From a modest $35 million fund closed in 1998, Nigeria’s private capital industry has grown into one of Africa’s most dynamic markets. A report by Banwo & Ighodalo estimates that the country now attracts as much as 31.4 percent of all private equity investments on the continent.

The sector’s rise can be traced to Africa Capital Alliance (ACA), which pioneered activity with its Capital Alliance Private Equity (CAPE) I fund. That initial $35 million close set the stage for what has since become an industry worth billions of dollars, supported by more than 30 private equity firms operating across Nigeria and the wider African continent. Global names like Actis have made their mark, investing in projects such as Ikeja City Mall before exiting, while still holding stakes in Heritage Place, a commercial development in Ikoyi, and Azura Power, a 435MW power plant in Edo State.

Despite their footprint in Nigeria, Actis co-heads Torbjorn Caesar and Michael Harrington are absent from this list, given that most of the firm’s $16 billion in assets under management are deployed outside the country. Also excluded is Norrsken22 Africa Fund, a $205 million vehicle targeting African tech startups, which holds only three Nigeria-focused companies in its portfolio.

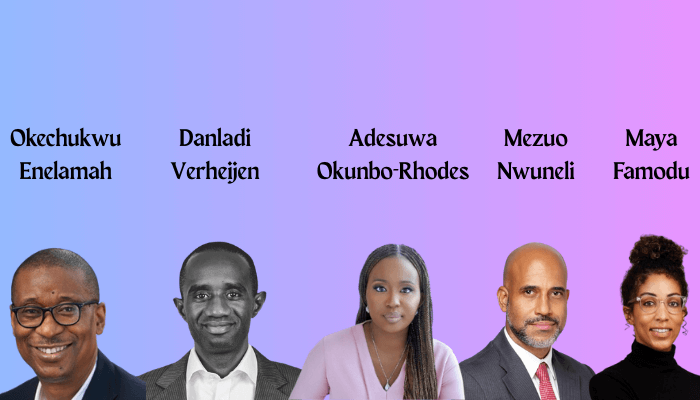

After reviewing the industry, BusinessDay highlights five key figures shaping Nigeria’s private equity story.

Okechukwu Enelamah – Africa Capital Alliance

No account of Nigeria’s private equity growth is complete without mentioning Okechukwu Enelamah. A physician turned investment banker, Enelamah was Nigeria’s Minister for Trade, Industry, and Investment between 2015 and 2019, but his legacy in finance rests with ACA, where he served as chief executive.

On the Afropolitan podcast, Enelamah described ACA’s foray into private equity, pointing to MTN Nigeria as one of its standout successes. The firm reportedly achieved a 46x return on its exit from the telecom giant. ACA entered MTN Nigeria through its maiden CAPE I fund, negotiating minority protections that included an ACA partner serving as board chairman and representation for minority shareholders. At entry, MTN Nigeria was valued at $400 million; by the time of ACA’s exit, the company’s valuation had soared to $13 billion, making it the fund’s most successful investment.

Beyond MTN, ACA’s CAPE III fund invested $3.5 million in Associated Bus Company (ABC Transport) in 2013, later exiting in 2018 with $51 million, a tenfold return. Altogether, ACA has raised about $1.2 billion across CAPE I–IV and its Capital Alliance Property Investment Company (CAPIC) fund. It also has a portfolio spanning 51 companies such as Aradel Holdings, Wakanow, FilmOne, Cornerstone Insurance, and First Hydrocarbon Nigeria.

Danladi Verheijen – Verod Capital

Another prominent figure is Danladi Verheijen, managing partner and co-founder of Verod Capital. Founded in 2008, Verod launched its first fund, the $55 million Verod Capital Growth Fund I, in 2014. Before that, the firm invested on a deal-by-deal basis, backing nine companies.

Since then, Verod has raised about $380 million across multiple vehicles, including the $60 million Verod-Kepple Africa Ventures, a venture fund created with Kepple Africa Ventures. Its portfolio includes Emzor Pharmaceuticals and CSCS Plc, while it was also among the earliest investors in Niyyah Foods, makers of the “Farm Pride” juice brand. More recently, Verod participated in Moniepoint’s $110 million Series C round, and in 2024 acquired a 65 percent stake in fitness chain i-Fitness for $12 million.

Adesuwa Okunbo Rhodes – Aruwa Capital Management

Adesuwa Okunbo Rhodes has carved a space as one of Nigeria’s most influential women in private equity. After a career in finance and private equity in the United Kingdom, she returned in 2019 to launch Aruwa Capital Management. The firm was created with a focus on channeling capital into women-led and women-focused businesses.

Under her leadership, Aruwa has raised $55 million across two funds. Its first, a $20 million vehicle, invested in Lifestores Healthcare, the company behind OGApharmacy, alongside other deals in FairMoney Microfinance, KoolBoks, and OmniRetail. Aruwa Capital Fund II, which has so far raised $35 million, has backed ventures including footwear maker Yikodeen with $1.5 million and restaurant chain Toasties. Rhodes’ strategy places strong emphasis on gender inclusion, setting the firm apart in Nigeria’s investment landscape.

Mezuo Nwuneli – Sahel Capital

In agriculture-focused private equity, Mezuo Nwuneli stands out. As managing partner and co-founder of Sahel Capital, he oversees the $65.9 million Fund for Agricultural Finance in Nigeria (FAFIN), which draws backing from the Nigerian Sovereign Investment Authority, the AfDB, British International Investment, and KfW Development Bank.

Through FAFIN, Sahel Capital has provided investments ranging from $500,000 to $8.2 million across several agribusinesses, including Dayntee Farms, Crest Agro, TradeDepot, and LADGroup. This has positioned Nwuneli as a central figure in financing the country’s agricultural value chain.

Maya Horgan Famodu – Ingressive Capital

Finally, Maya Horgan Famodu has built a reputation as a trailblazer in tech-focused venture capital. The Nigerian-American investor founded Ingressive Capital in 2017, establishing Africa’s first female-led tech fund. The firm has since raised $60 million across two vehicles, the $10 million Ingressive Fund I and the $50 million Ingressive Fund II.

Ingressive typically invests up to $500,000 at the pre-seed or seed stage in exchange for a 10 percent equity stake. Its portfolio spans 52 companies with six exits, including notable Fund I investments in Paystack, Bamboo, Tizeti, SeamlessHR, Mono, Grey, and Carry1st. About 40 percent of its portfolio is female-founded, reflecting Famodu’s push for inclusive investing.

Stay ahead with the latest updates!

Join The Podium Media on WhatsApp for real-time news alerts, breaking stories, and exclusive content delivered straight to your phone. Don’t miss a headline — subscribe now!

Chat with Us on WhatsApp