Following investors’ demand for banks shares driven by the ongoing banking sector recapitalisation exercise directed by the Central Bank of Nigeria (CBN) and first quarter financial performance, the market capitlisation of Guaranty Trust Holdings Company Plc (GTCO), Zenith Bank Plc, United Bank for Africa (UBA) Plc and seven other banks reached N11.07 trillion at the end of May 2025.

The N11.07 trillion represents 15.7per cent of the N70.463 trillion overall equities market capitalisation during the period under review.

The other seven banks are: Access Holdings Plc, Fidelity Bank Plc, Wema Bank Plc, Stanbic IBTC Holdings Plc, FCMB Group Plc,First Holdco Plc and Ecobank Transnational Incorporated (ETI).

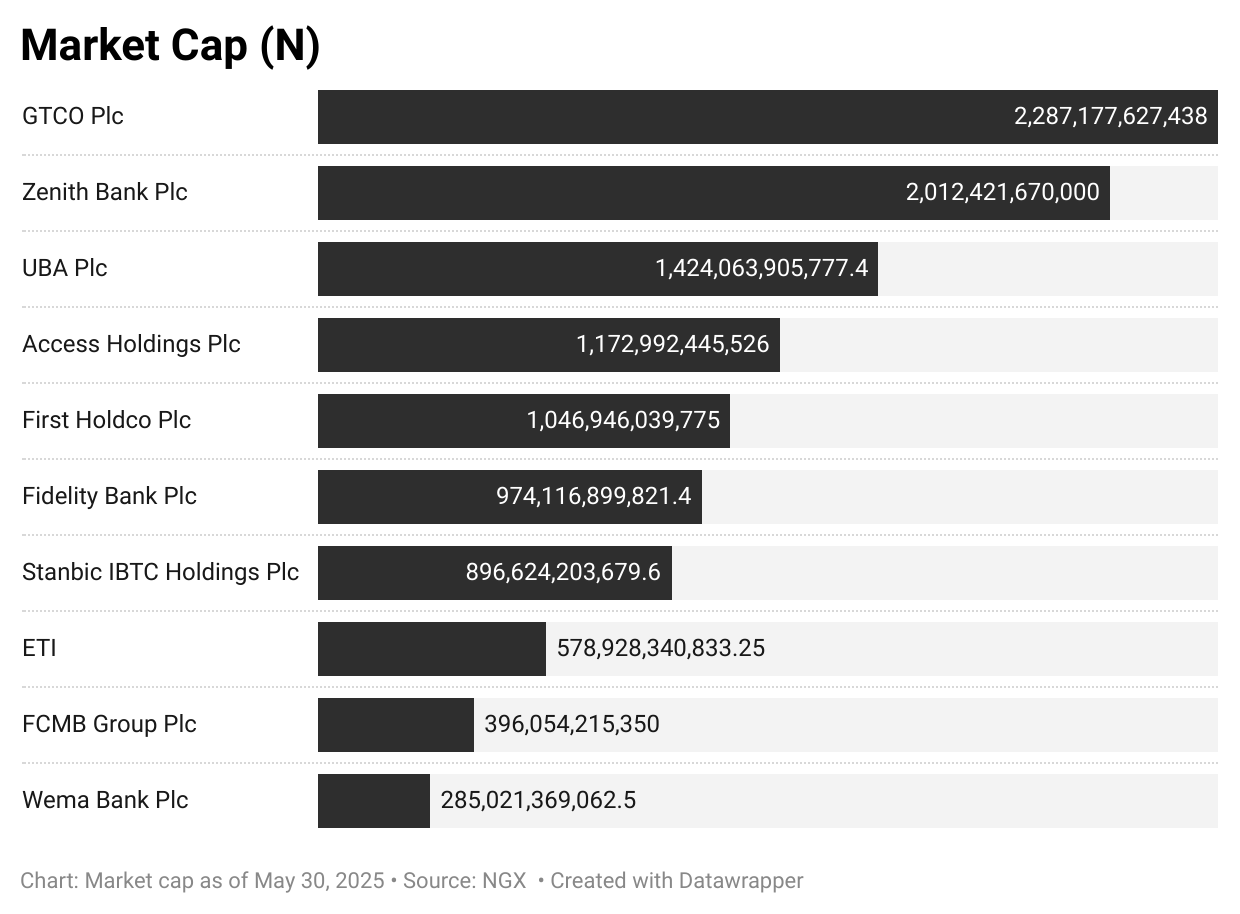

Analysis of trading numbers showed that GTCO, followed by Zenith Bank and UBA are the most capitlised listed banks on NGX, contributing about N5.72 trillion or 51.68 per cent of the N11.07 trillion total banking sector capitalisation in the first five months of 2025.

Further breakdown revealed that while GTCOo’s market capitlisation stood at N2.29 trillion as of May 30, 2025, Zenith Bank’s market capitlisation closed at N2.01 trillion. UBA’s market capitalisation stood at N1.42 trillion with a stock price of N34.70 per share as of May 30, 2025.

In addition, First Holdco and Access Holdings saw their market capitlisation at N1.05 trillion and N1.17 trillion, respepctively as of May 30, 2025.

