Stocks are diving globally amid trade wars

Stock markets dropped sharply on Monday as the White House stood firm on new tariff plans. Investors now believe the U.S. might cut interest rates as early as May due to growing recession concerns.

Financial markets are now expecting almost five interest rate cuts this year, which pushed Treasury yields down and weakened the dollar.

The market troubles worsened after President Donald Trump told reporters that investors would need to accept the consequences. He stated he wouldn’t make a deal with China until U.S. trade deficit issues were resolved. Meanwhile, Chinese officials suggested that the market reaction spoke for itself regarding their response plans.

U.S. stock futures fell dramatically, with S&P 500 futures down 3.1% and Nasdaq futures dropping 4.0%. This adds to last week’s losses of nearly $6 trillion in market value.

The troubles spread to Europe, with major European market futures all falling between 2.7% and 3.5%.

In Asia, Japan’s Nikkei index fell 6% to its lowest point since late 2023, while South Korea’s market dropped 5%. The broader index of Asia-Pacific shares fell 3.6%.

Investors rushed to safer investments, causing 10-year Treasury yields to drop by 0.08 percentage points to 3.916%.

Crypto markets are bleeding from Trump’s trade wars

Cryptocurrencies fell dramatically as the new week began in Asia, showing investors are avoiding risky assets across all markets.

Bitcoin dropped about 7% from Sunday night through Monday morning in Singapore, reaching a low of $77,077. Ether, the second-largest cryptocurrency, fell to $1,538, its lowest point since October 2023.

These losses happened as US President Donald Trump maintained his position on broad tariffs that have already caused trillions of dollars in losses to US stocks. US stock futures fell and the Japanese yen rose sharply, signaling growing trouble throughout financial markets.

According to Coinglass data, about $745 million worth of optimistic cryptocurrency bets were forced to close in the past 24 hours, the largest amount in nearly six weeks.

Digital currencies had previously shown some resistance to the panic affecting markets after Trump first announced his tariff plans, suggesting they might break away from following technology stock trends. Monday’s sell-off may indicate the end of that independence.

South Korea plans June 3 for its presidential election

South Korea has planned June 3 as the likely date for its upcoming presidential election, according to a Yonhap News report on Monday that cited an unnamed government official.

This election became necessary after the Constitutional Court unanimously voted on Friday to remove President Yoon Suk Yeol from office. The court ruled that Yoon violated the constitution with his December 3 martial law decree. Under South Korean law, the country must hold a new presidential election within 60 days after a president is removed from office.

Acting President Han Duck-soo is expected to officially announce the election schedule during Tuesday’s cabinet meeting, Yonhap reported.

If this timeline is confirmed, candidates must register by May 11, and the official campaign period will begin on May 12. Public servants wanting to run for president must resign from their current positions by May 4, which is 30 days before the election.

The Nigerian Police is bracing for protests today

The police authorities have put their officers on red alert before a fresh nationwide protest scheduled for Monday (today) by the Take-It-Back Movement and other civil society groups.

The Nigerian Police Force said it had deployed its personnel in strategic locations while warning the protesters to cancel the planned demonstration. The protest aims to express opposition to the worsening hardship in the country, restrictions on civil liberties, and the crisis in Rivers State.

The state police commands told The Punch about the measures they are taking to prevent the rally from turning violent.

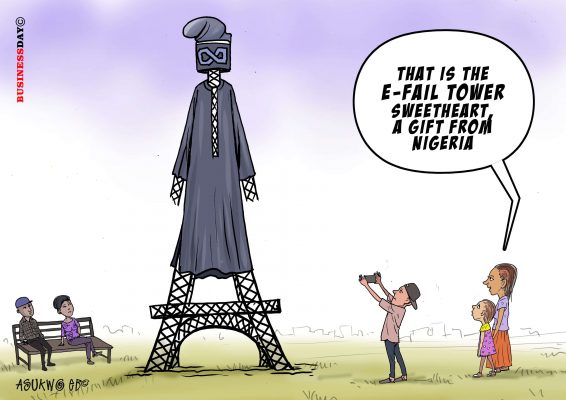

However, Juwon Sanyaolu, the National Coordinator of the Take-It-Back Movement, said the protest also intends to address concerns about the misuse of the Cybercrime Act, and confirmed that the group would proceed with the rally.

This civil disobedience comes nine months after the #EndBadGovernance protests held last August, which opposed the high cost of living in the country.

In Abuja, the protest organisers said they would gather at the National Assembly.

Nigeria’s debt servicing surged to N13trn

Nigeria spent N13.12 trillion on debt servicing in 2024, a 68% increase from the N7.8 trillion spent in 2023, according to new data from the Debt Management Office.

This spending exceeded the government’s budgeted allocation of N12.3 trillion for debt servicing in 2024, highlighting growing pressure on the country’s finances.

Looking ahead, the Federal Government has set aside N16 trillion for debt servicing in the 2025 budget, recognizing the continued growth of debt-related expenses.

Domestic debt servicing costs reached N5.97 trillion in 2024, up 14.15% from N5.23 trillion in 2023. This increase is largely due to higher interest rates and increased borrowing within Nigeria.

For external debt, Nigeria spent $4.66 billion (equivalent to N7.15 trillion at an exchange rate of N1,535.32/$1), which represents a dramatic 167% increase from N2.57 trillion in 2023.

Stay ahead with the latest updates!

Join The Podium Media on WhatsApp for real-time news alerts, breaking stories, and exclusive content delivered straight to your phone. Don’t miss a headline — subscribe now!

Chat with Us on WhatsApp