Valero Energy has disclosed it was taking a $1.1 billion pre-tax impairment regarding its California refineries, telling state regulators that it would permanently close or restructure its San Francisco-area refinery by the end of April 2026.

The development comes as refiners face rising regulatory and cost pressures in California, the largest petrol market in the US.

The state’s emissions targets and proposed refinery transparency rules have impacted long-term investment plans.

The US Energy Information Administration (USEIA) says the refinery processes an average of 145,000 barrels per day of crude oil into fuels.

Reuters reports that Lane Riggs, Valero’s chief executive, said that the move may impact the refinery’s employees, its business, partners and community and will continue to work with them throughout the period.

The facility disclosed on Wednesday, April 16, 2025, that it was considering strategic options for its 91,300 bpd Los Angeles refinery.

According to reports, the number of refineries in California processing crude has been dropping, with firms citing heightened regulation, like plans to ban the sale of petrol-powered vehicles by 2035.

Six facilities have shut since 2008, two of which have converted to producing renewable diesel.

Another US facility, Phillips 66, said it would close its 139,000 bpd Los Angeles plant within a year.

The move came days after a state law, signed by Governor Gavin Newsom, required refineries to stockpile fuel to limit price increases.

Petrol prices in the US state are among the priciest in the country due to the state’s dependence on West Coast refineries or imports from Asia

or the Middle East.

There are pipelines connecting refineries along the Gulf Coast and in the Midwest.

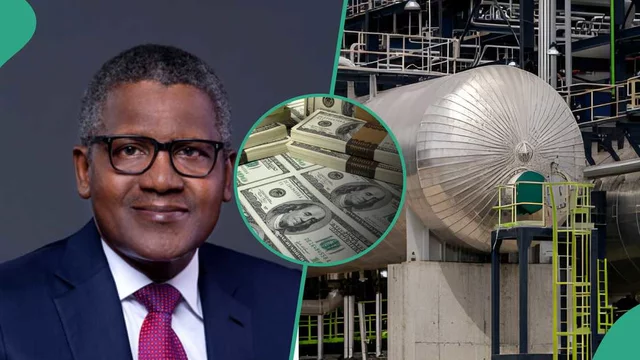

The development came as the Dangote refinery exported

1.7 million barrels of jet fuel to the United States.

According to ship-tracking service Kpler, this shipment arrived at the United States ports on Monday, March 24, 2025.

Further data from Kpler indicates that another vessel, the Hafnia Andromeda, is scheduled to dock at the Everglades terminal by March 29, carrying approximately 348,000 barrels of jet fuel.

These exports highlight the refinery’s expanding footprint in North America and Europe

.

Reuters reports that Dangote oil refinery has also issued a tender on Tuesday, March 25, to sell 128,000 metric tons of residual fuel oil in April.

The report added that the Dangote refinery will close the tender on Wednesday at 1200 GMT, as it seeks buyers for 88,000 tons of low-sulphur straight-run fuel oil and 40,000 tons of slurry oil for loading on April 10-12.

S&P Global, an American financial analytics company, disclosed in its recent report that Dangote’s price reduction

was not significant enough relative to the global crash in crude prices.

The mega refinery has reduced petrol and other petroleum product prices several times, creating a price war with industry leaders.

Stay ahead with the latest updates!

Join The Podium Media on WhatsApp for real-time news alerts, breaking stories, and exclusive content delivered straight to your phone. Don’t miss a headline — subscribe now!

Chat with Us on WhatsApp