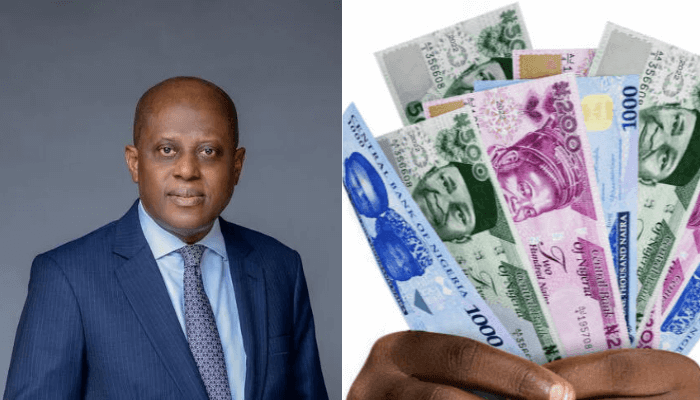

Olayemi Cardoso, the governor of the Central Bank of Nigeria (CBN) has raised concerns over the growing liquidity levels in the banking system from statutory revenue distributions, warning that the surge may spike inflationary pressures and trigger a tight monetary measure.

“We are also confronted with increased liquidity injections into the banking system from statutory revenue distributions, highlighting the need for tight monetary conditions to avoid renewed inflationary pressures,” Cardoso said after a May 20 committee meeting, the central bank said in a statement published on its website.

The windfall from oil revenue and exchange rate gains are feeding naira liquidity across the banking system, a situation that could result in money-induced inflationary concerns, countering the efforts of the apex bank to curb rising prices and stabilise the economy.

The Federal Account Allocation Committee (FAAC) distributed N1.81 trillion to the federal, state and local government in June 2025, marking the highest levels on record. The allocation increased by N159 billion month-on-month from N1.65 trillion in May.

This is as gross statutory revenue rose sharply to N3.48 trillion in June, up from N2.09 trillion in May, representing a N1.39 trillion month-on-month increase.

According to the CBN governor, inflation is estimated to further trend downward due to the stability of the exchange rate and lower prices for food, energy, and transportation. He however noted that the country’s macroeconomic outlook is still fraught with elevated risks and uncertainty

Inflation has slowed for the third consecutive months in June, according to the National Bureau of Statistics (NBS) as efforts by both the fiscal and monetary authorities continue to drive prices downward.

Consumer prices cooled to 22.22 percent year-on-year in June, down from 22.97 percent in the prior month. This fall is the lowest this year and marks the softest inflation reading since April 2023, helped by a stable exchange rate, subdued energy prices and favourable base effect.

Even as inflation continues to moderate, analysts are divergent as to whether the monetary authorities will hold or begin an easing cycle when it announces its rate decision tomorrow after the 301st MPC meeting.

The monetary authorities have kept interest rates unchanged twice this year after it aggressively increased the borrowing costs all through 2024 to anchor a stubbornly high inflation and shore up the value of the naira.

The Monetary Policy Rate (MPR) was raised by a combined 875 basis points to 27.5 percent, marking the highest level in the country. But prices are beginning to slow down and the naira has been largely stable in 2025.

While some analysts are calling for the CBN to further hold interest rates and maintain a rather cautious stance, many others think a token rate cut of between 25 t0 50 basis points is necessary to stimulate growth.

Stay ahead with the latest updates!

Join The Podium Media on WhatsApp for real-time news alerts, breaking stories, and exclusive content delivered straight to your phone. Don’t miss a headline — subscribe now!

Chat with Us on WhatsApp