25.4 billion lawsuit against Ayeni and Oguntayo in 2019, but it was withdrawn in July 2022, after an alleged settlement that led to the forfeiture of cash and assets worth N15 billion.

Since the takeover of Skye Bank, now known as Polaris Bank, AMCON has been unable to sell the bank to new investors, with AMCON and CBN pumping about N848 billion of taxpayers’ money as of December 2020 into the firm.

Reports, however, say that an extra N350 billion has been invested in the commercial bank by the two government agencies in the last one and a half years. This means about 96% of the investment by AMCON will be lost if Polaris Bank is sold at N40 billion, when pegged at N848 billion, and 97% loss based on the total sum of N1.2 trillion reportedly invested by the government agencies.

It was gathered that the Governor of the Central Bank, Godwin Emefiele, is pushing for a prompt sell-off, and has received the backing of AMCON’s managing director and chief executive officer, Ahmed Kuru, Peoples Gazette earlier reported.

To confirm the veracity of this news, Falana wrote a letter of request to the apex bank to seek their reaction to the circulating news on the purported sale of Polaris Bank.

Falana’s letter dated August 25, 2022, and obtained by SaharaReporters, reads: “We commend the Central Bank of Nigeria for bailing out Polaris Bank Nigeria Limited with the sum of N1.2 trillion.

“We have however read in the People’s Gazette online medium that the Central Bank has concluded arrangements to sell the Polaris Bank at a ridiculous sum of N40 Billion. In view of the foregoing, kindly furnish us with detailed information on the proposed sale of Polaris Bank Nigeria Limited including the name of the lucky buyer.

“As this request is made pursuant to the provisions of the Freedom of Information Act 2011, you are required to accede to our request within 7 days of the receipt of this letter.”

“TAKE NOTICE that if you fail or refuse to furnish us with the requested information we shall not to pray the Federal High Court to compel you to accede to our request,” the letter added.

Reacting, the apex bank in a letter signed by Aminu Mohammed, for Director/ Secretary to the Board and obtained by SaharaReporters, acknowledged the receipt of the inquiry letter on September 1, 2022, promising to make available the needed information relating to the matter.

“We write to acknowledge the receipt of your letter dated the 25th of August 2022 and received on the 1st of September 2022 on the above subject and wish to inform you that the information being sought, where available, will be communicated to you in due course,” the apex bank responded. \

Sahara Reporters