On the back of investors’ demand for bank stocks, the NGX Banking Index appreciated by 7.29 per cent from 1,084.52 basis points to 1,163.59 basis points to remain as one of the best-performing indicators on the exchange.

Capital market analysts have attributed the 7.29 per cent growth in the NGX Banking Index to the ongoing recapitalisation exercise directed by the CBN, maintaining that dividend payout for the 2024 financial year and the impressive first quarter ended March 31, 2025, also played a critical role.

Cumulatively, the 10 banks shares appreciated by N712.09 billion in the first five months of 2025. However, out of the 10 banks, First Holdco and Access Holdings, recorded a decline of N226.4 billion in market value during the period under review.

This decline was reflected in their share prices between December 31, 2024 and May 30, 2025.

While Access Holdings stock underwent a price adjustment to account for dividend payments for the 2024 financial year, First Holdlco stock price dropped as investors were rattled its first quarter 2025 results that showed a significant decline in profit before tax, down by over 20.4 per cent to N186.5 billion from the N234.17billion posted in Q1 2024.

First Holdco’s market value declined by N127.7 billion in the first five months of 2025 amid a 10.87 per cent or N3.05 drop in its stock price to close May 30, 2025, at N25.00 per share from N28.05 per share it opened for trading this year.

Also, Access Holdco stock price dropped by 7.76 per cent or N1.85 per share to close May 2025 at N22.00 per share from the N23.85 per share it opened for trading this year, leading to N98.64 billion drop in its market value.

On the flip side, GTCO gained N341.4billion in market value as its stock price went up 17.5 per cent or N10.00 per share from N57.00 per share 2024 end to close May 2025 at N67.00 per share.

Despite reporting a 41-per cent drop in profit before tax to N300.4 billion in Q1 2025, the stock price of GTCO crossed the N70.00 per share, a 52-week high on the NGX, becoming the first financial institution to achieve such a milestone on the bourse.

The market capitalisation of GTCO currently at N2.39 trillion, is ahead of Zenith Bank with N2.08 trillion as of June 5, 2025.

Further analysis by THISDAY showed that the market value of ETI went up by N65.14 billion; FCMB Group, N23.76billion; Stanbic IBTC Holdings, N150.3 billion; Zenith Bank, N143.7billion; Fidelity Bank, N95.4billion; Wema Bank, N90.01 billion and UBA, N28.73 billion.

Among the 10 banks, the stock price of Wema Bank witnessed significant growth in the period.

It appreciated by 46.2 per cent or N4.20 per share to close May 2025 at N13.30 per share from N9.10 per share it closed for trading in 2024.

Market operators who spoke to THISDAY noted that the momentum in banking stocks reflects investors’ optimism and anticipation of continued growth in the sector despite broader economic challenges such as surging inflation and steady hike in interest rates.

“This continued preference for banking stocks aligns with the sector’s strong start to 2025, building on the momentum already established in January when the banking index emerged as the best performing indicator,” they said.

Reacting to banks’ performance during the period, the Vice President of Highcap Securities Limited, Mr. David Adnori, stated that investors’ keen interest in banking stocks impacted positively on listed banking stocks on the bourse.

He added, “The banking stocks had propelled trading volumes that have triggered the market. The listed banking stocks are always the most traded sector on NGX. GTCO and Zenith Bank, among others, are larger movers in the market.

“A lot of investors bought these stocks in early 2023 at lower prices. GTCO early 2023 was trading below N20.00 per share and Zenith Bank between N21-N22 per share. The stock price of GTCO has appreciated significantly due to proposed rights issues and 2024 totall dividend payment to shareholders.

“When the stock price of these banks gradually appreciated, investors decided to take profit-taking while some opted to stay because of their 2025 earnings and dividend payout.Nigerian banks command the best fundamentals of companies in the stock market and the action of investors not connected to the fundamentals of listed banks. The decline in market value last month is connected to profit-taking by investors.”

Analysts at Cordros Research in a report said, “For the equities market, macroeconomic challenges are expected to linger, yet opportunities for strategic positioning remain.We anticipate a strong start to 2025FY, supported by investors’ position for dividends, which will accompany financial results for 2024FY.Furthermore, we anticipate an increase in foreign portfolio investors’ (FPI) participation, supported by improved FX liquidity and strategic positioning in undervalued stocks.”

They explained that its prognosis is underpinned by expectations of elevated interest rates in the interim and growth in banks earning assets.

The analysts explained further that non-core income would likely face pressure due to the CBN’s Net Open Position restrictions, eradicating FX revaluation gains.

They said, “On risky asset creation, we expect banks to maintain a cautious lending approach despite the penalties associated with LDR-induced CRR debits, given the challenging economic environment. Elsewhere, we anticipate that higher interest rates will lead to increased funding costs for banks while rising operating expenses pressure profitability.

“Our top picks are (1) GTCO (BUY, TP: N64.98/s), as the HoldCo maintains a robust operational efficiency, and AccessCorp (BUY, TP: N38.53/s), given their dominance in the corporate and retail segments of the industry.”

Stay ahead with the latest updates!

Join The Podium Media on WhatsApp for real-time news alerts, breaking stories, and exclusive content delivered straight to your phone. Don’t miss a headline — subscribe now!

Chat with Us on WhatsApp