The Senate has said the timely amendments to the Nigerian Deposit Insurance Corporation (NDIC) Act, and the Banks and Other Financial Institutions Act (BOFIA), have laid a solid foundation for financial sector stability.

The Chairman, Senate Committee on Banking, Insurance, and Other Financial Institutions, Senator Adetokunbo Abiru broke the news during NDIC retreat held in Lagos with theme: “Building Resilient Financial Systems through Effective Legislative Intervention”.

According to Abiru, the Nigerian banking sector faces new and emerging risks, particularly in areas such as cybersecurity, and the rise of Fintech and digital financial services.

He advised that legislative frameworks should evolve to keep pace with these changes. “We must ensure that regulators like the Central Bank of Nigeria (CBN) and the NDIC have the tools they need to effectively oversee the financial sector, while also encouraging innovation and competition,” he said.

Abiru said that as Nigerian financial system continues to embrace digital banking and financial technologies, the threats posed by cybercrime and data breaches are becoming more pronounced.

“Recent cybersecurity incidents in the banking sector highlight the need for more stringent regulatory oversight and greater investment in cybersecurity measures. Legislative interventions must prioritize the establishment of robust cybersecurity frameworks that safeguard not only financial institutions but also the sensitive data of millions of Nigerians,” he said.

Abiru explained that building a resilient financial system is not the sole responsibility of lawmakers or regulators. He said: “It requires the collective efforts of all stakeholders – from the banking and insurance sectors to Fintech companies, depositors, and the wider Nigerian public. Collaborative partnerships are key to ensuring that our financial systems are both resilient and inclusive”.

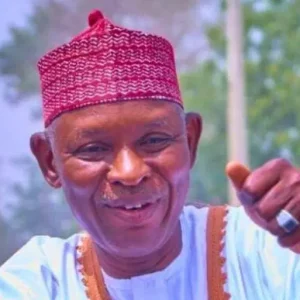

In his address, Managing Director/Chief Executive of NDIC, Bello Hassan, reiterated the retreat’s purpose of enhancing collaboration with the Senate to address risks associated with advancements in technology, globalisation, and financial sector consolidation.

He stated: “In recent years, the financial services sector has experienced significant transformation, largely driven by advances in technology, globalisation, and consolidation. New services and products have emerged, while new players and financial technologies have been challenging traditional service providers through faster, cheaper, and reliable services.”

Hassan also stressed the importance of managing the additional risks posed by the developments. According to him, “While this development presents opportunities for growth, we must, however, be conscious of the additional risks and complexities that the system may be further exposed to. To address this concern, stakeholders, particularly those charged with oversight functions, must collaborate more than ever before.”

He added that the legislature’s support is crucial in redesigning the legal framework to adapt to financial advancements while protecting consumers and encouraging innovation.

Stay ahead with the latest updates!

Join The Podium Media on WhatsApp for real-time news alerts, breaking stories, and exclusive content delivered straight to your phone. Don’t miss a headline — subscribe now!

Chat with Us on WhatsApp